Mortgage Rate Data Deluge – NOV 17 🏠📉🔒

Here is a deluge of mortgage rate data to start your week!

Included in this week’s deluge are the following:

MARKET RECAP ⏪

------------------

Whether the blame falls on the delayed employment data, Fed rate cuts amidst sticky inflation, slightly better than expected service-sector data, or just a big bond rebalancing after months of improvements, the result is the same…

After reaching the best level in years, mortgage rates have given back all of the October gains.

BITCOIN BLOODBATH 🩸

-------------------------

Watch out below…

Bitcoin tumbles through $100k, down 25% ($30k) from the all-time high of $125k in October.

Crypto markets have become a barometer for investor risk appetite and market liquidity.

Big moves down like this matter to mortgage rates because they could be an early sign that sentiment is shifting more towards “risk off”, which favors higher bond prices.

MORTGAGE RATE PRICES 📉

-----------------------------

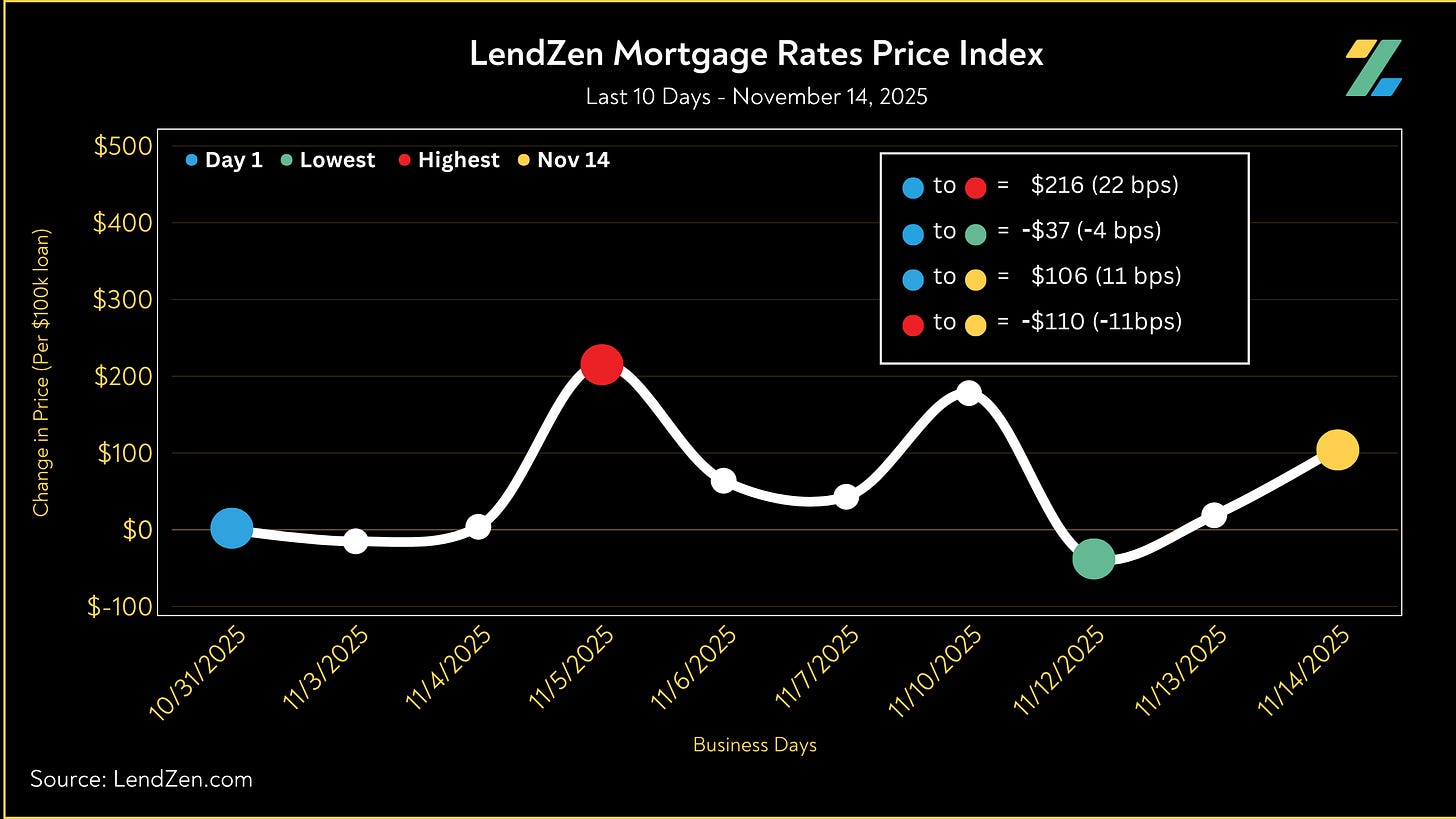

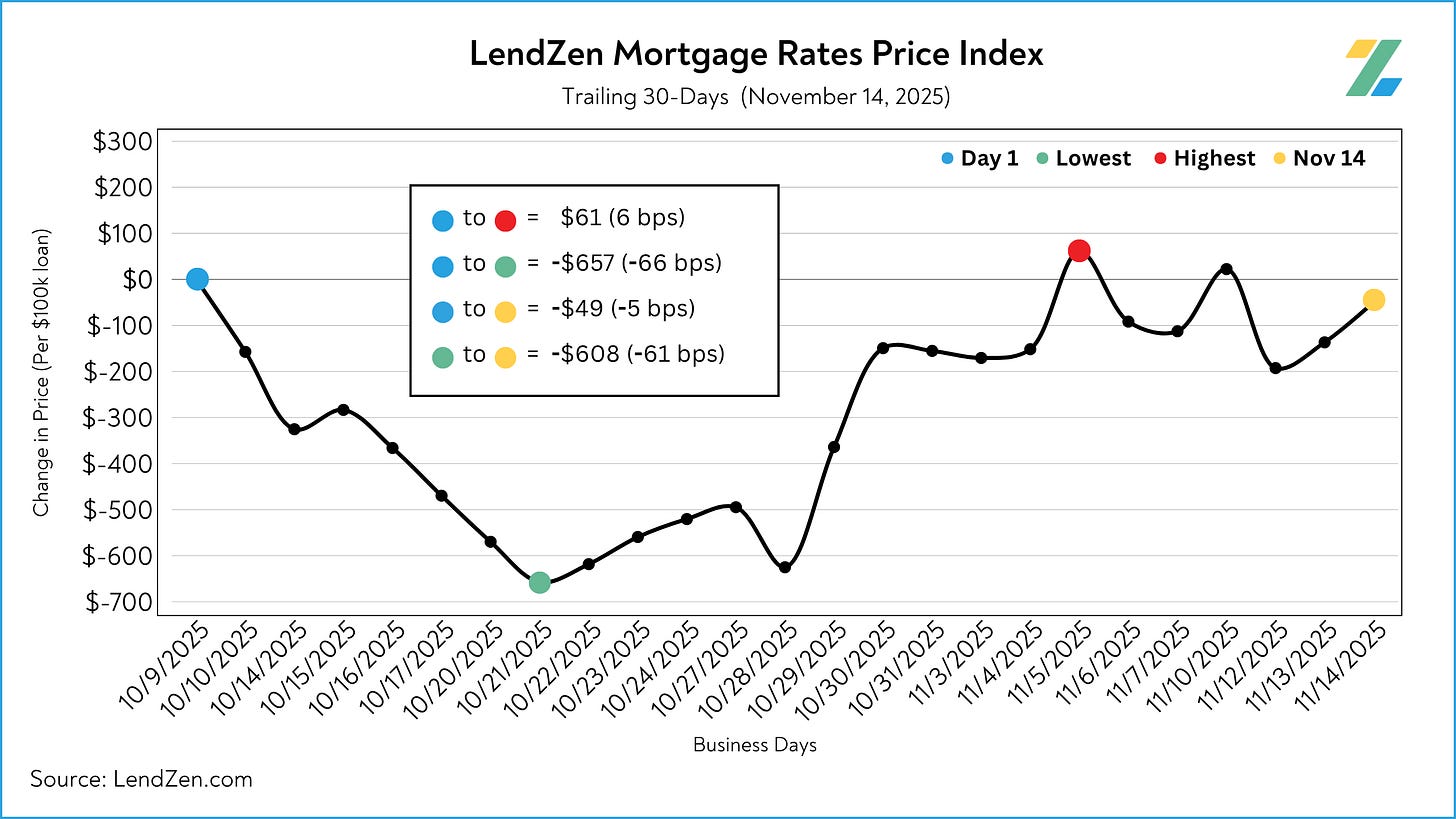

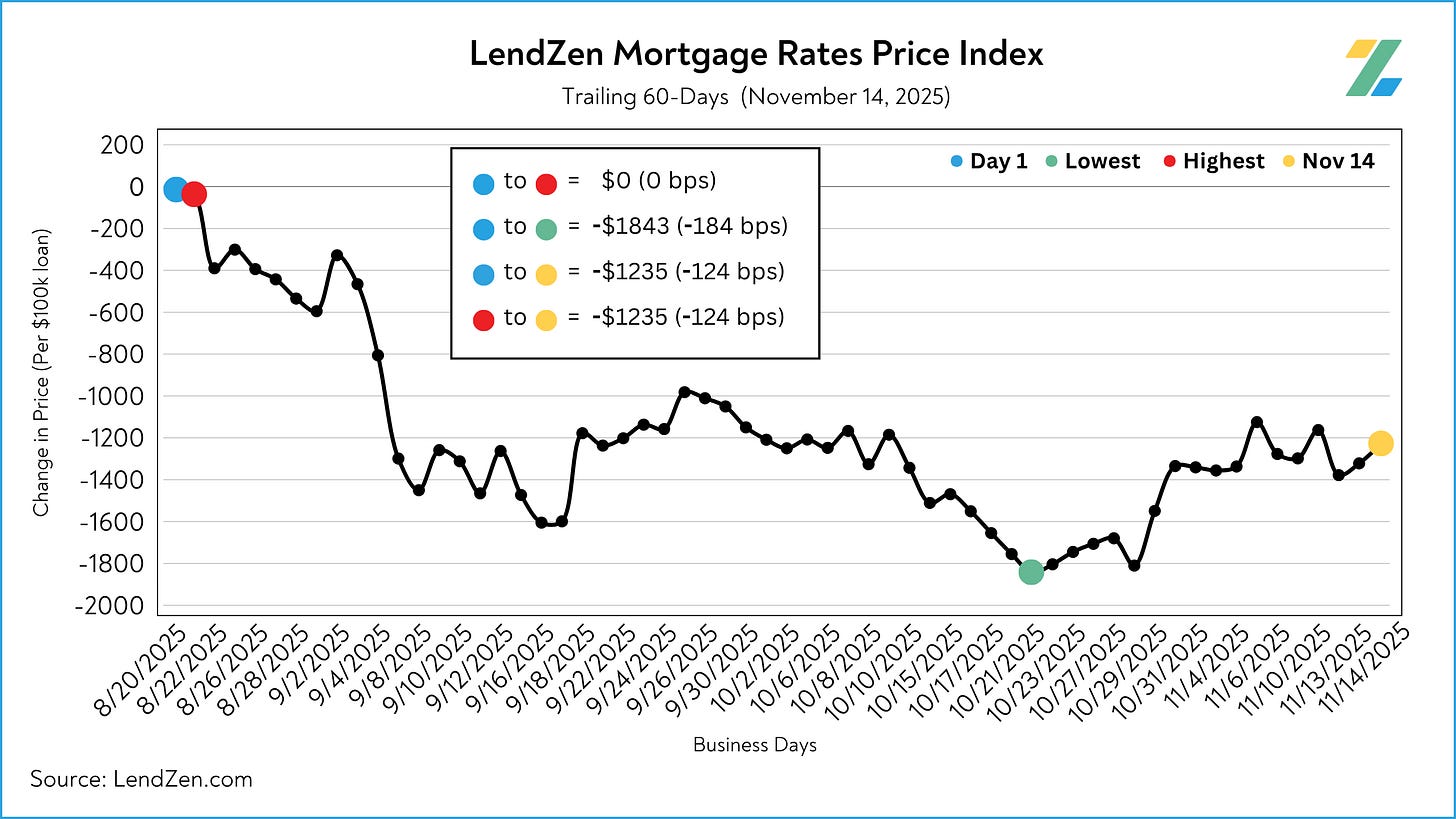

Mortgage rates do not rise or fall, instead the PRICE of rates change.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

This provides borrowers with a more specific measurement of how the cost to obtain a mortgage is changing, regardless of the lender, rate, or credit score.

-----------

11/14/2025

-----------

24-Hour: +9 bps ($87 per $100K)

5-Day: +6 bps ($63)

10-Day: +11 bps ($106)

30-Day: -5 bps (-$49)

60-Day: -124 bps (-$1235)

Bonds have put up a good fight as they try to find their footing amidst a volatile few weeks.

The down move in October reached the best levels of the year but has now been fully reversed.

The recent sell-off leaves borrowers vulnerable as mortgage rates sit at the base of August’s post-NFP rally.

