Mortgage Rate Data Deluge 🏠📉🔒 (DEC 8)

Here is a deluge of mortgage rate data to start your week!

Included in this week’s deluge are the following sections:

MARKET RECAP ⏪

-------------------

Last week continued November’s uneventful streak with economic data mostly mixed, creating a bit of choppiness but no breakout in either direction.

It is clear markets are “all eyes on the Fed” with expectations of another 25-bps cut.

FED RATE CUTS ✂️

------------------

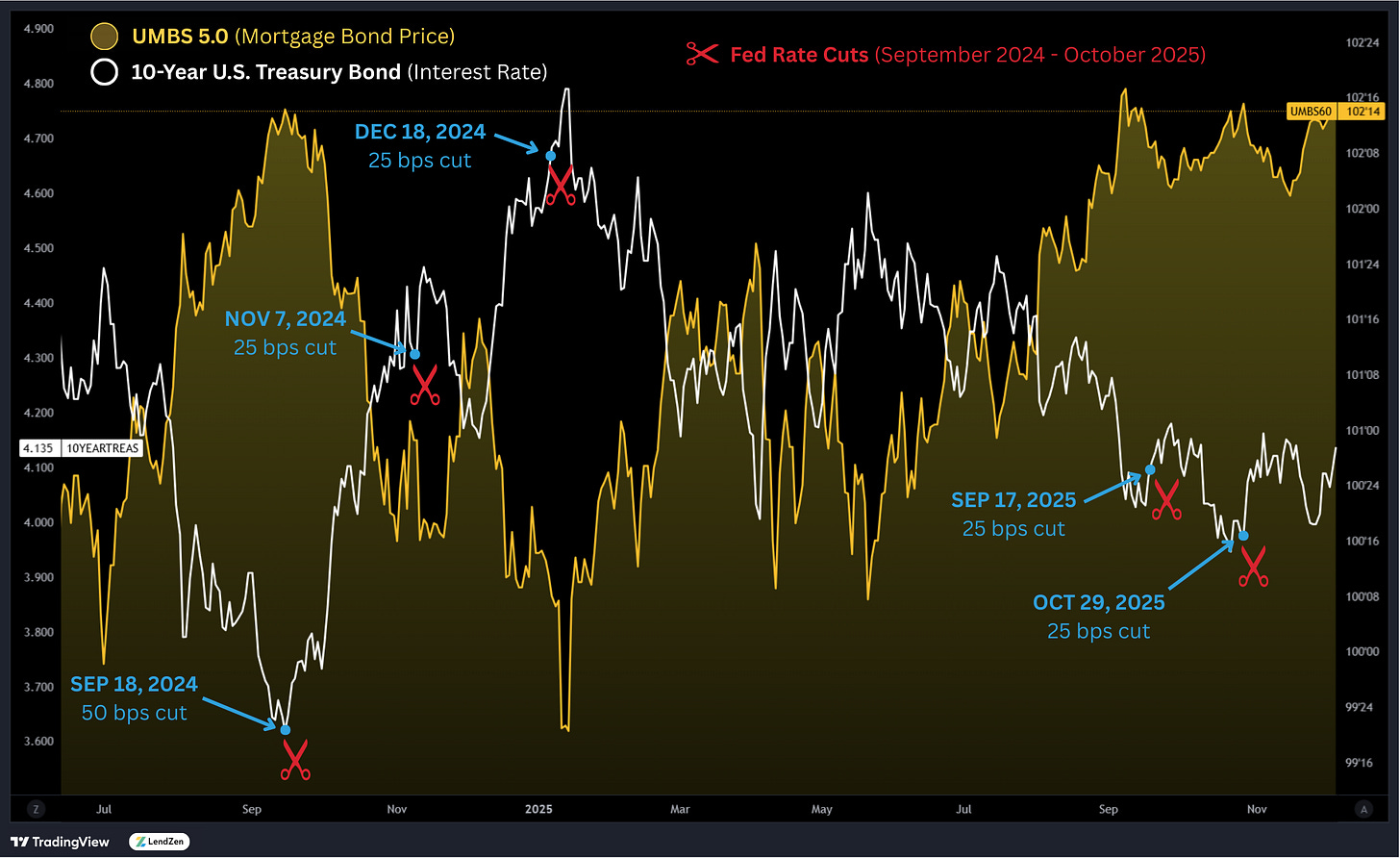

Although expectations and optimism are high that the Fed will cut another 25-bps, the last 5 rate cuts have all resulted in a bond sell-off (higher mortgage rate prices).

