Mortgage Rate Data Deluge 🏠📉🔒 (JAN 5)

Here is a deluge of mortgage rate data to start your week!

Included in this week’s deluge are the following sections:

MARKET RECAP ⏪

------------------

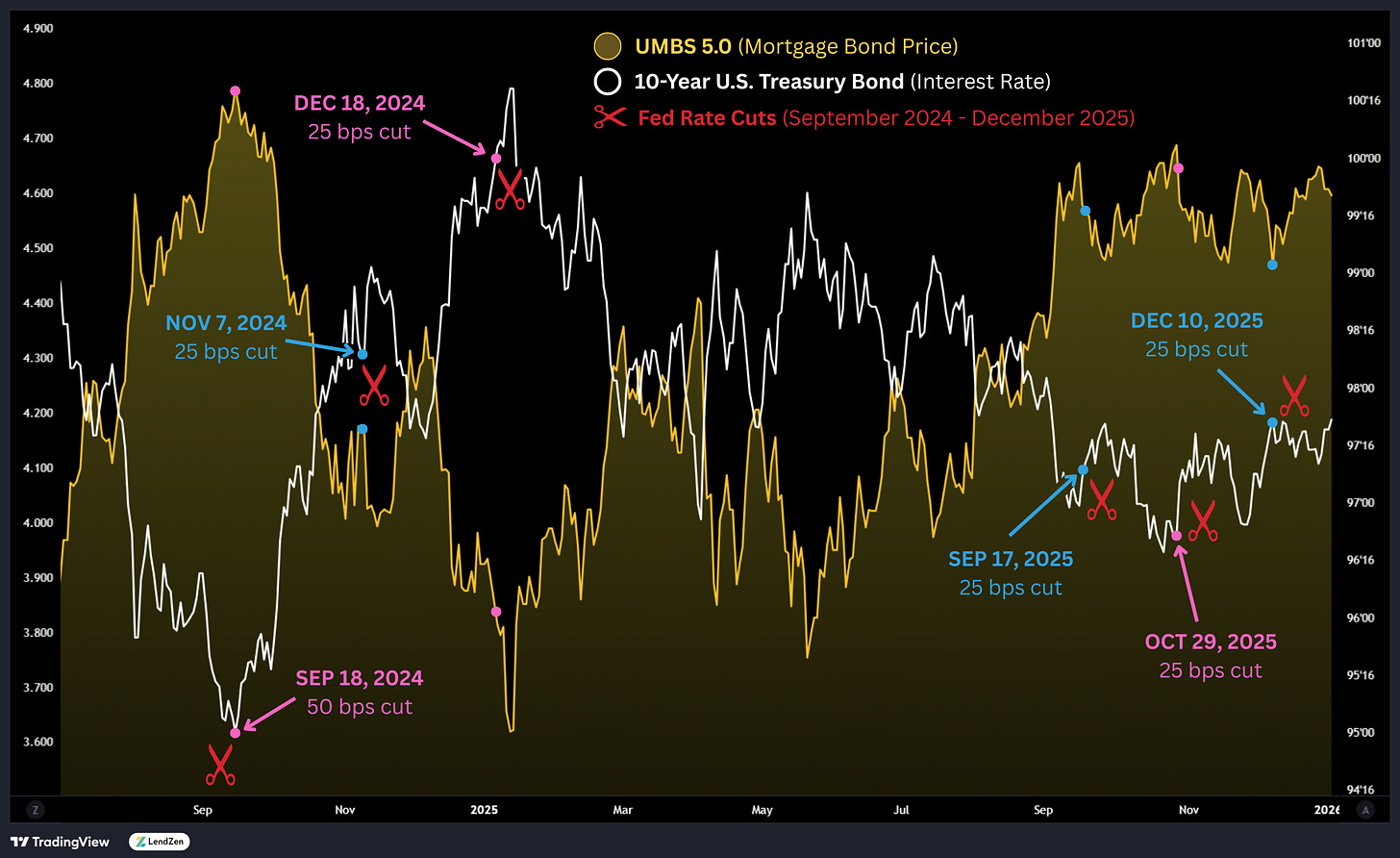

The final week of 2025 was similar to the rest of December - mortgage bonds traded sideways most of the month, with a mini-rally following the Fed’s third and final rate cut of the year.

The momentary bump in bond prices was an unusual reaction, even if only temporary, considering the previous 5 fed cuts were not bond friendly.

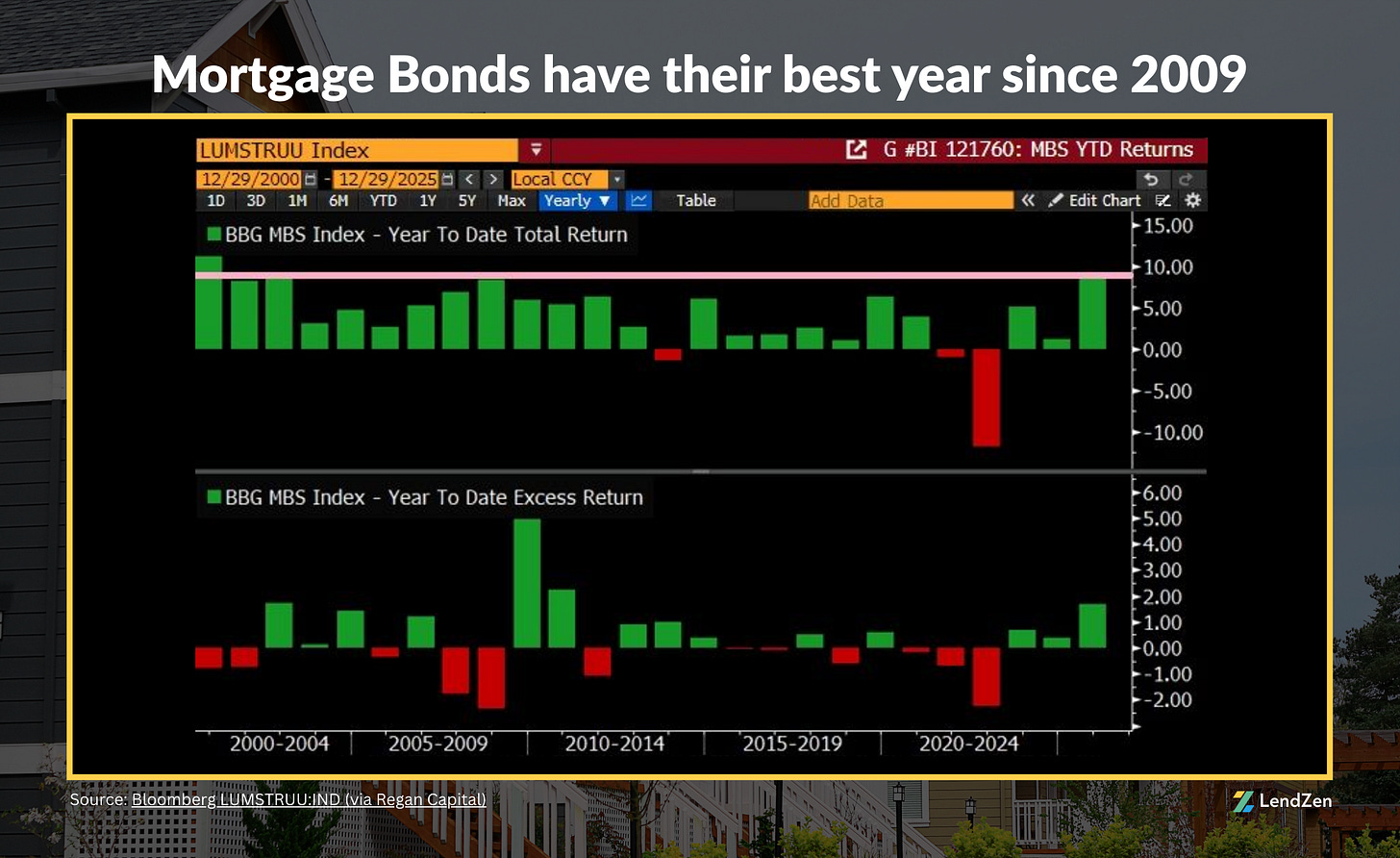

In the end, December had no surprises, and 2025 ended as the best year for mortgage rates since 2020 and the best total return for MBS in nearly two decades.

