Mortgage Rate Data Deluge – NOV 03 🏠📉🔒

Here is a deluge of mortgage rate data to start your week!

WATCH LIST 👀

---------------

Data Drought:

With JOLTS and NFP likely delayed, Wednesday’s ADP Jobs report becomes the proxy for measuring labor market health. A soft print (below expectations) could help ease bond market tensions, at least temporarily.

Technicals takeover:

The post-FOMC press conference comments from Powell has left bond markets fragile. Meanwhile the government shutdown has surpassed the 30-day mark. In the ongoing absence of meaningful economic data, markets will lean more heavily on technicals - support levels on the 10-Year to watch are 4.10 and 4.20.

Words of a feather:

Will the Fed President’s flock together and reinforce Powell’s message? Look for the rest of the FOMC to echo the “not a foregone conclusion” message but with a more dovish tone (hopefully). Thursday will be a key day to watch, with 6 different appearances, following Wednesday’s ADP jobs report and ISM Services data.

**Events marked blue could be delayed by the shutdown

Deeper analysis - be sure to read the RATE LOCK GUIDE at the bottom of this post for a more detailed rationale of what could impact mortgage rates in the weeks ahead.

MARKET RECAP 📉

------------------

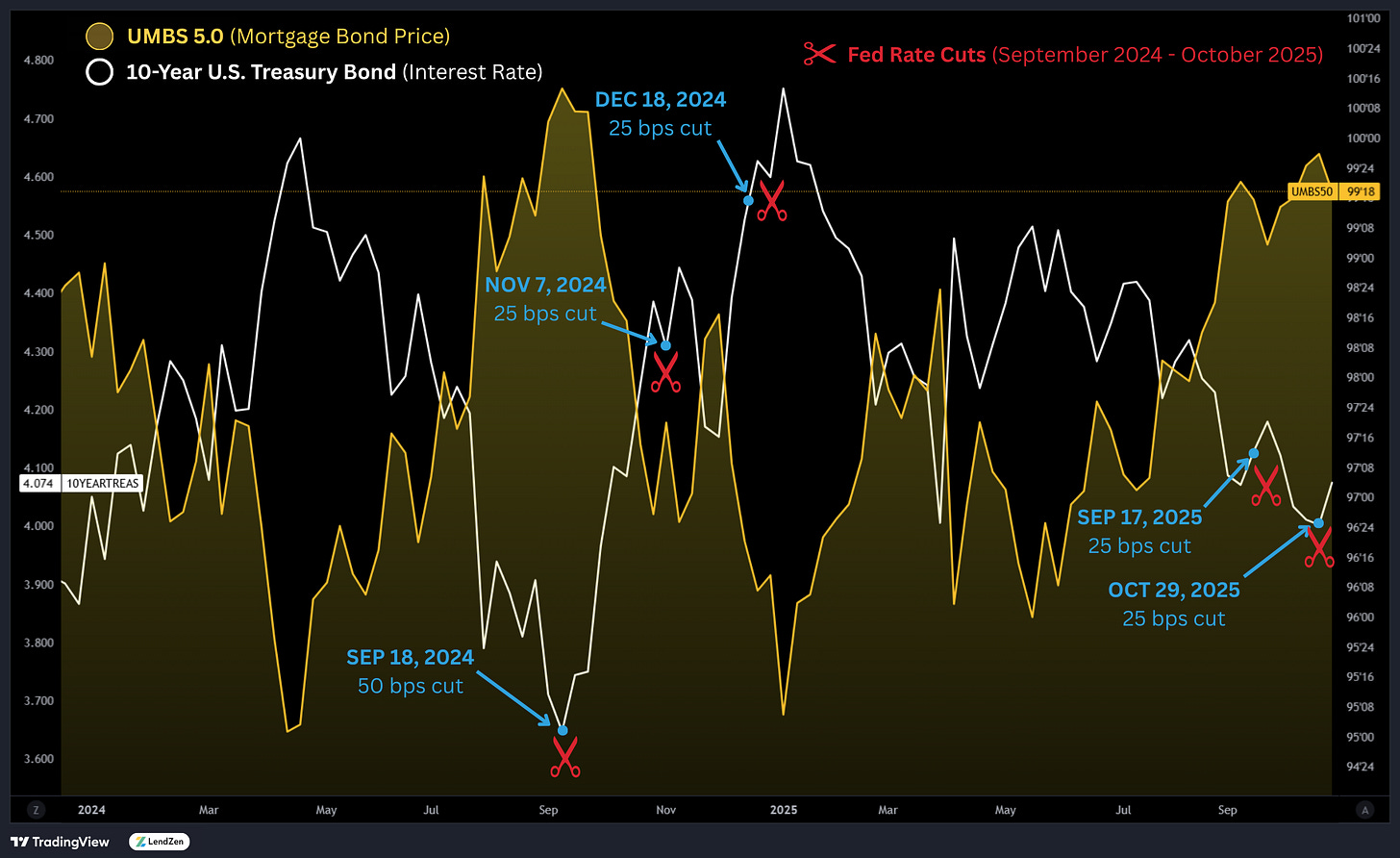

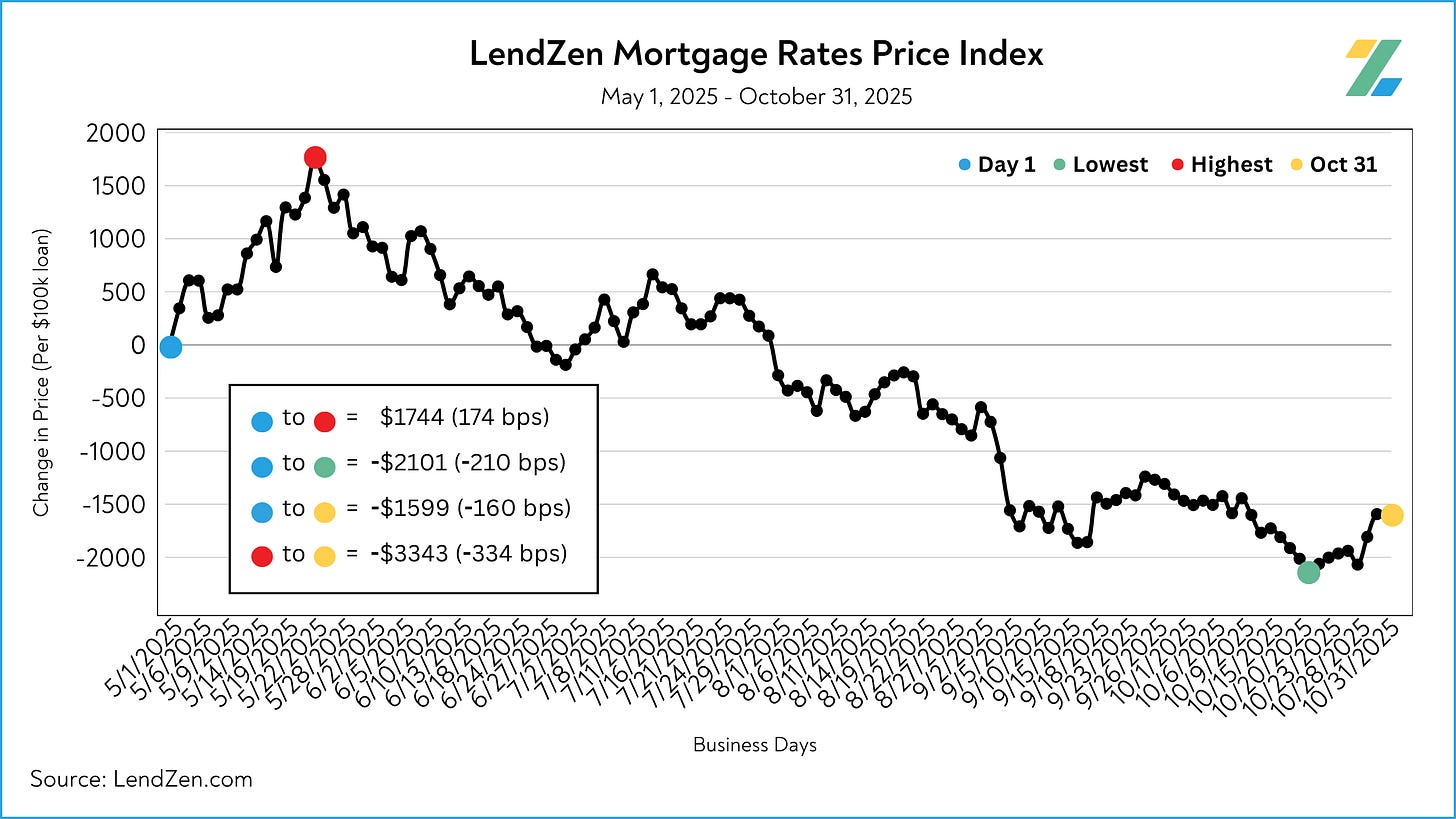

October saw mortgage rates improve to their best levels in over a year before experiencing an almost full reversal in the final days of the month.

This occurred within two days, following Wednesday’s Fed rate cut decision and Powell’s “not a foregone conclusion” press conference statement.

Despite the midweek damage, Friday ended the day unchanged.

Although the reason may have been slightly different each time, the bond market has reacted negatively after the last 5 Fed rate cut announcements.

Fortunately, bonds weathered the last two better than the previous 3.

Let’s hope this resilience continues, along with tighter mortgage spreads (more on spreads later in this post).