RATE PRICE INDEX 📉

----------------------

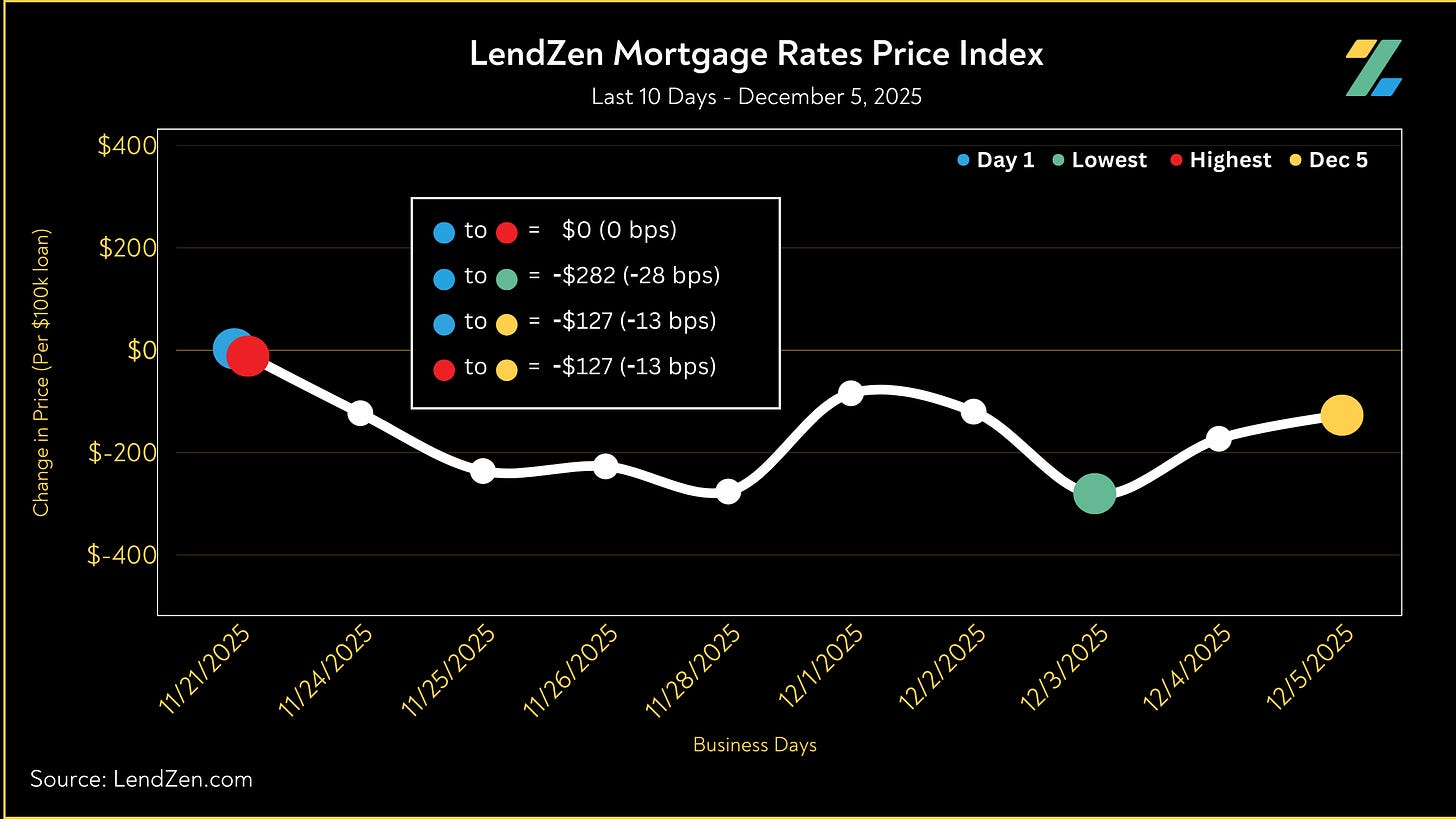

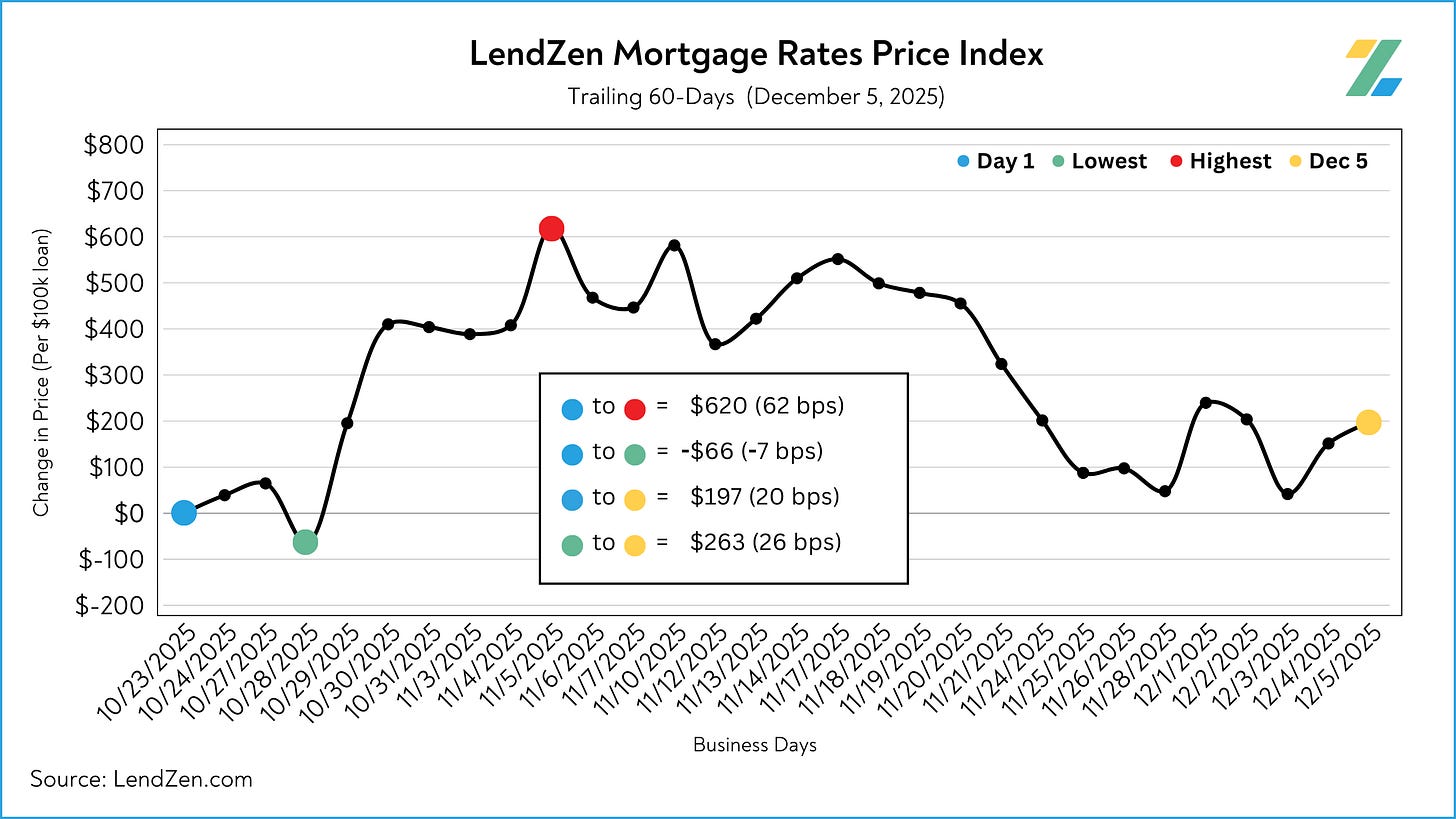

Mortgage rates DO NOT rise or fall.

The full range of rates is always available, and instead the price of each rate changes based on the trading of individual mortgage bonds.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

This provides borrowers with a more specific measurement of how the cost to obtain a mortgage is changing, regardless of the lender, rate, or credit score.