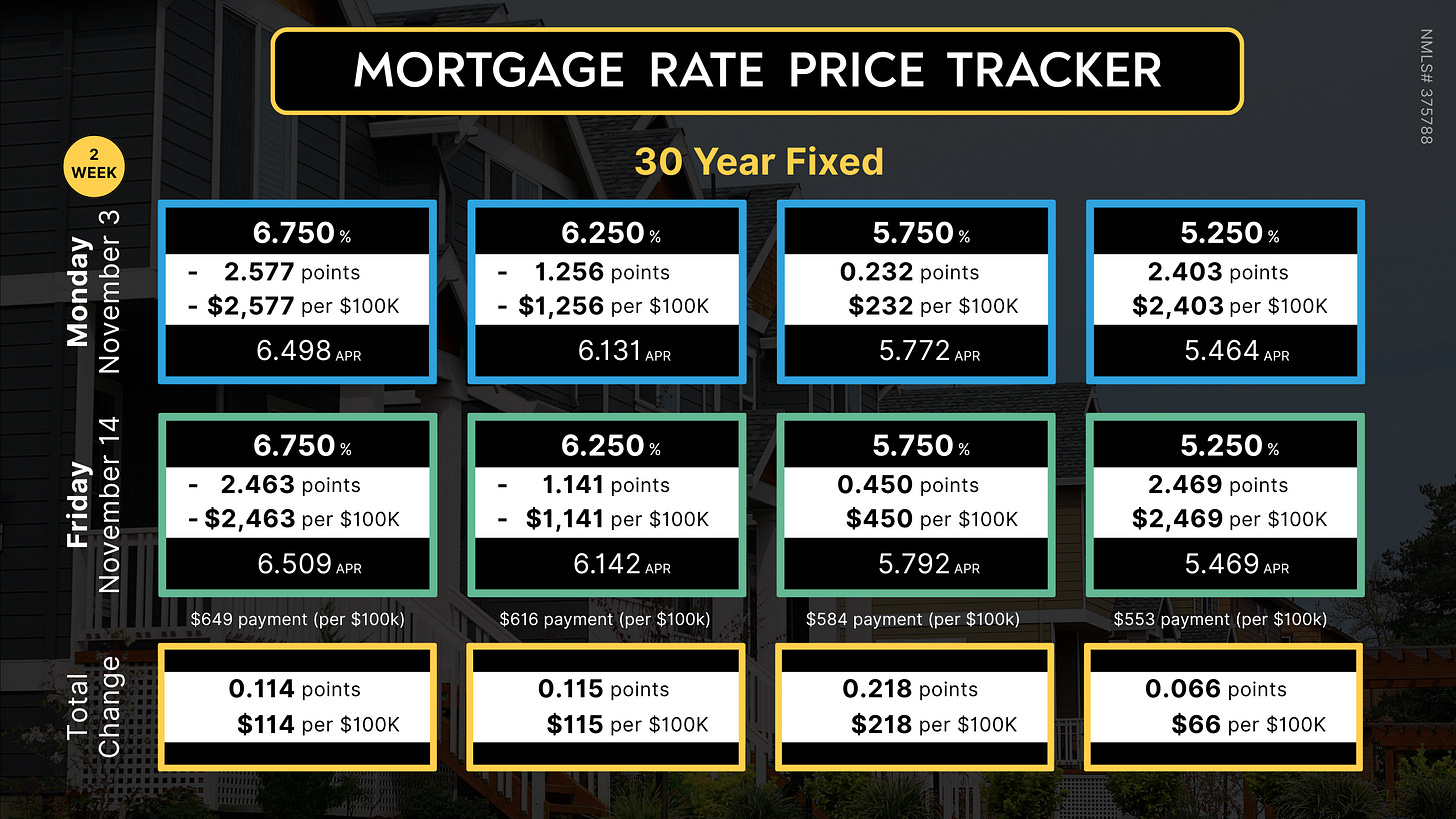

The LendZen Index monitors the change in price across a broad set of rates and mortgage bond coupons, whereas the LendZen Mortgage Rate Price Tracker is more “rate and loan program” specific.

Both are an example of how mortgage rates do not rise or fall, but instead it is their price that changes.

Since the LendZen Index has a variety of time series, the MRPT focuses on the current month’s activity.

You can explore the full results from November Week 2 on this Substack post.