MADURO MAYHEM 🚁

-----------------------

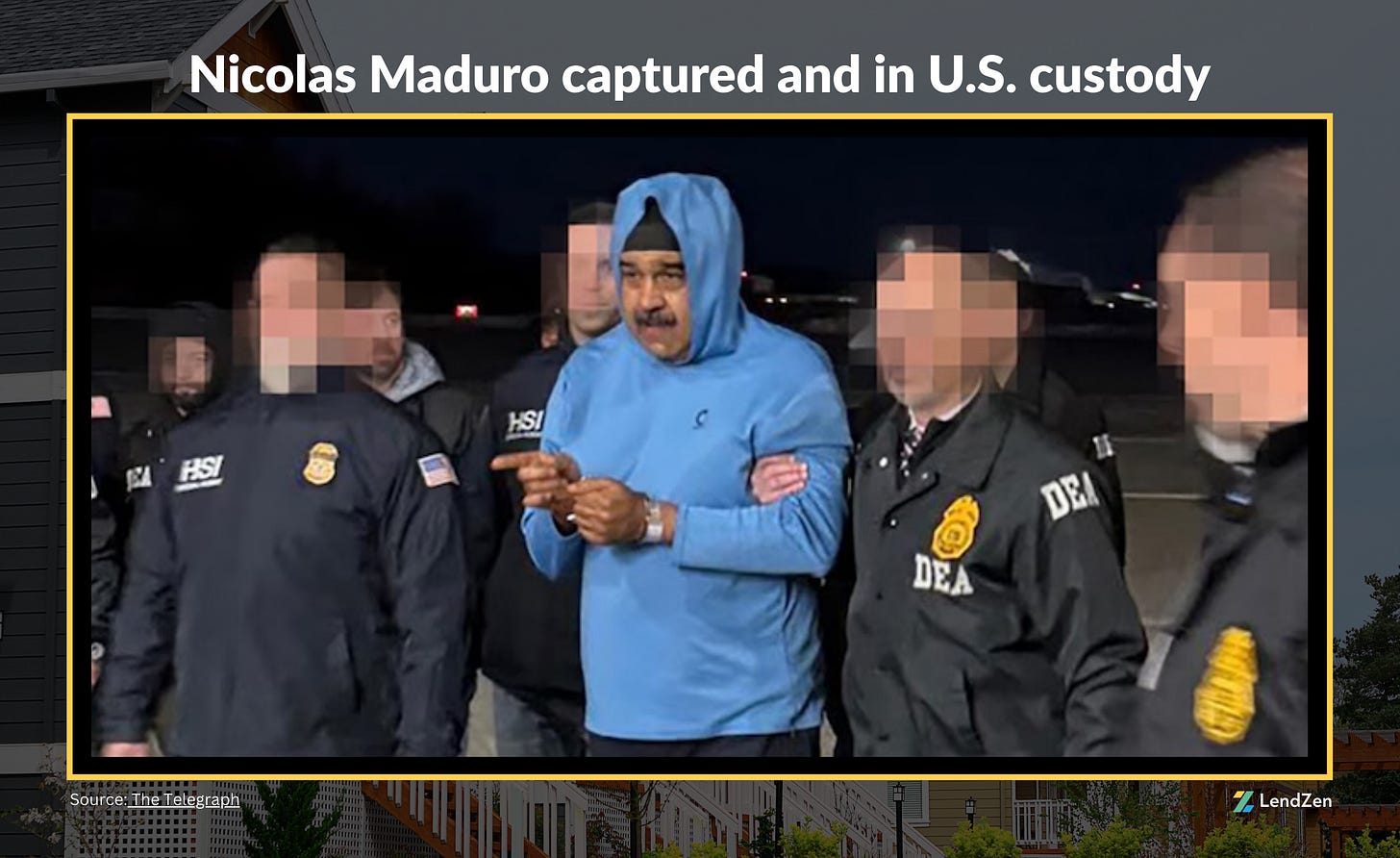

Geopolitical events are unpredictable and therefore one of the biggest causes of market volatility.

The latest wildcard is this weekend’s capture of Venezuelan President Nicolas Maduro.

Drama, chaos, and uncertainty tend to be good for bonds, so this sudden turn of events could help slingshot mortgage rates back to the October lows.

However, knee jerk reactions are rarely sustained. If bonds respond positively to the news on Monday it could be an opportunity to lock in some modest gains if you are in a short closing window.

Read more in the Rate Lock Guide section below.

RATE PRICE INDEX 📉

----------------------

Mortgage rates DO NOT rise or fall.

The full range of rates is always available, and instead the price of each rate changes based on the trading of individual mortgage bonds.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

This provides borrowers with a more specific measurement of how the cost to obtain a mortgage is changing, regardless of the lender, rate, or credit score.

-----------

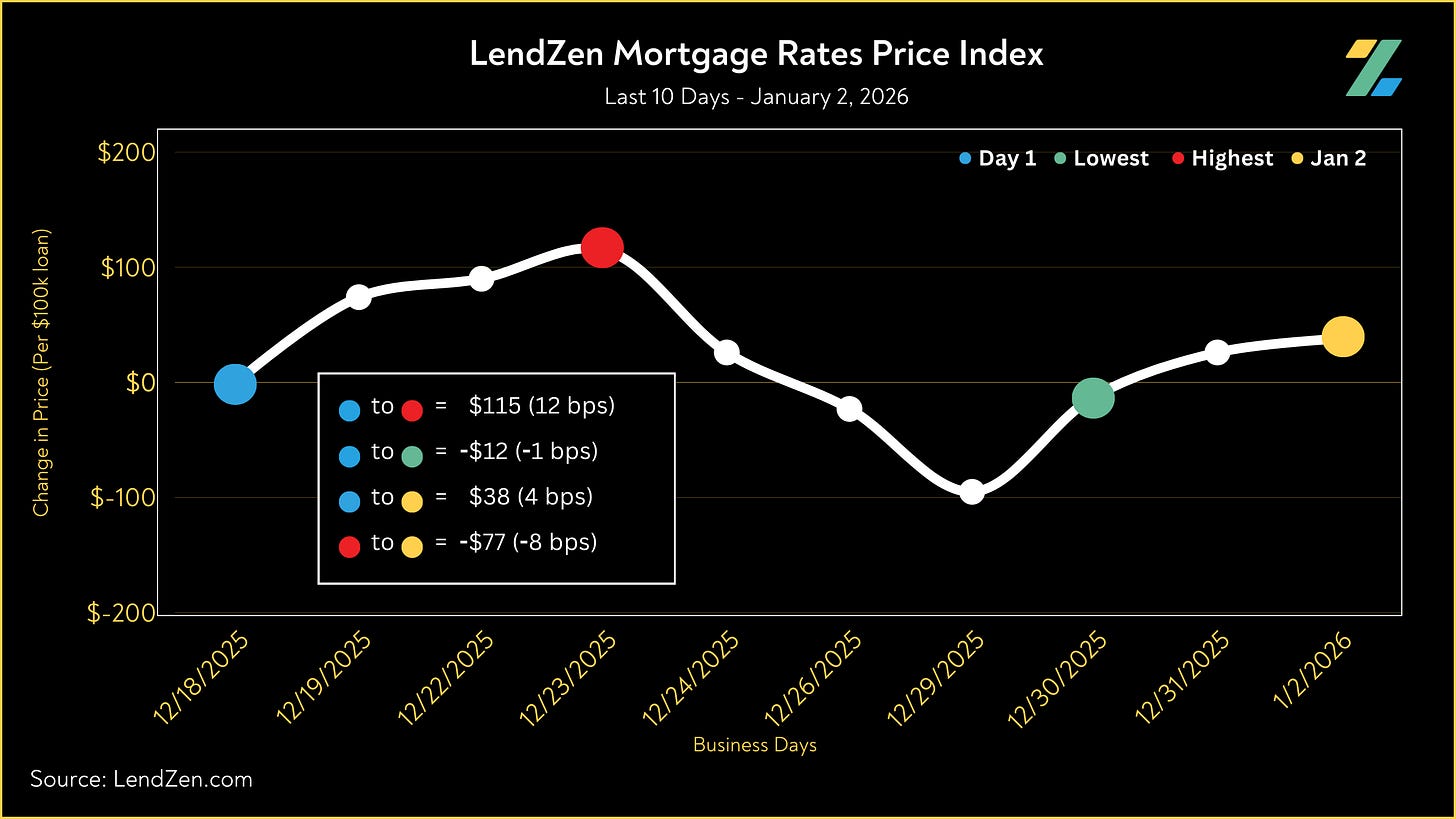

01/02/2026

-----------

24-Hour: +1 bps ($13 per $100K)

5-Day: +6 bps ($61)

10-Day: +4 bps ($38)