-----------

12/05/2025

-----------

24-Hour: +5 bps ($46 per $100K)

5-Day: -4 bps (-$43)

10-Day: -13 bps (-$127)

30-Day: -21 bps (-$213)

60-Day: +20 bps ($197)

Although bonds have recently found some footing, just like after previous cuts, mortgage rates have not yet fully recovered from the October jump.

This could leave bonds more vulnerable than previous FOMC rate decisions, and if the past is any indicator of the future the likely knee jerk reaction won’t be mortgage rate friendly.

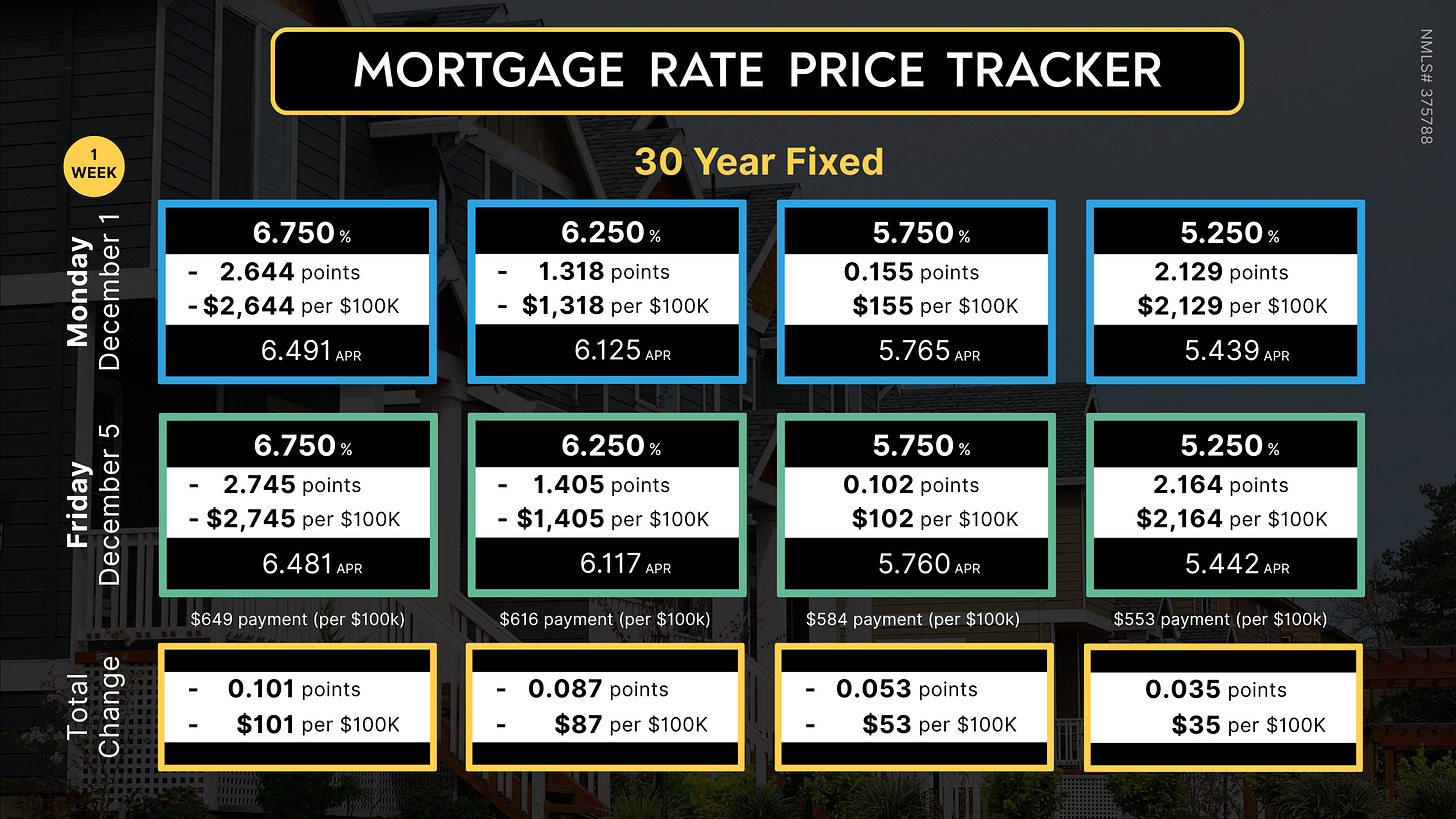

The LendZen Index monitors the change in price across a broad set of rates and mortgage bond coupons, whereas the Mortgage Rate Price Tracker is more “rate and loan program” specific.