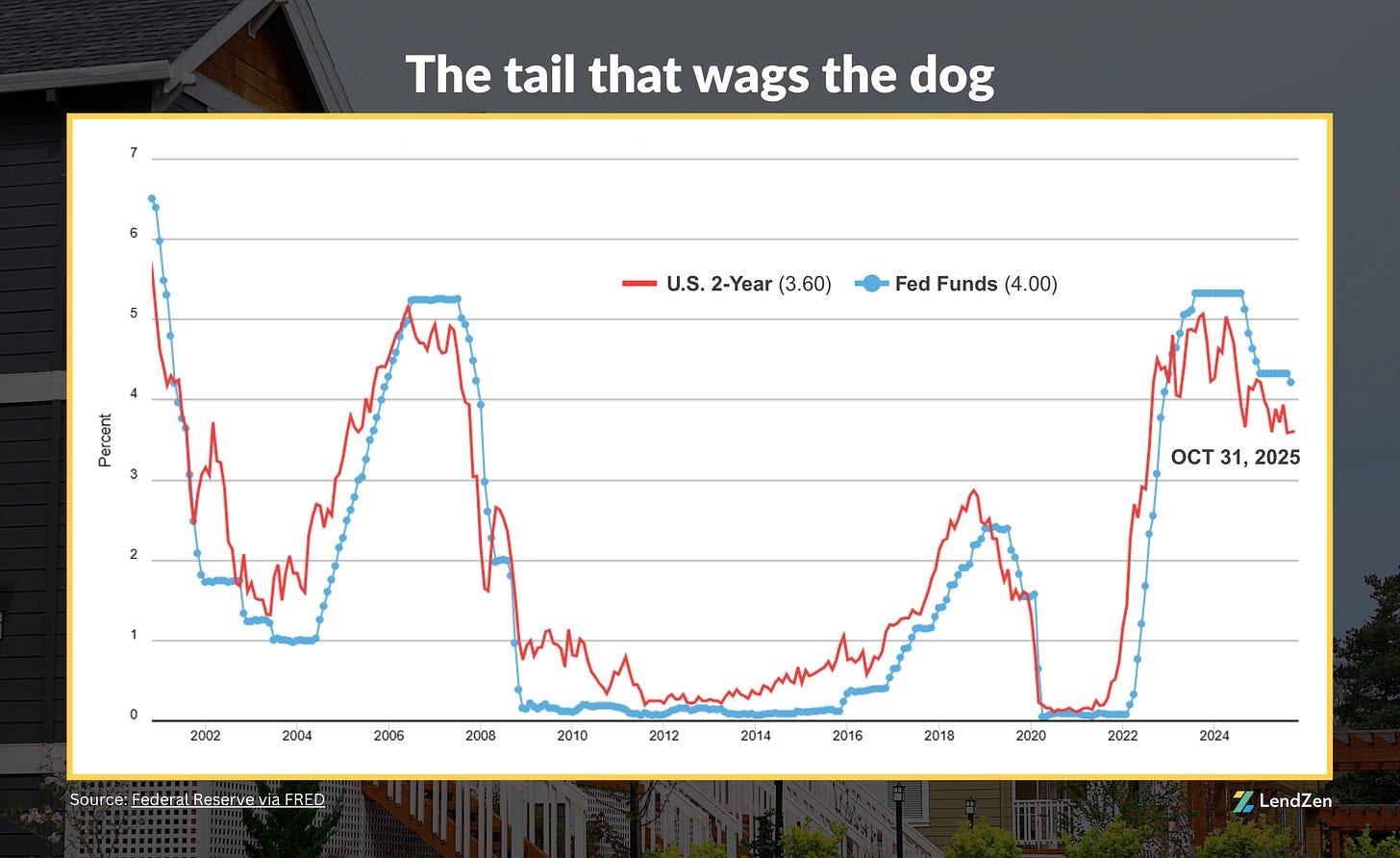

Despite Jerome’s jawboning, the bond market is telling the Fed they are too tight, specifically 40-bps too tight.

More on the “tail wags the dog” relationship between the 2-Year Treasury Bond and The Fed Funds Rate in this Substack post.

MORTGAGE RATE PRICES 📉

------------------------------

Mortgage rates do not rise or fall, instead the PRICE of rates change.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

This provides borrowers with a more specific measurement of how the cost to obtain a mortgage is changing, regardless of the lender, rate, or credit score.