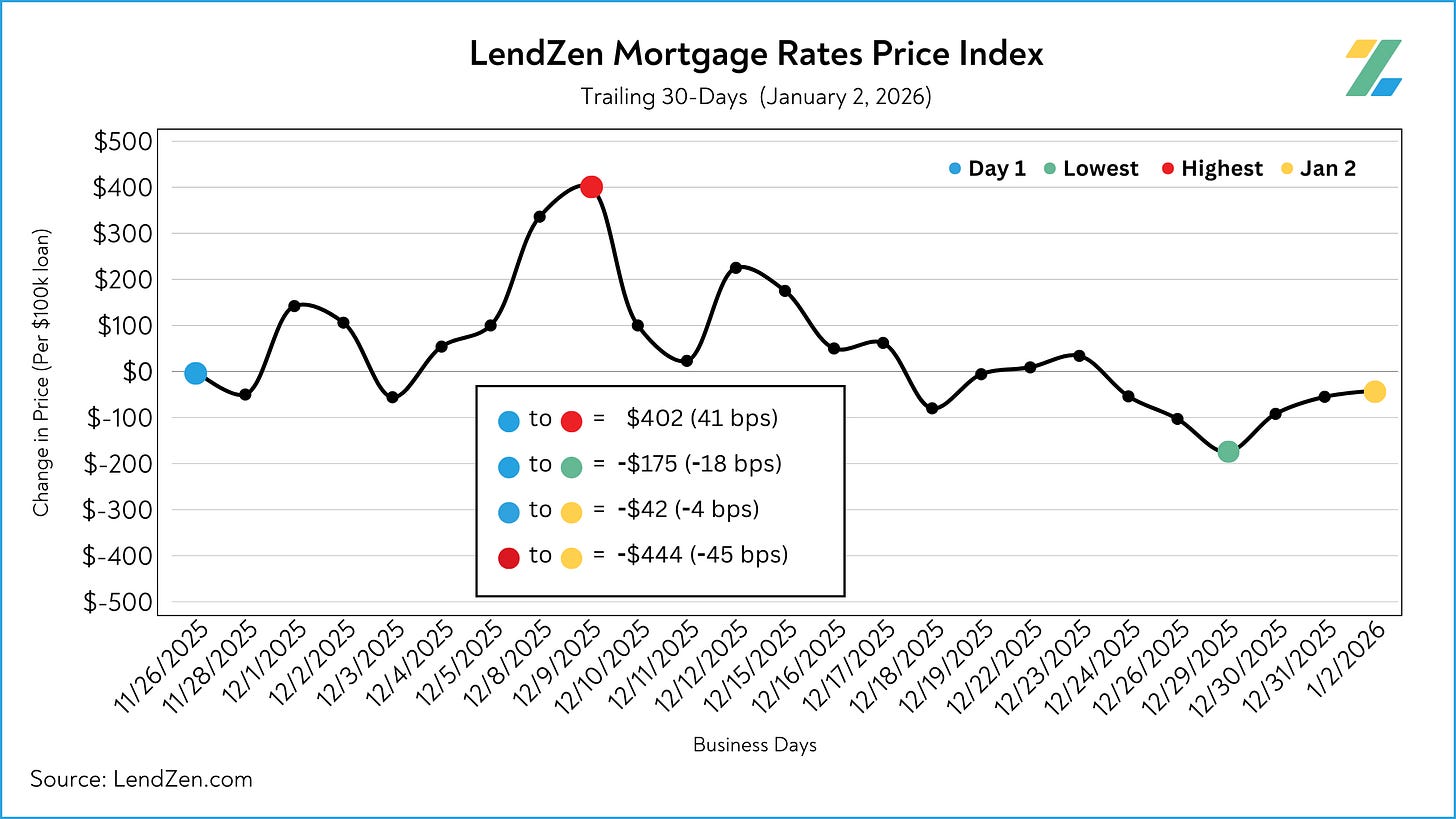

30-Day: -4 bps (-$42)

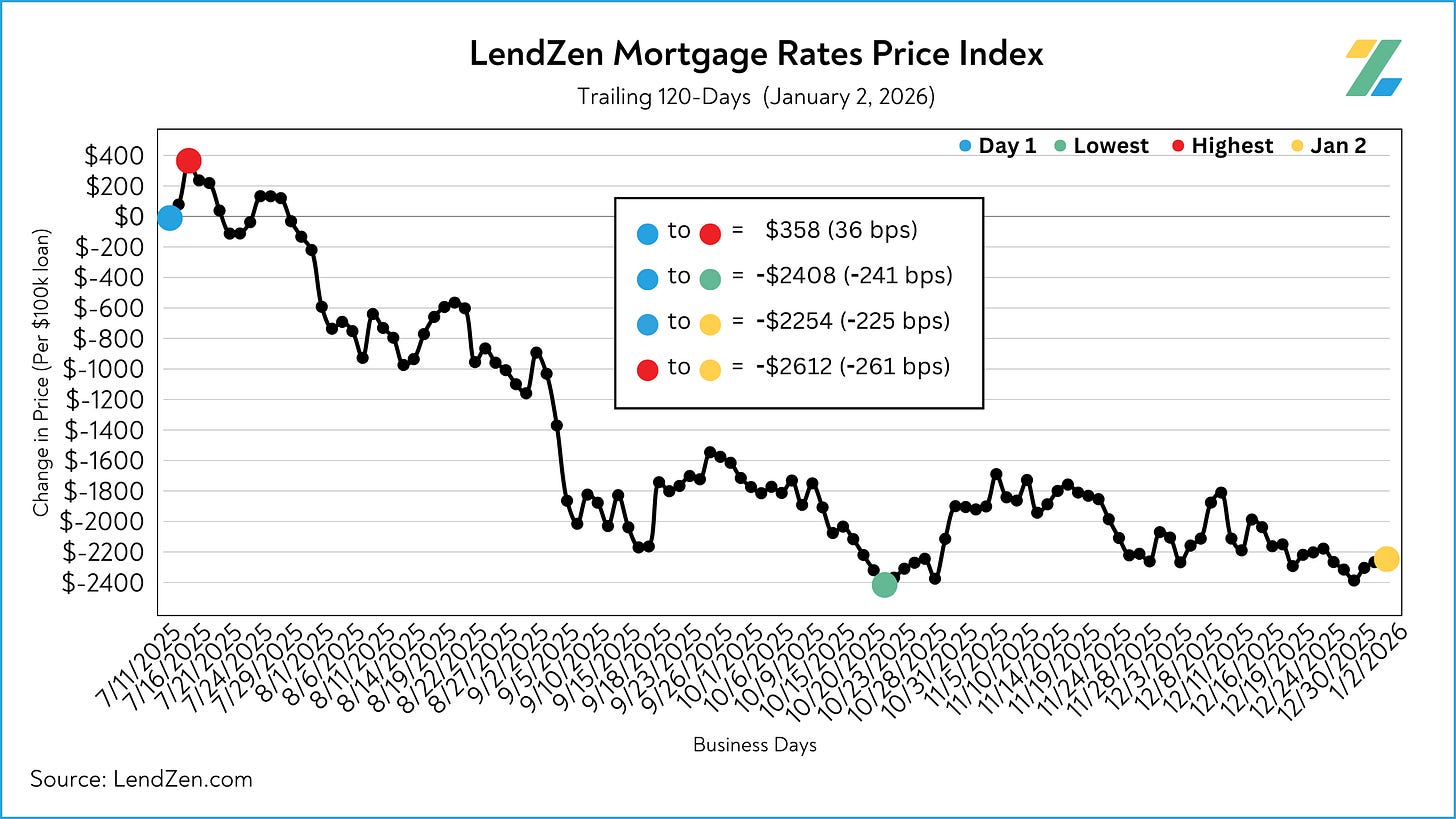

60-Day: -60 bps (-$600)

120-Day: -225 bps (-$2254)

Mortgage rates coasted through the holiday season.

In fact, the entire month of December was relatively uneventful.

However, the final two quarters of 2025 were winners, with mortgage rate prices declining 225 bps.

That means the cost of getting a $500,000 mortgage (regardless of the rate) declined by $11,250 in the 2nd half of the year.