Both are an example of how mortgage rates do not rise or fall, but instead it is their price that changes.

Since the LendZen Index has a variety of time series, the MRPT focuses on the current month’s activity.

You can explore the full results from December Week 1 on this Substack post.

MORTGAGE SPREADS 🧈

-------------------------

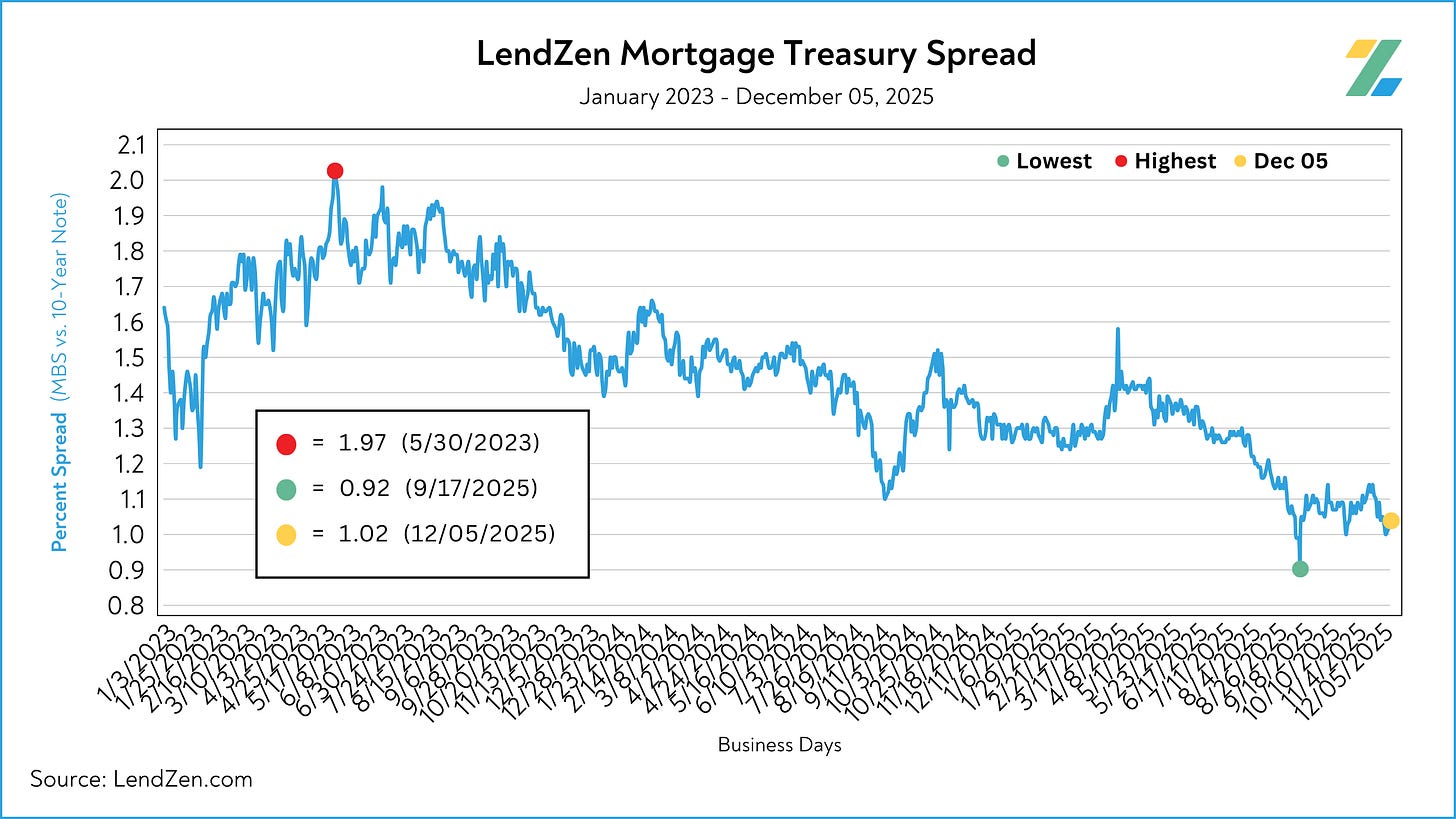

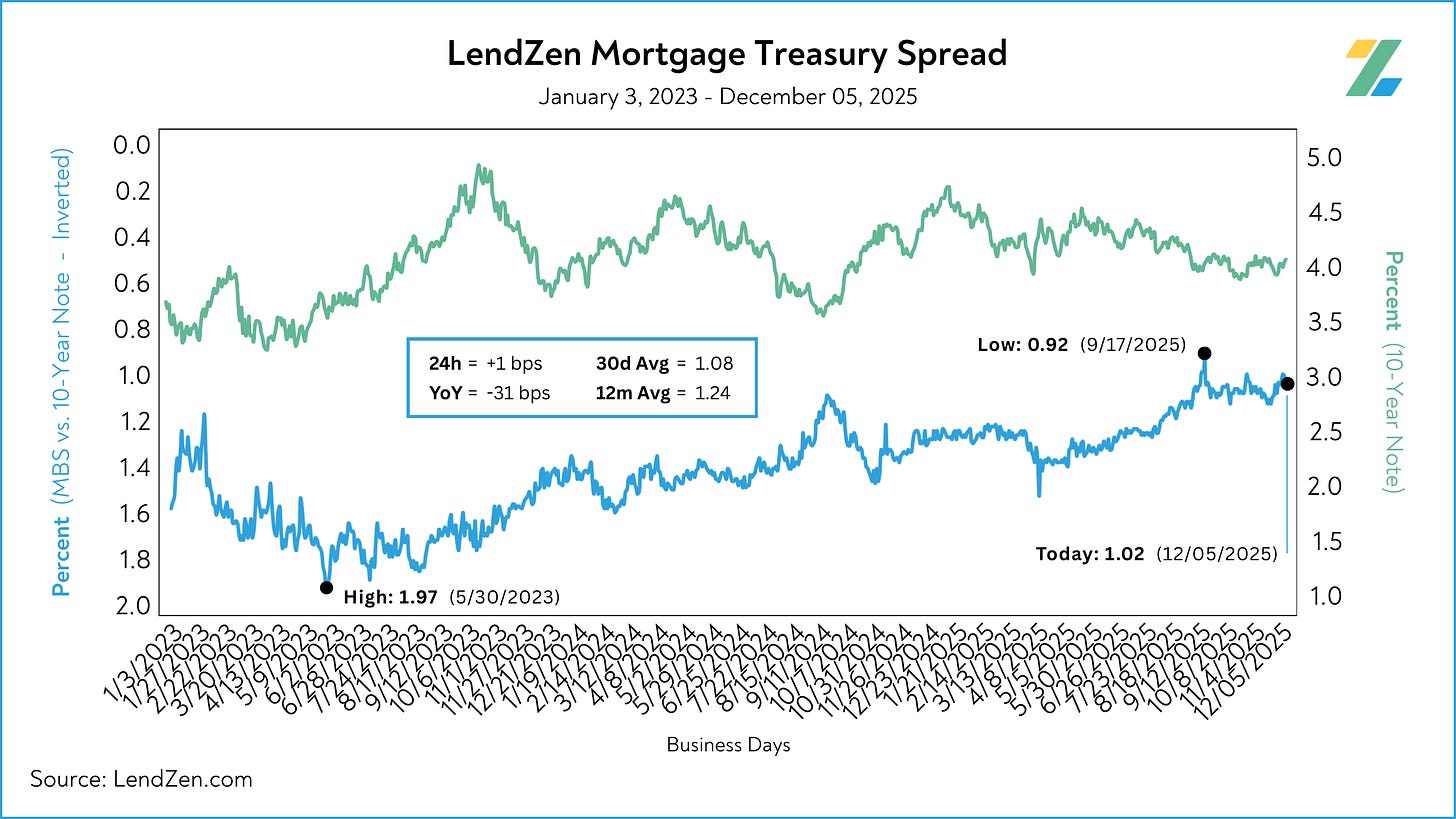

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

Learn more about the importance of accurately calculating spreads on this Substack post.

The spread between mortgage bonds and the U.S. 10-Year tightened 4-bps during the week.

Dec 01: 1.06

Dec 05: 1.02

5d: -4 bps

30d Avg: 1.08

12m Avg: 1.24

YoY: -31 bps

With a decline of over 30 bps since last year, spreads have been the real story behind mortgage rates now versus 2024.