The index is posted daily at LendZen.substack.com

-------------

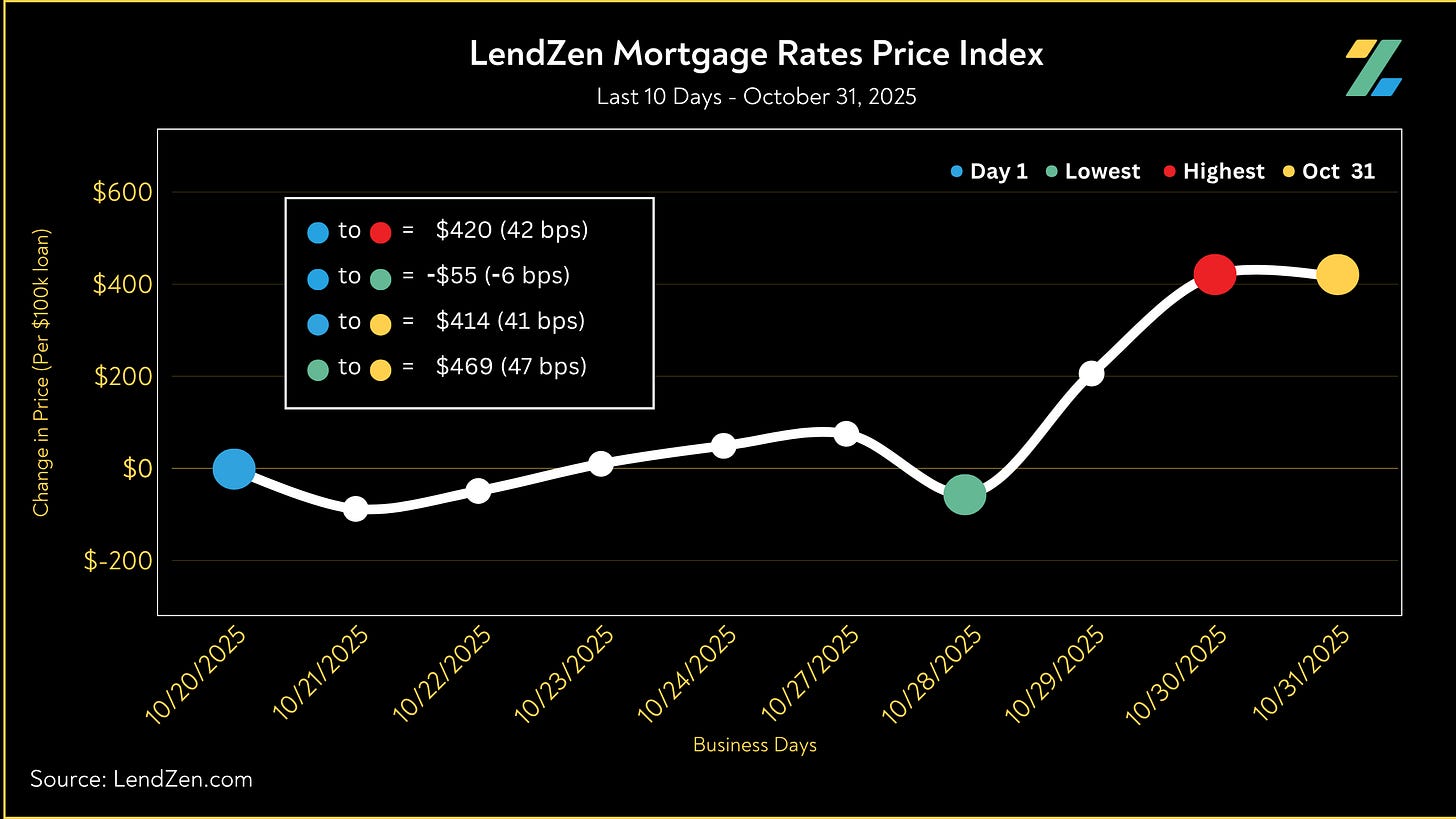

10/31/2025

-------------

24-Hour: +4 bps ($39 per $100K)

5-Day: +5 bps ($49)