MORTGAGE SPREADS 🧈

-------------------------

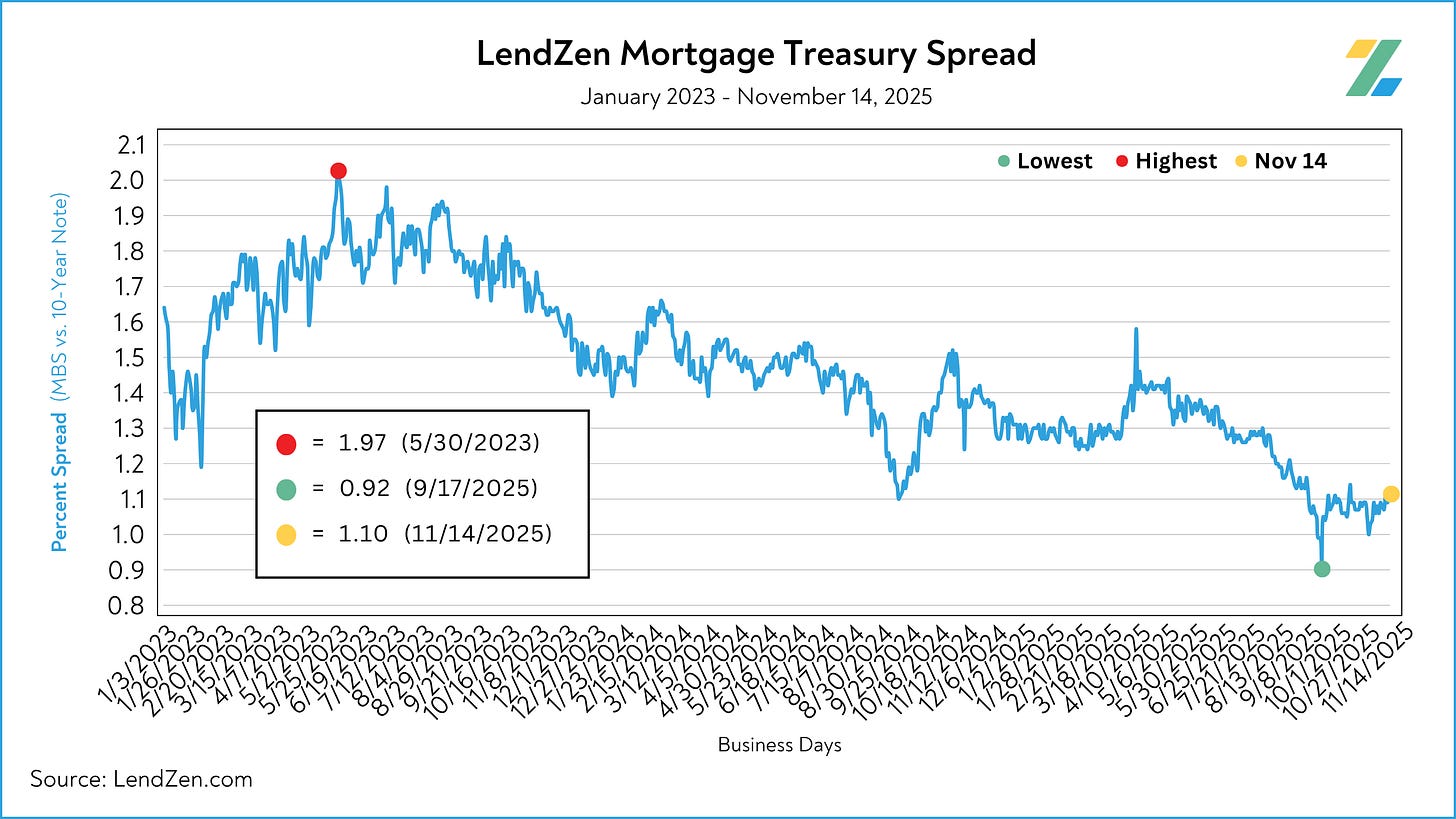

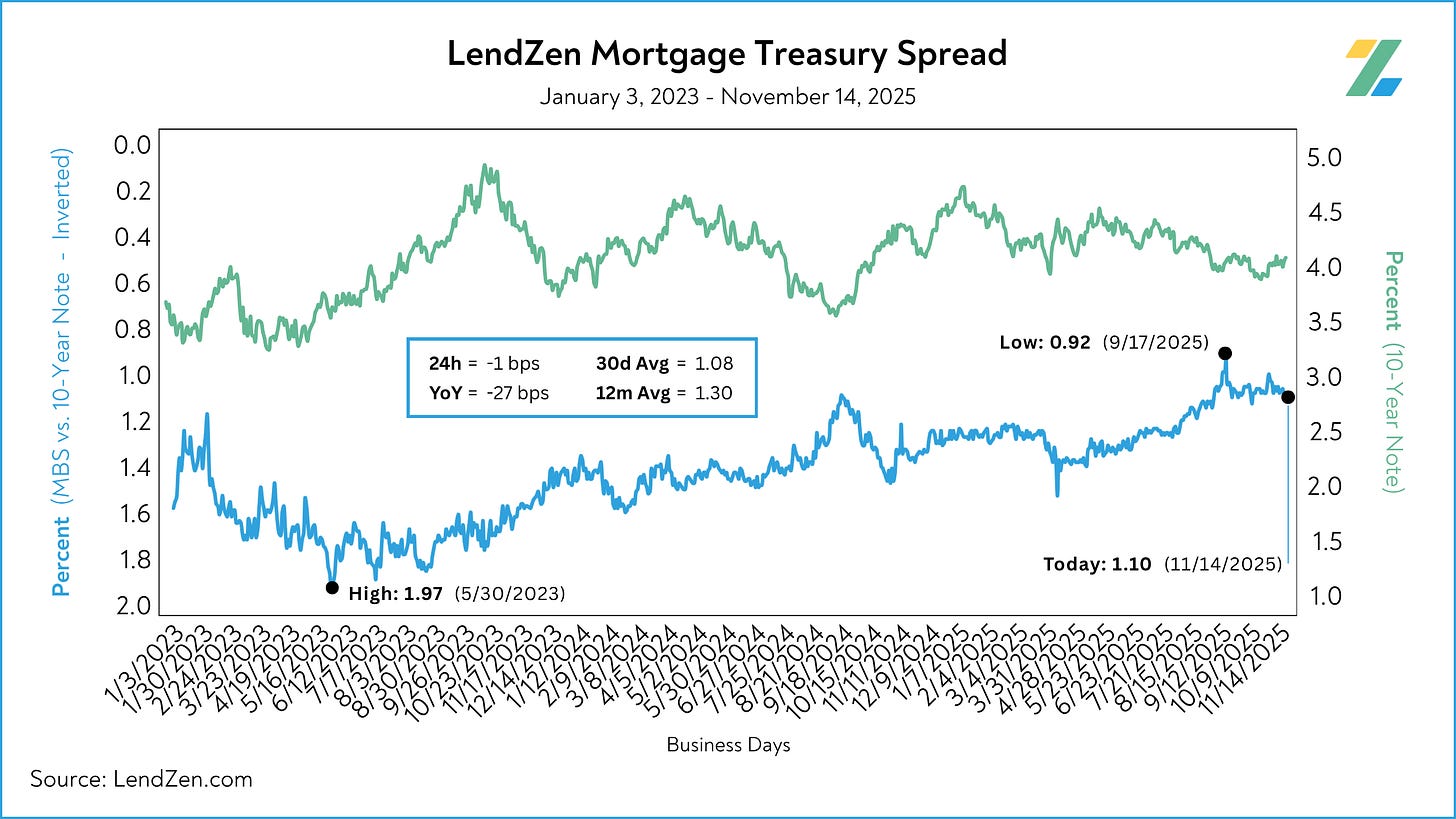

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

Learn more about the importance of accurately calculating spreads on this Substack post.

The spread between mortgage bonds and the U.S. 10-Year widened 3-bps during the week.

Nov 10 = 1.07

Nov 14 = 1.10

30d Avg = 1.08

12m Avg = 1.30

YoY = - 27 bps (1.37)

However, with declines of over 30 bps since last year, spreads have been the real story behind mortgage rates now versus 2024.

Get the full scoop in this recent Substack post.