MBS PRICING 🏦

----------------

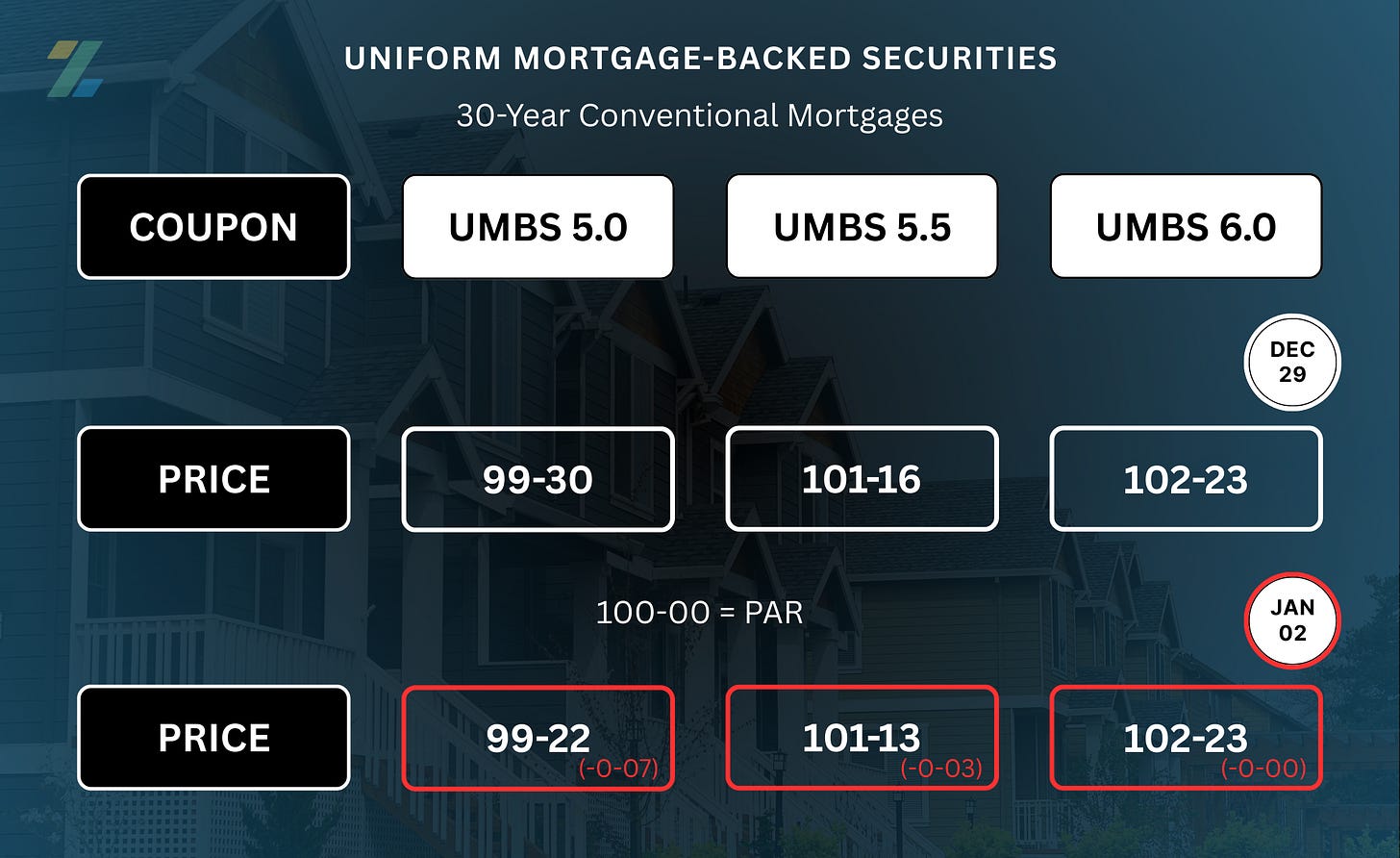

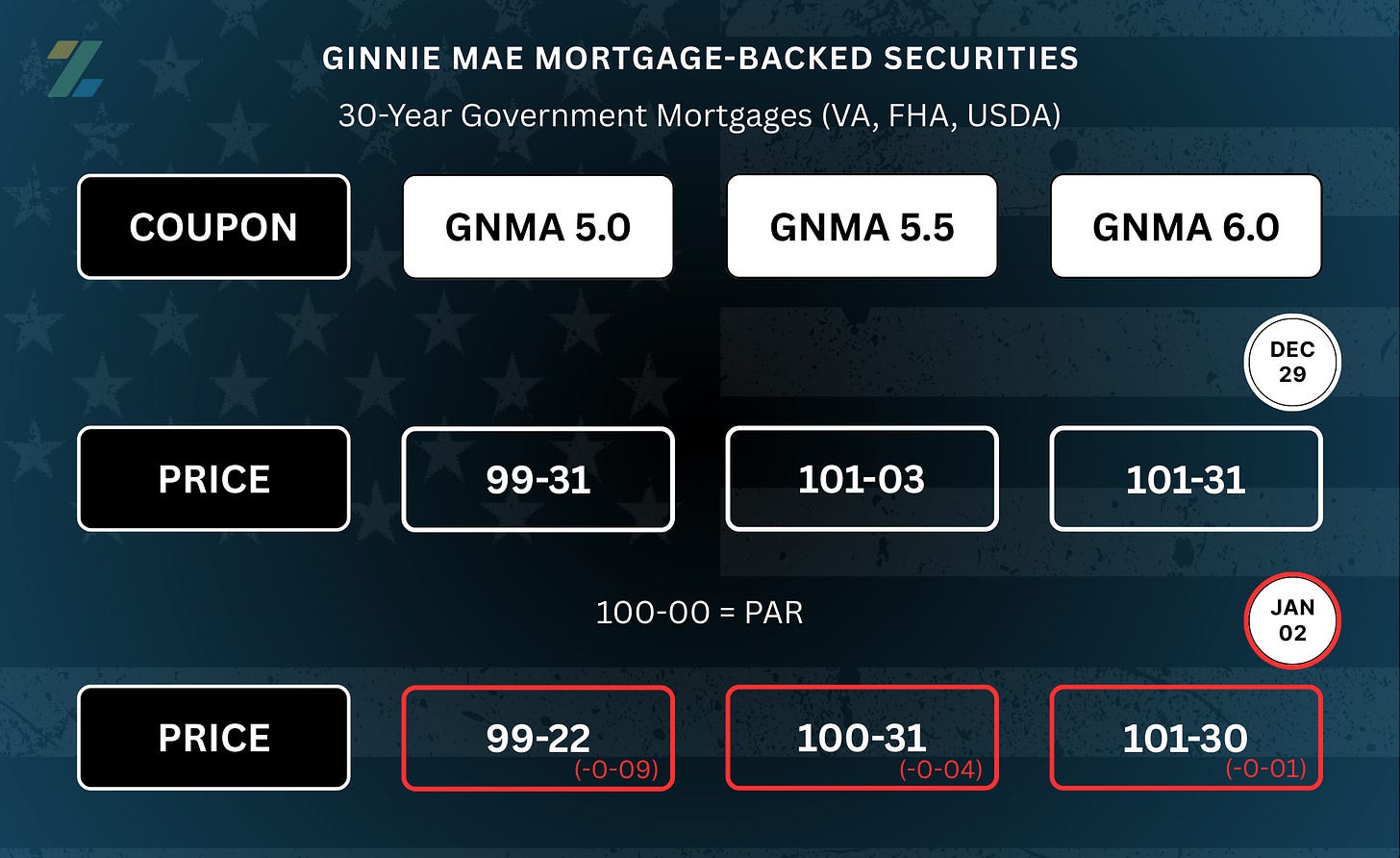

MBS coupons are sold at half-percent increments, while their price moves in 32nds (ticks).

ex. (0-04) = 4/32 = 12.5 bps

100-00 acts as the starting line, also referred to as PAR.

The higher the coupon price, the less expensive the rates will be that are sold into that security.

Therefore, an increase in the price of mortgage bonds is good for mortgage rates.

Learn more about the dynamics of MBS pricing and how it impacts your mortgage options in any of the bi-weekly “Rate Snapshot” Substack posts.

Bond prices drifted slightly lower last week, which is why the 5-day LendZen Index showed a slight uptick in the price of mortgage rates.