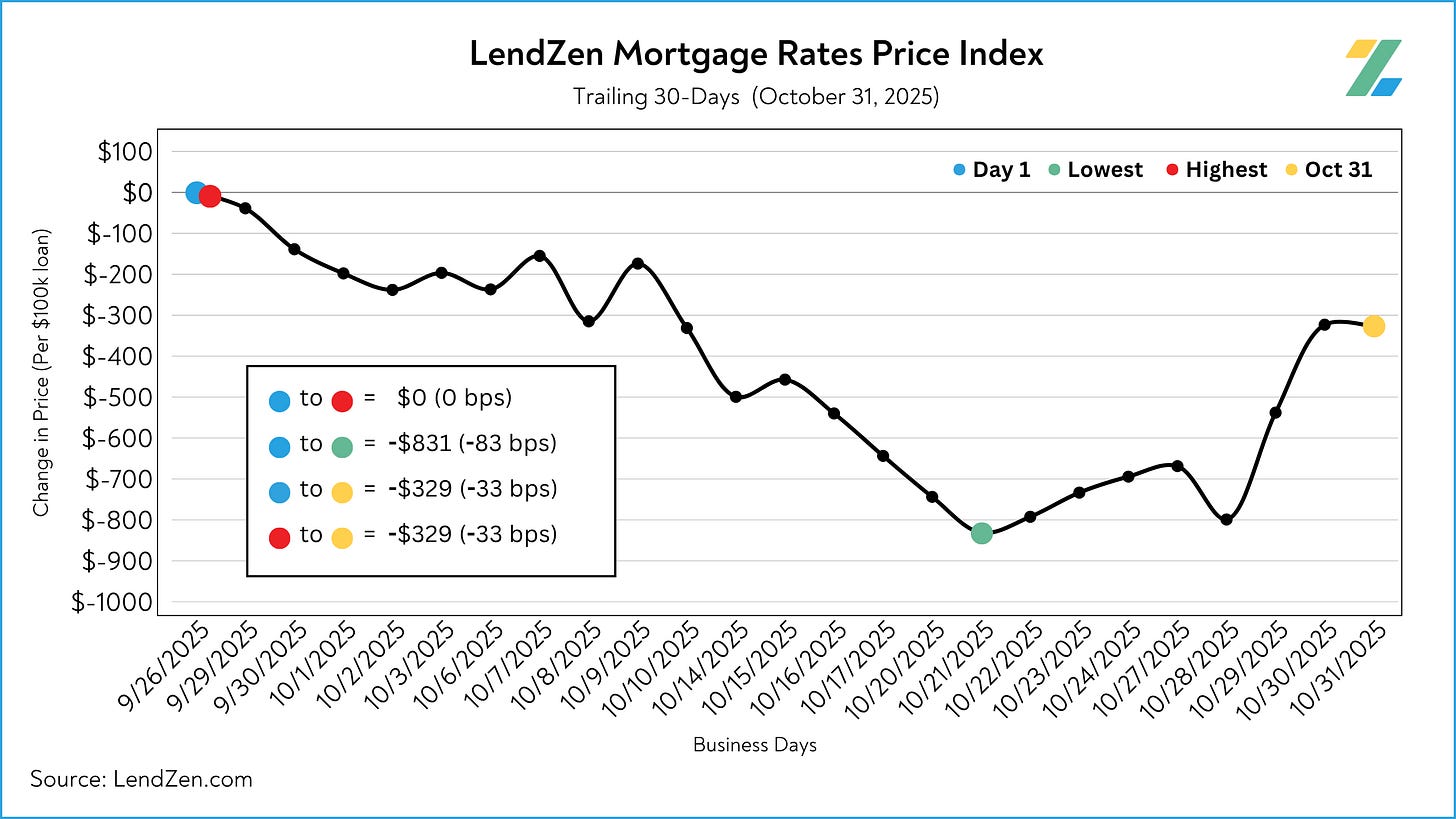

10-Day: -36 bps (-$363)

30-Day: -47 bps (-$469)

60-Day: -98 bps (-$978)

Since July 15: -226 bps (-$2,263 less expensive per $100K)

Last week was not pretty but at least the bleeding stopped on Friday.

Mortgage rate prices are still down 33 basis points in the last month.

However, for the first time since mid-July bonds are at risk of losing positive momentum, although the latest move looks in line with similar pullbacks seen throughout the year.