HOUSING DATA 🏠

---------------------

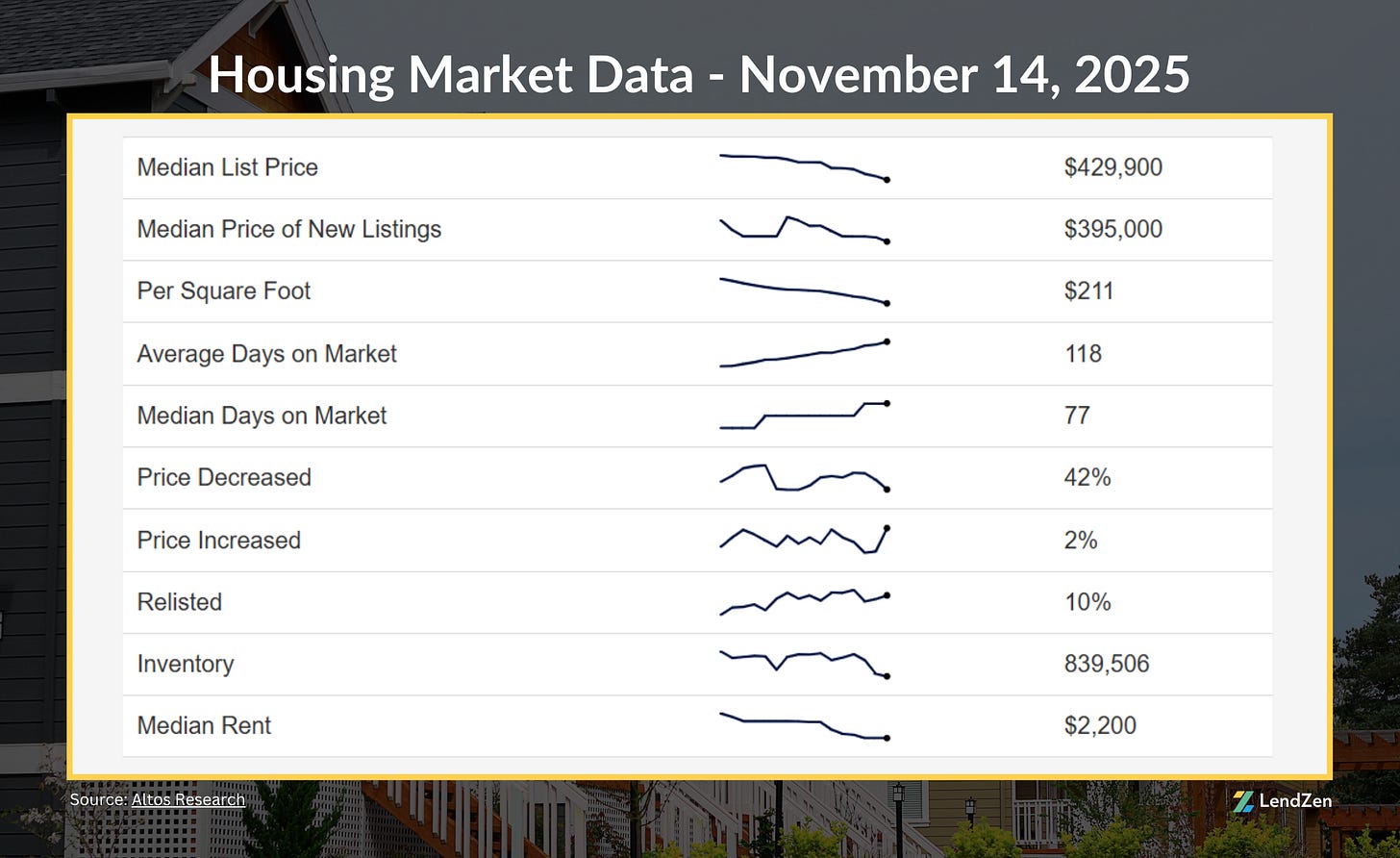

Here are the latest housing market stats, with trends from the last 90 days.

The U.S. median list price is $429,900.