MORTGAGE SPREADS 🧈

-------------------------

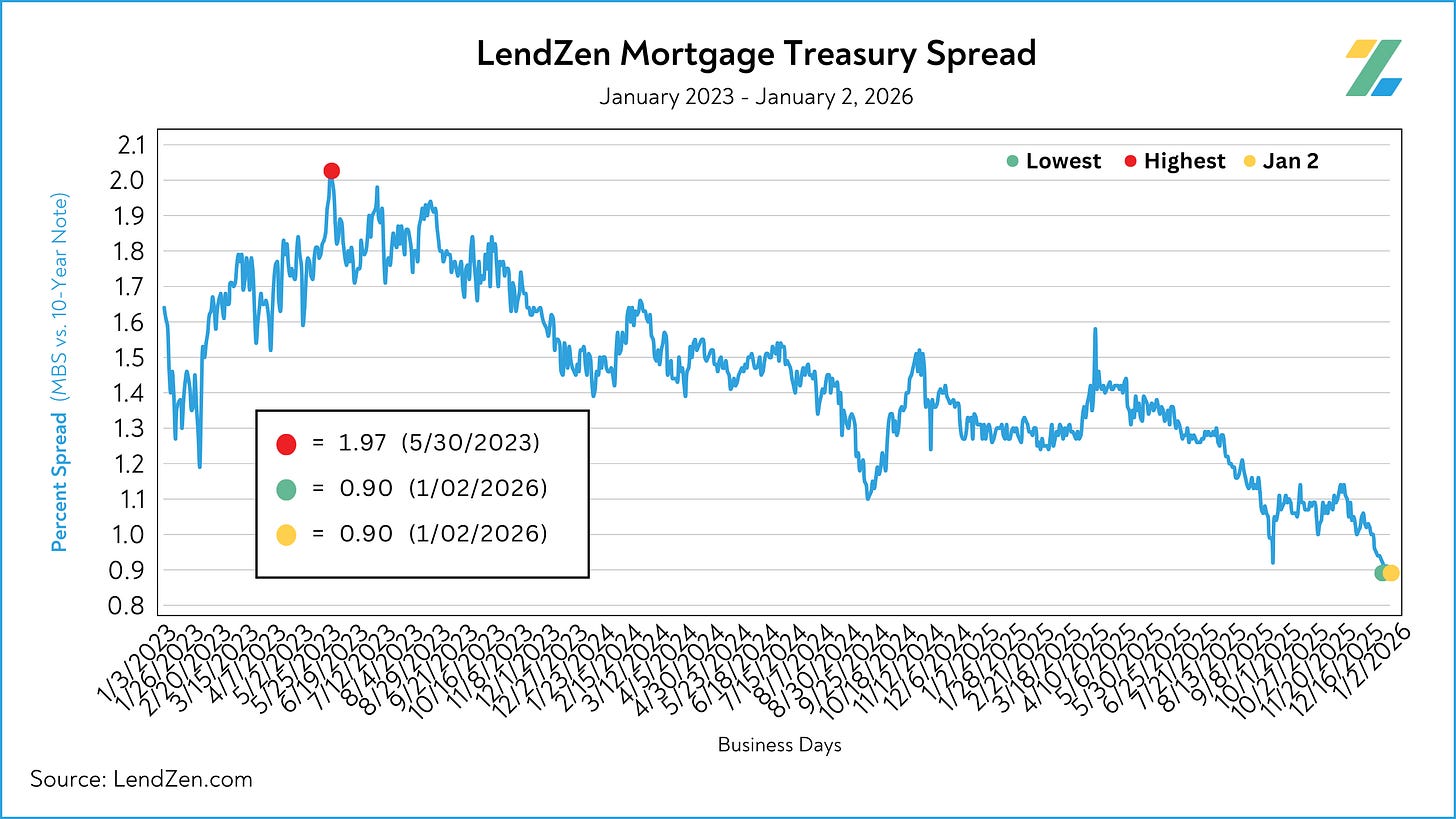

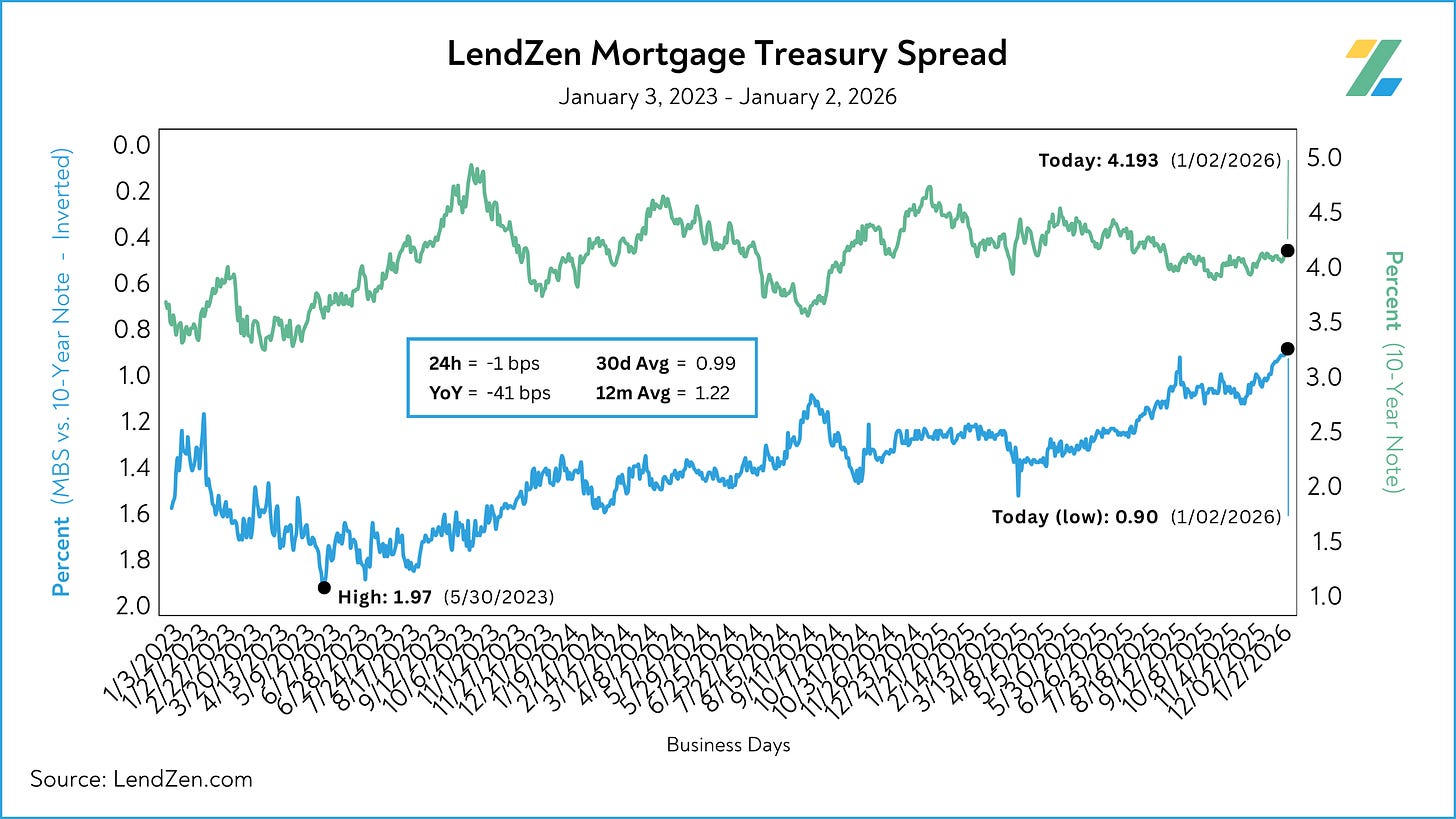

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

Learn more about the importance of accurately calculating spreads on this Substack post.

The spread between mortgage bonds and the U.S. 10-Year tightened 2-bps during the week, reaching a multi-year low.

Dec 26: 0.92

Jan 02: 0.90

5d: -2 bps

30d Avg: 0.99

12m Avg: 1.22

YoY: -41 bps

Compared to 2024, spreads were tighter by nearly 40-bps at various times during the last quarter of the year and started the new year off by reaching a multi-year low.

This dramatic outperformance from mortgage bonds is why mortgage rate PRICES improved so much despite the 10-Year yield sitting 53-bps higher (3.66 vs 4.19) than at the lows of 2024.