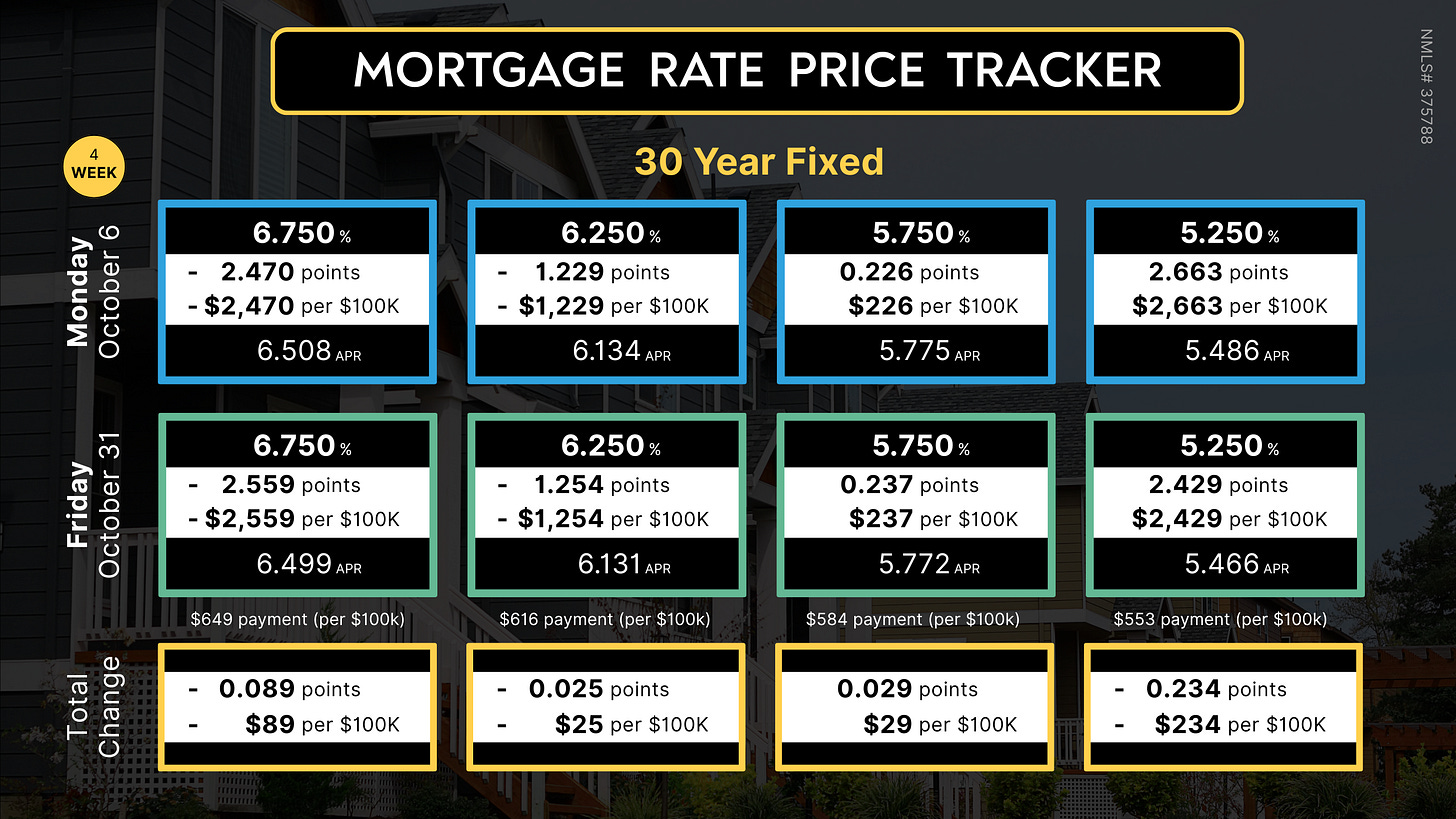

The LendZen Index monitors the change in price across a broad set of rates and mortgage bond coupons, whereas the LendZen Mortgage Rate Price Tracker is more “rate and loan program” specific.

Both are an example of how mortgage rates do not rise or fall, but instead it is their price that changes.

The month of October was a roller coaster ride with each rate uniquely reflecting how its correlated MBS coupons traded, resulting in lopsided moves for rates in the 5% range.

See Friday’s price tracker results on this Substack post.