Get the full scoop in this recent Substack post.

HOUSING DATA 🏠

------------------

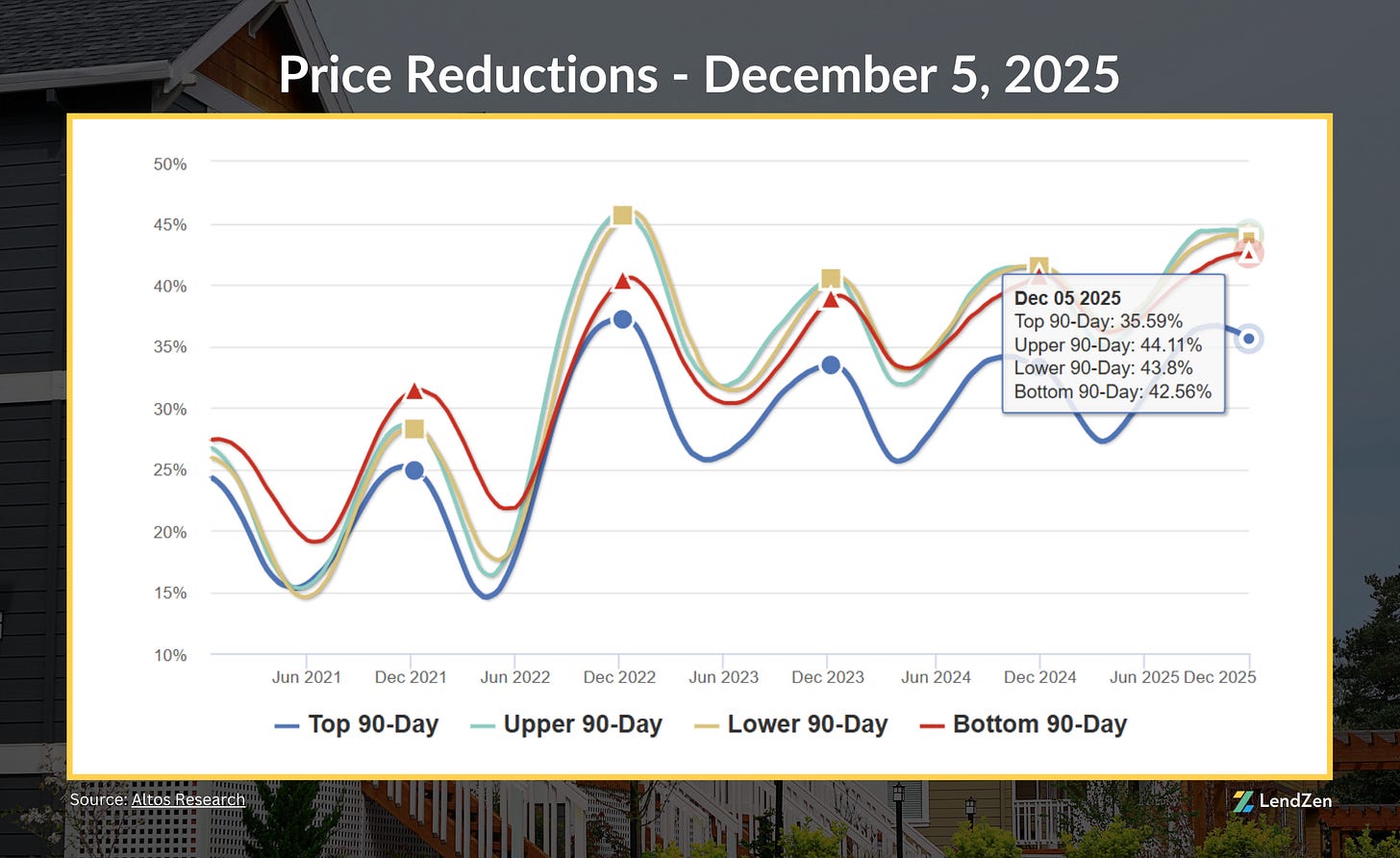

Here are the latest housing market stats, with trends from the last 90 days.

The U.S. median list price is $425,000, unchanged from last week.

Price reductions remain steady with a 90-day national average of 41%, but reductions in the middle price segments increased slightly.