HOUSING DATA 🏠

------------------

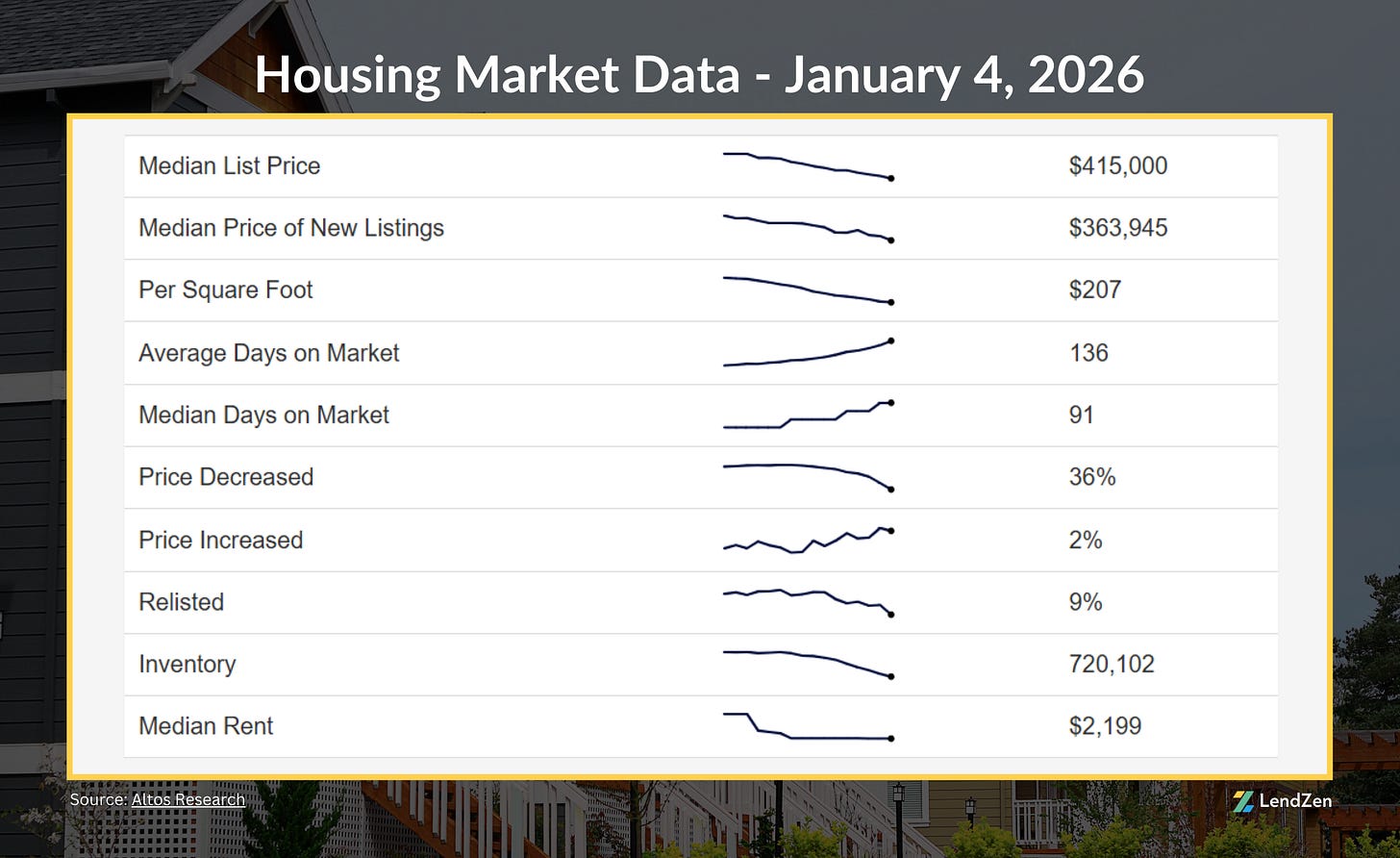

Here are the latest housing market stats, with trends from the last 90 days.

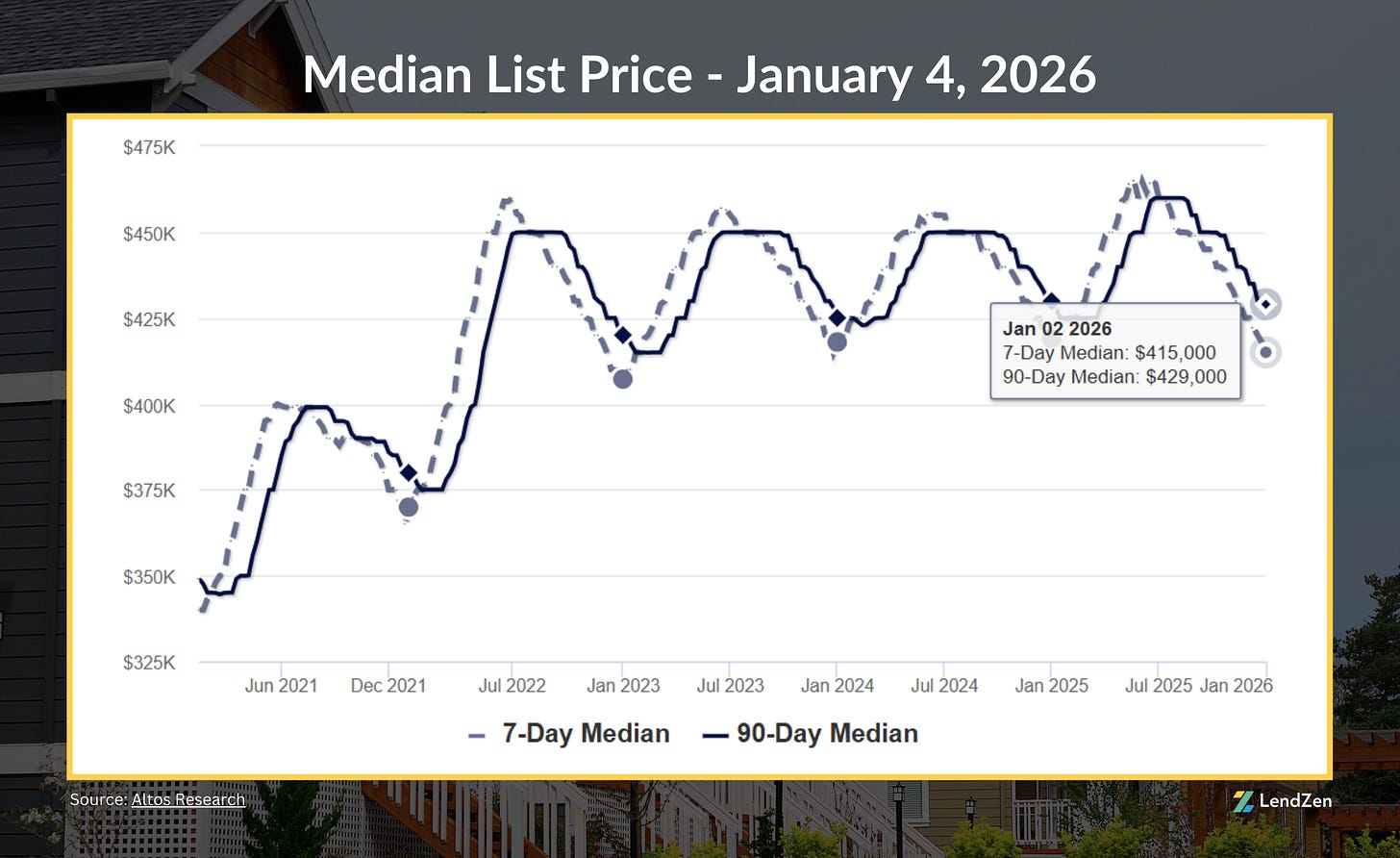

The U.S. median list price is $415,000, down about 3/4 of a percent (0.72%) from last week and a decline of 6.5% over the quarter.

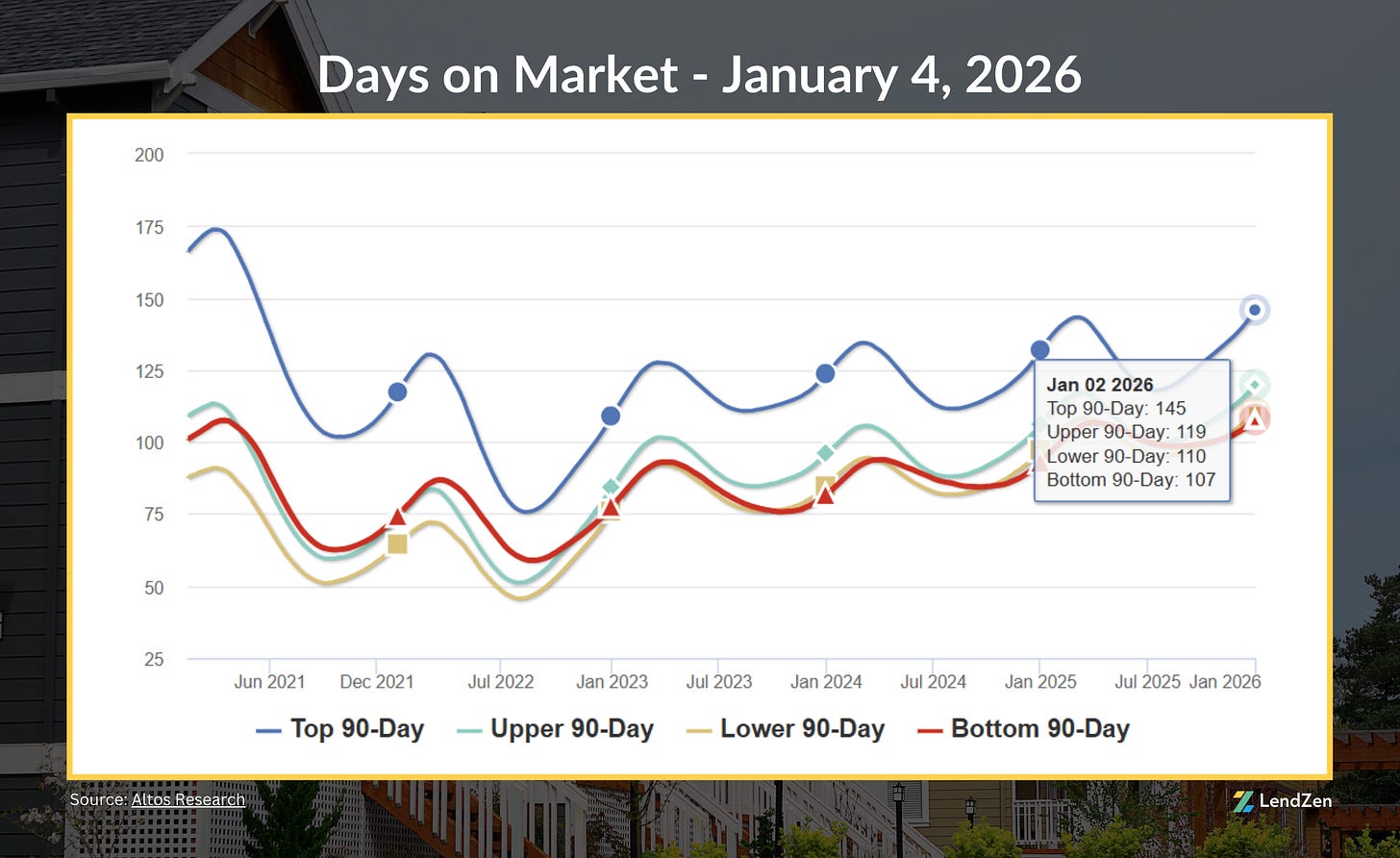

Days on market is up 4 days from last week to an average of 136.