MORTGAGE SPREADS 🧈

-------------------------

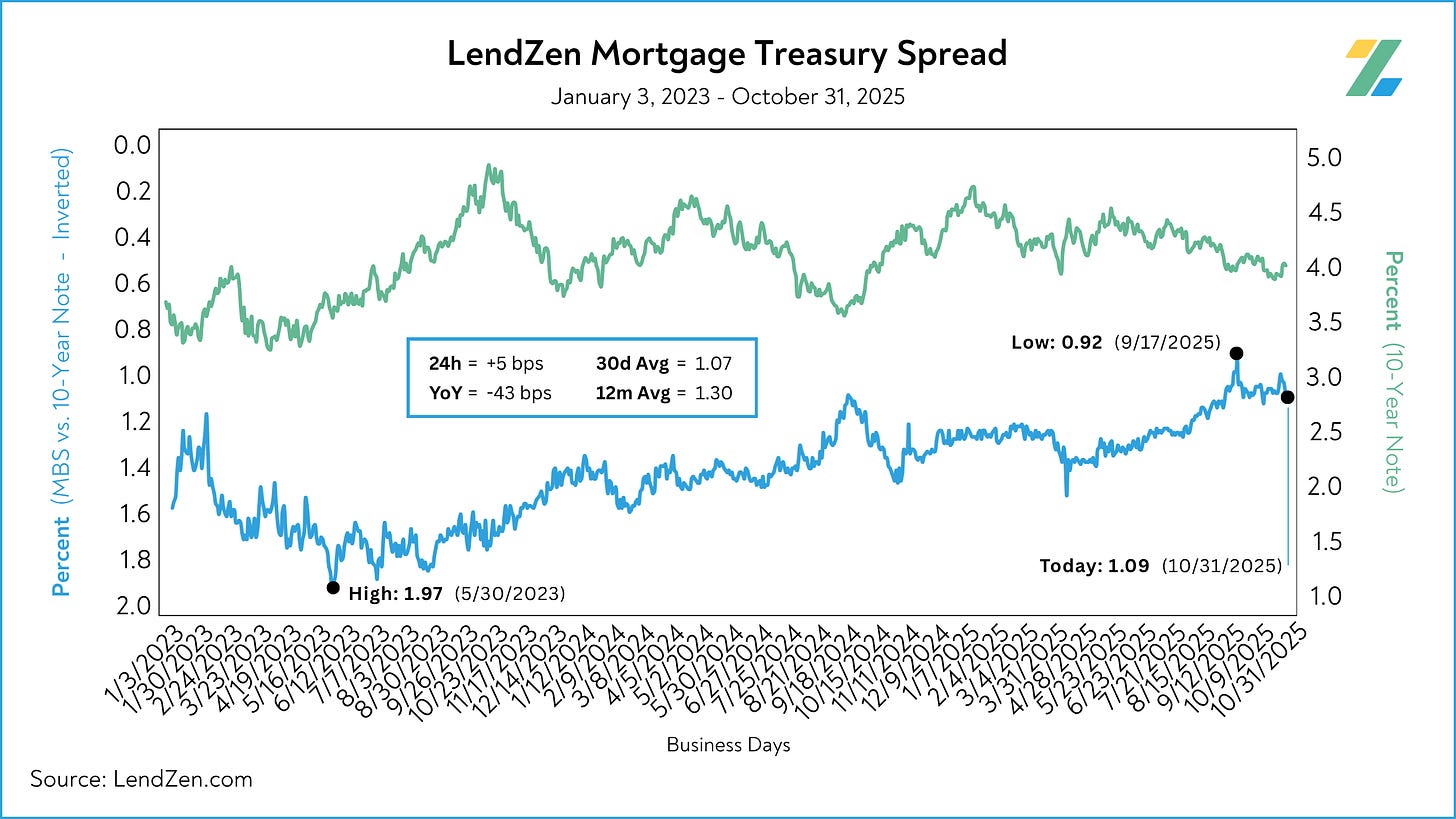

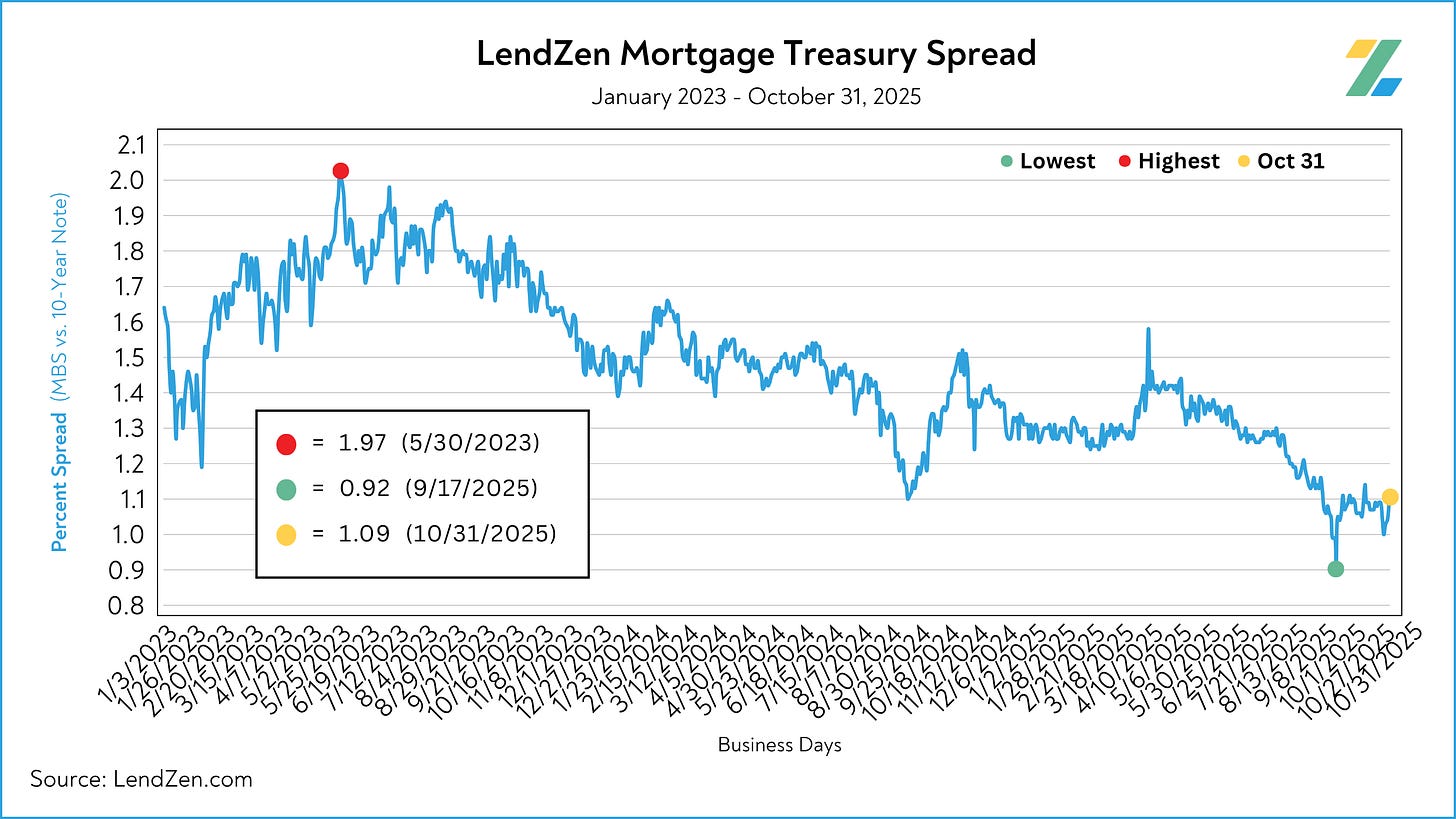

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

Learn more about the importance of accurately calculating spreads on this Substack post.

The spread between mortgage bonds and the U.S. 10-Year widened 4-bps during the week, after flirting with a sub-1% spread before the Fed rate cut decision.

Oct 27 = 1.05

Oct 31 = 1.09

30d Avg = 1.07

12m Avg = 1.30

YoY = - 43 bps (1.52)

However, with a decline of 40 - 49 bps since last year, spreads have been the real story behind mortgage rates now versus 2024.

Get the full scoop in this recent Substack post.