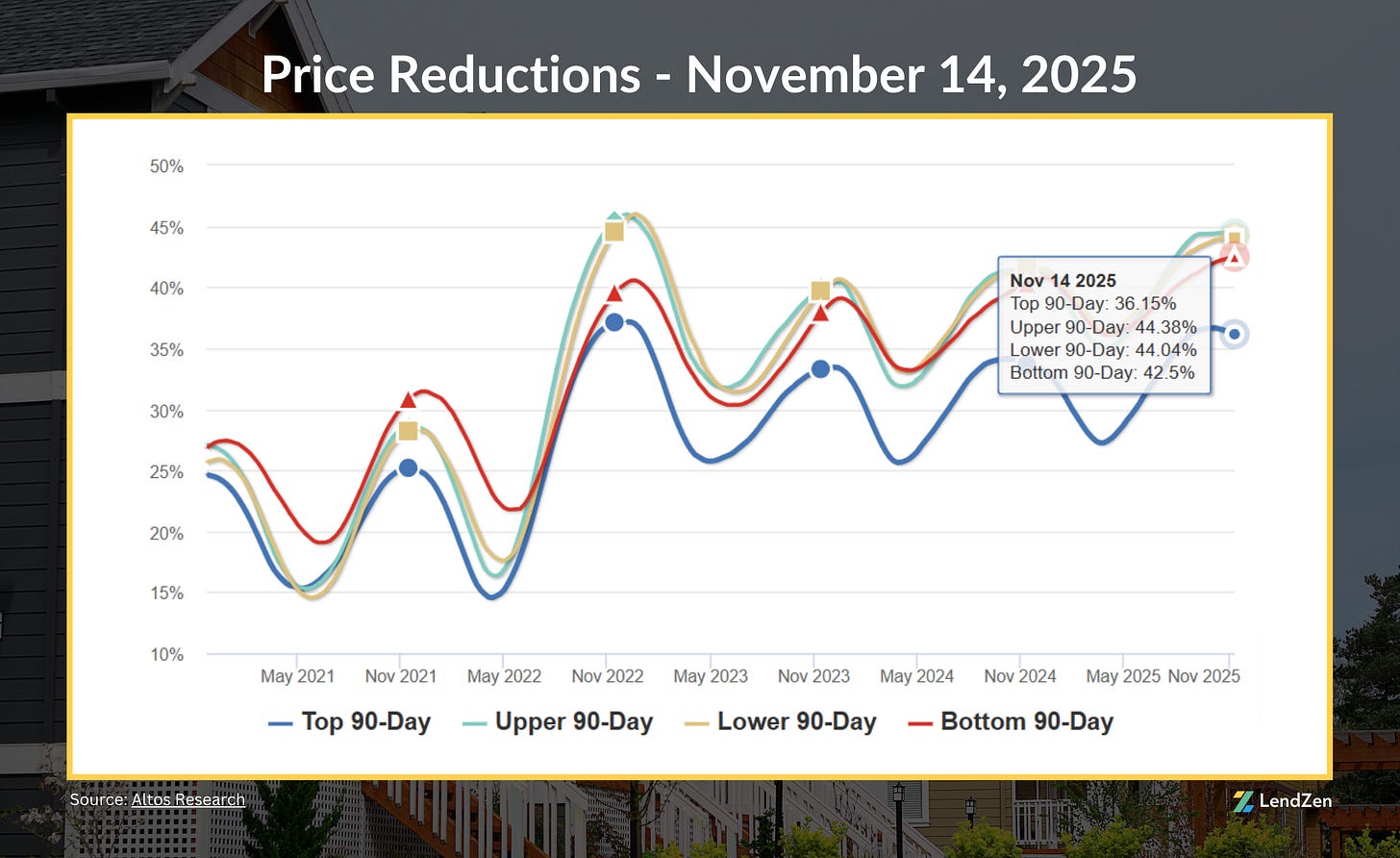

Price reductions remain steady with a 90-day national average of 42%.

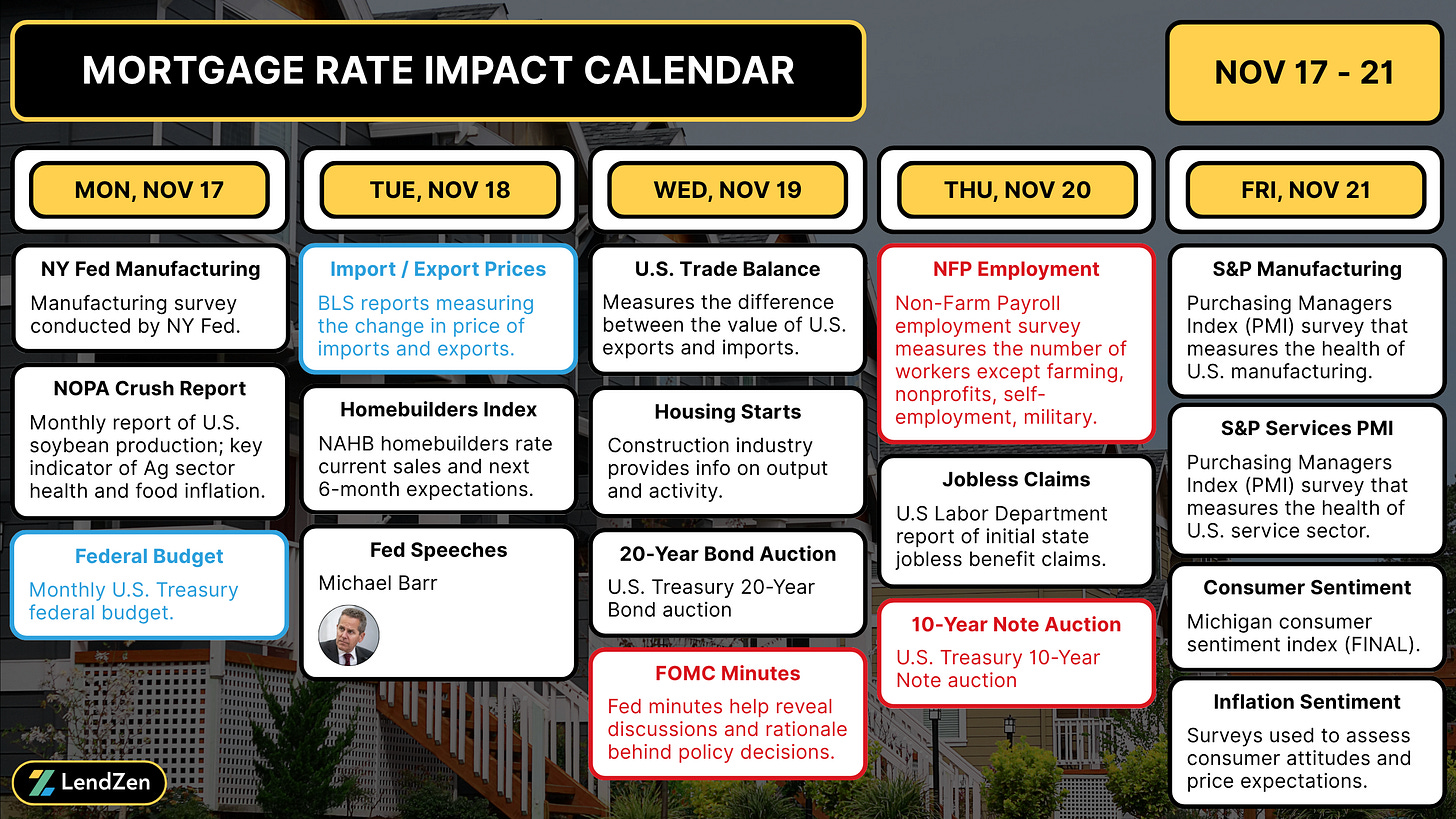

WEEK AHEAD 📅

------------------

With the shutdown lifted, the return of postponed data like Non-Farm Payrolls could reset the economic narrative.