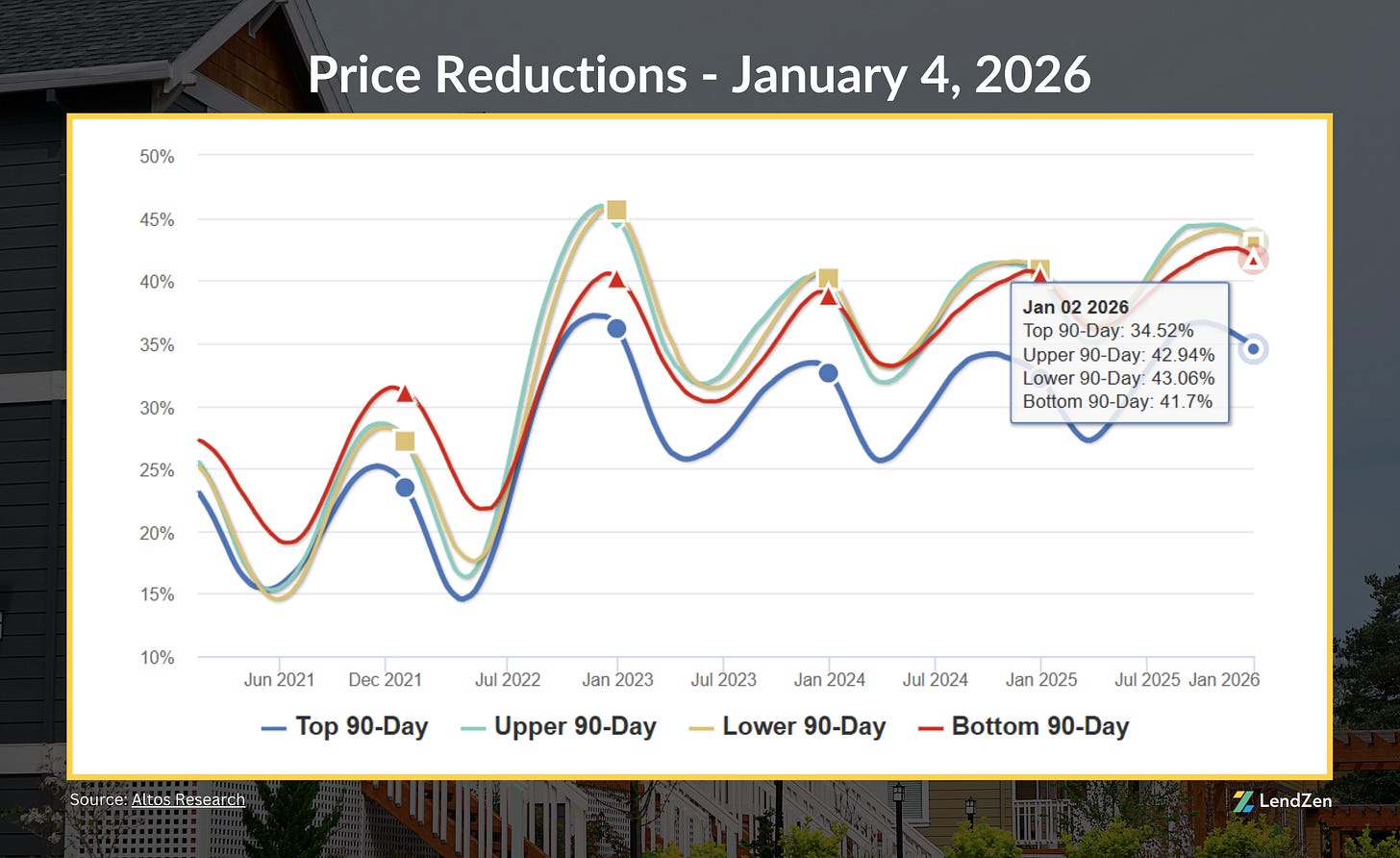

Price reductions slowed across all market tiers with a 90-day national average of 36%.