RATE LOCK GUIDE 🔒

---------------------

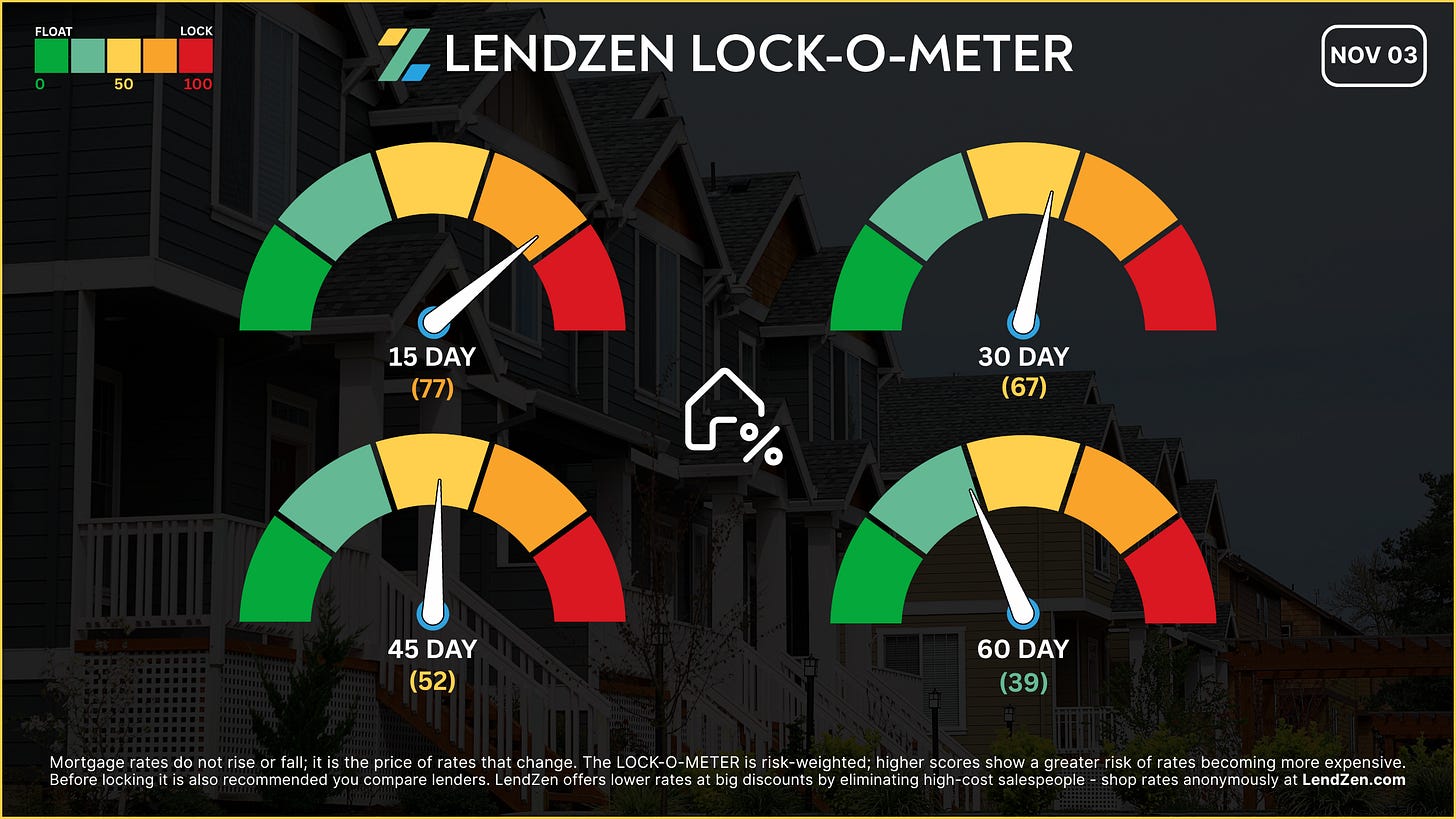

The LendZen LOCK-O-METER provides borrowers with a risk-weighted score based on how various macroeconomic events, including market data, central bank announcements, and geopolitics, each historically impacts the price of bonds.

higher risk scores = lean towards locking

------------------

Closing Window

------------------

[ 15 Days ] -- 77 🟠

Powell’s pushback against a December rate cut added volatility and spoiled post-FOMC optimism, while this week’s key labor data (NFP) is again at risk of delay due to the shutdown. Short-term risks remain elevated if Fed speakers damper rate cut hopes further.

[ 30 Days ] -- 67 🟡

As the shutdown enters its 2nd month markets will rely on Fed commentary in the absence of meaningful data. This adds an extra layer of uncertainty that rate sensitive borrowers should consider avoiding if this week continues to add to bond market weakness.

[ 45 Days ] -- 52 🟡

We are flying blind in the void of economic data, and with the December rate cut no longer a “foregone conclusion” it’s a wait and see approach for closing windows beyond 30-days.

[ 60 Days ] -- 39 🟢

Even if the tone surrounding future rate cuts improves, there is no guarantee it will be met positively by the bond market, as pointed out in the charts above. However, given the positive momentum of 2025, locking now for a 2026 close seems unnecessarily conservative.

If you are already in a strong position, locking makes the most sense since the focus should be on making a savvy rate choice based on your longer-term rate outlook.

I expand on this “long game” approach in this Substack article.

Thanks for reading.

If you are interested in more mortgage insights, then I suggest checking out this recent Substack article.