Meanwhile, markets are looking for future rate cut clarity from the Fed Minutes.

Read more in yesterday’s Week Ahead.

**Events marked blue could be delayed by the shutdown.

RATE LOCK GUIDE 🔒

---------------------

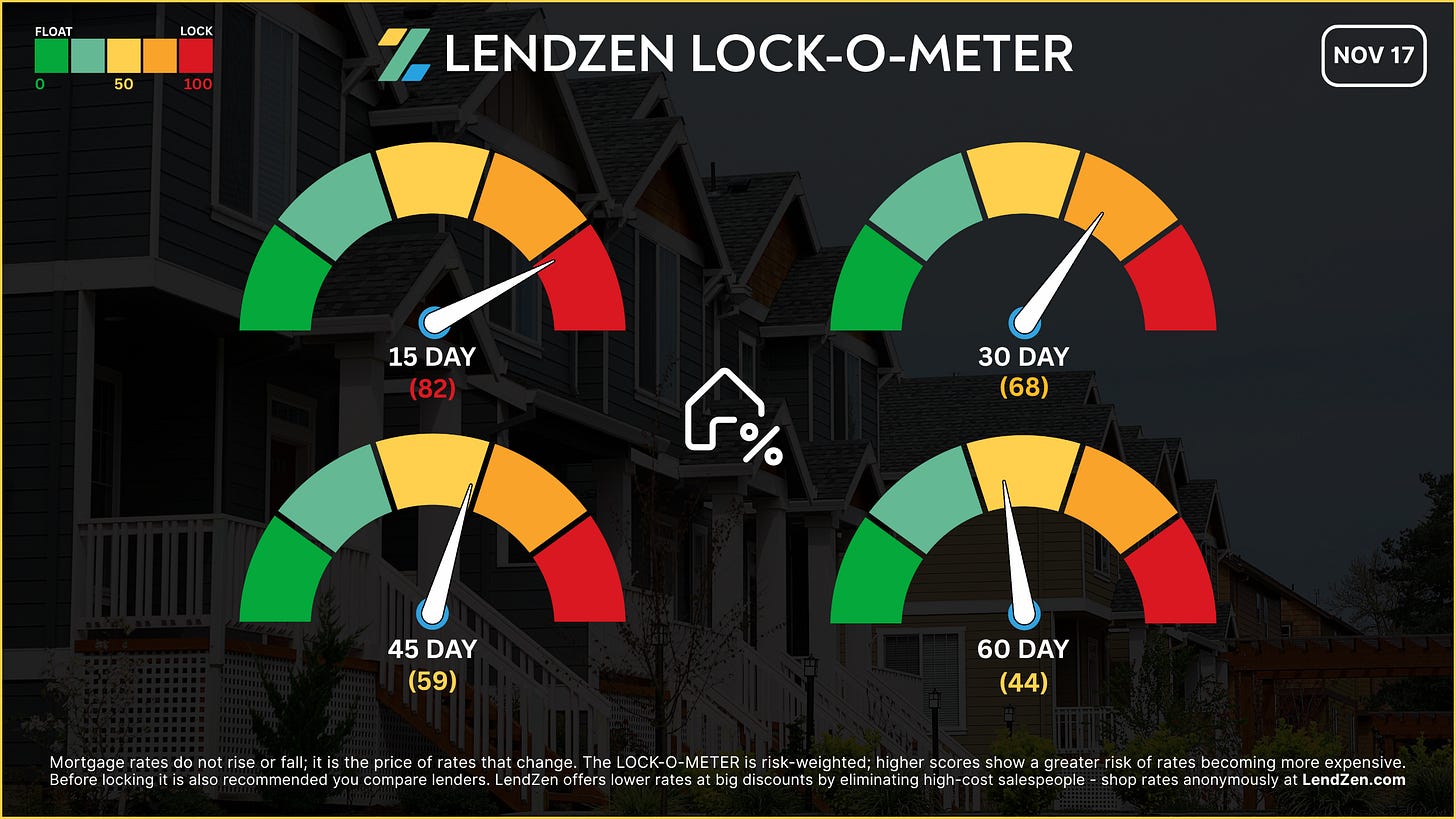

The LendZen LOCK-O-METER provides borrowers with a risk-weighted score based on how various macroeconomic events, including market data, central bank announcements, and geopolitics, each historically impacts the price of bonds.

higher risk scores = lean towards locking

------------------

Closing Window

------------------

[ 15 Days ] -- 82 🔴

The shutdown’s over and the recent bond weakness, combined with the market moving potential of NFP, elevates the short-term risks.

[ 30 Days ] -- 68 🟠

The post-FOMC sell-off seems to have finished playing out but the same cannot be said for a backlog of econ data that will be unleashed on markets over the coming weeks.

[ 45 Days ] -- 59 🟡

With bonds retracing back to the post August NFP levels, how markets digest the upcoming data onslaught will impact longer-term float strategies heading into the December Fed rate decision (FOMC).

[ 60 Days ] -- 44 🟡 🟢

Longer-term the disinflation narrative needs support from inflation and employment data. Watch closely how market sentiment responds to the post-shutdown backlog and FOMC announcements.

If you are already in a strong position locking generally makes the most sense, especially for shorter windows, since the focus should be on making a savvy rate choice based on your longer-term rate outlook.

I expand on this “long game” approach in this Substack post.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.