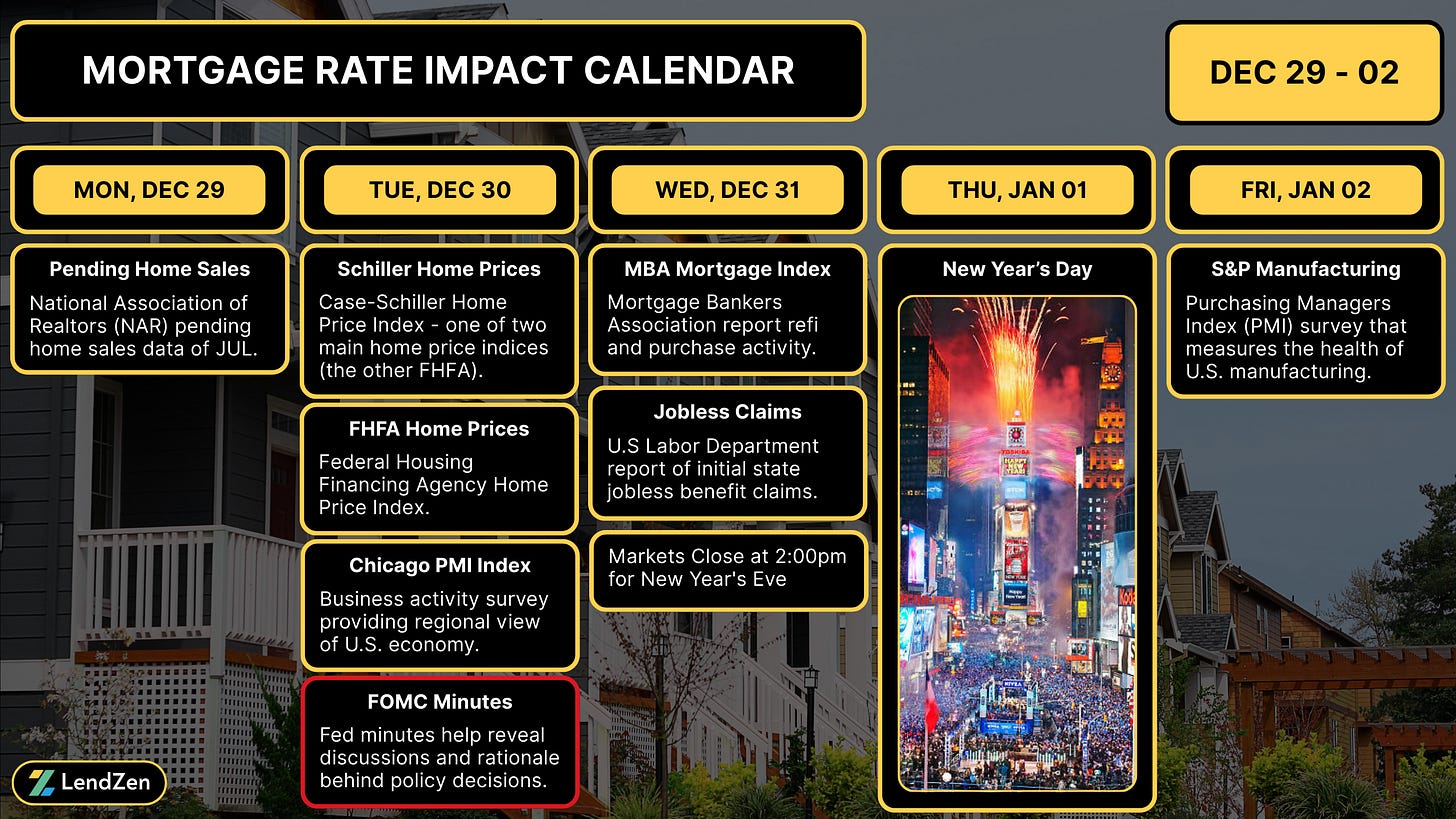

WEEK AHEAD 📅

----------------

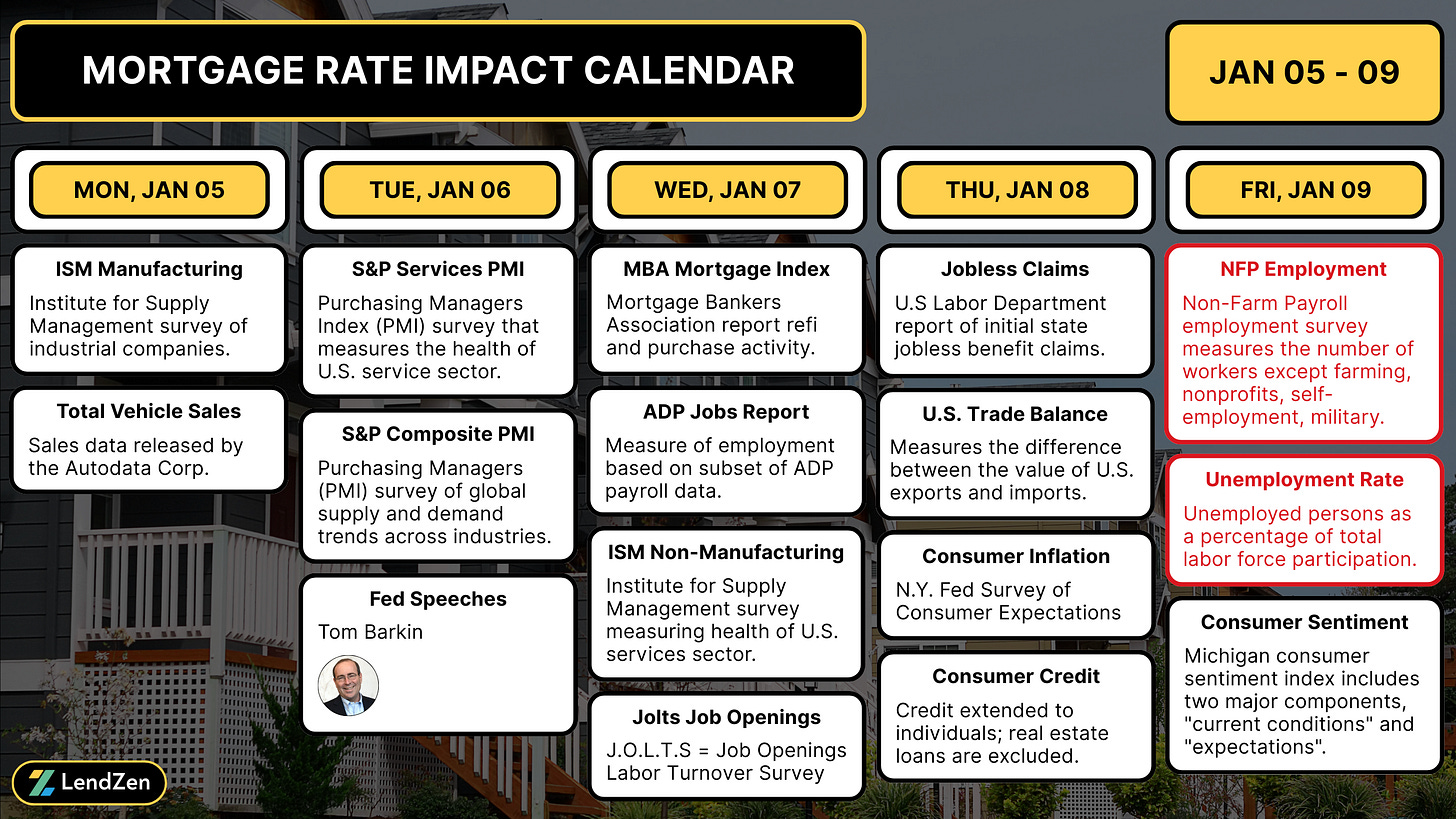

In the first week of 2026 markets prepare for a full calendar, including the latest NFP report.

Also on deck in the employment category is the Jobs Opening Labor Turnover Survey (JOLTS) and the Monthly ADP payrolls report.

Read more in yesterday’s Week Ahead.

RATE LOCK GUIDE 🔒

---------------------

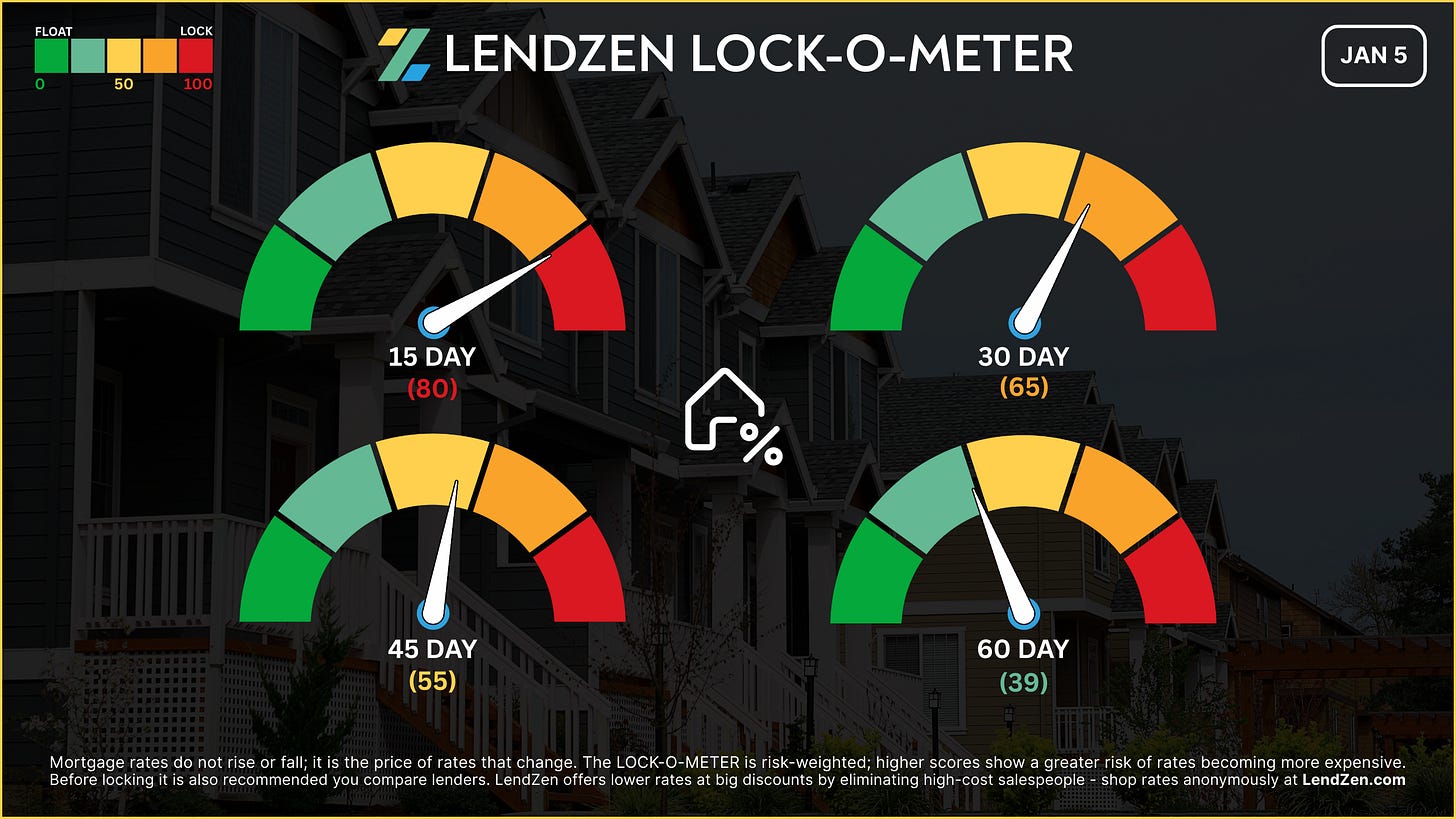

The LendZen LOCK-O-METER provides borrowers with a risk-weighted score based on how various macroeconomic events, including market data, central bank announcements, and geopolitics, each historically impacts the price of bonds.

higher risk scores = lean towards locking

------------------

Closing Window

------------------

[ 15 Days ] -- 80 🔴

Big week of market-moving data ahead (NFP, ADP, ISM, JOLTS) with uncertainty amplified by geopolitical volatility. Short-term pricing very sensitive to surprises, and Maduro capture elevates volatility although a potential short-term factor.

[ 30 Days ] -- 65 🟠

Mortgage rates hover near the 2025 lows, providing some breathing room. However, even if bonds survive this week’s employment data there is the inflation and GDP backlog to contend with as well.

[ 45 Days ] -- 55 🟡

The Big 3 are all on deck in January. Take each one-at-a-time and reassess your lock risks accordingly.

[ 60 Days ] -- 39 🟢

The broader 60-day trend remains favorable, as the previous two quarters delivered 225 bps of rate price improvement (LendZen Index). With this type of momentum there is no urgency to lock but stay vigilant and look for fresh guidance from January econ data.

If you are already in a strong position locking generally makes the most sense, especially for shorter windows, since the focus should be on making a savvy rate choice based on your longer-term rate outlook.

I expand on this “long game” approach in this Substack post.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.