WEEK AHEAD 📅

----------------

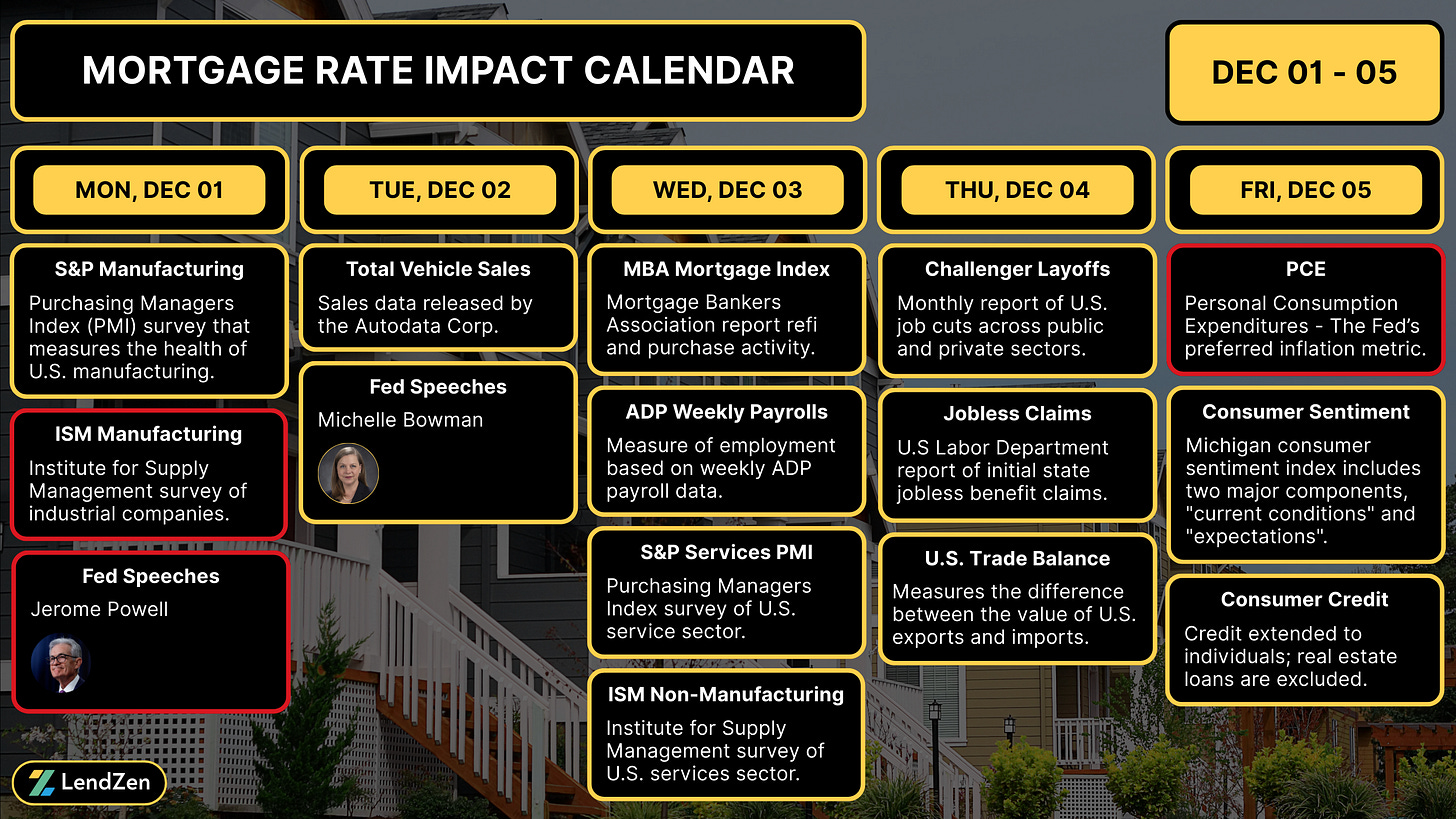

This week is all about the Federal Open Market Committee’s rate decision on Wednesday, but Tuesday preludes the Fed meeting with a rescheduled job openings report (JOLTS) and a 10-Year note auction.

Read more in yesterday’s Week Ahead.

RATE LOCK GUIDE 🔒

---------------------

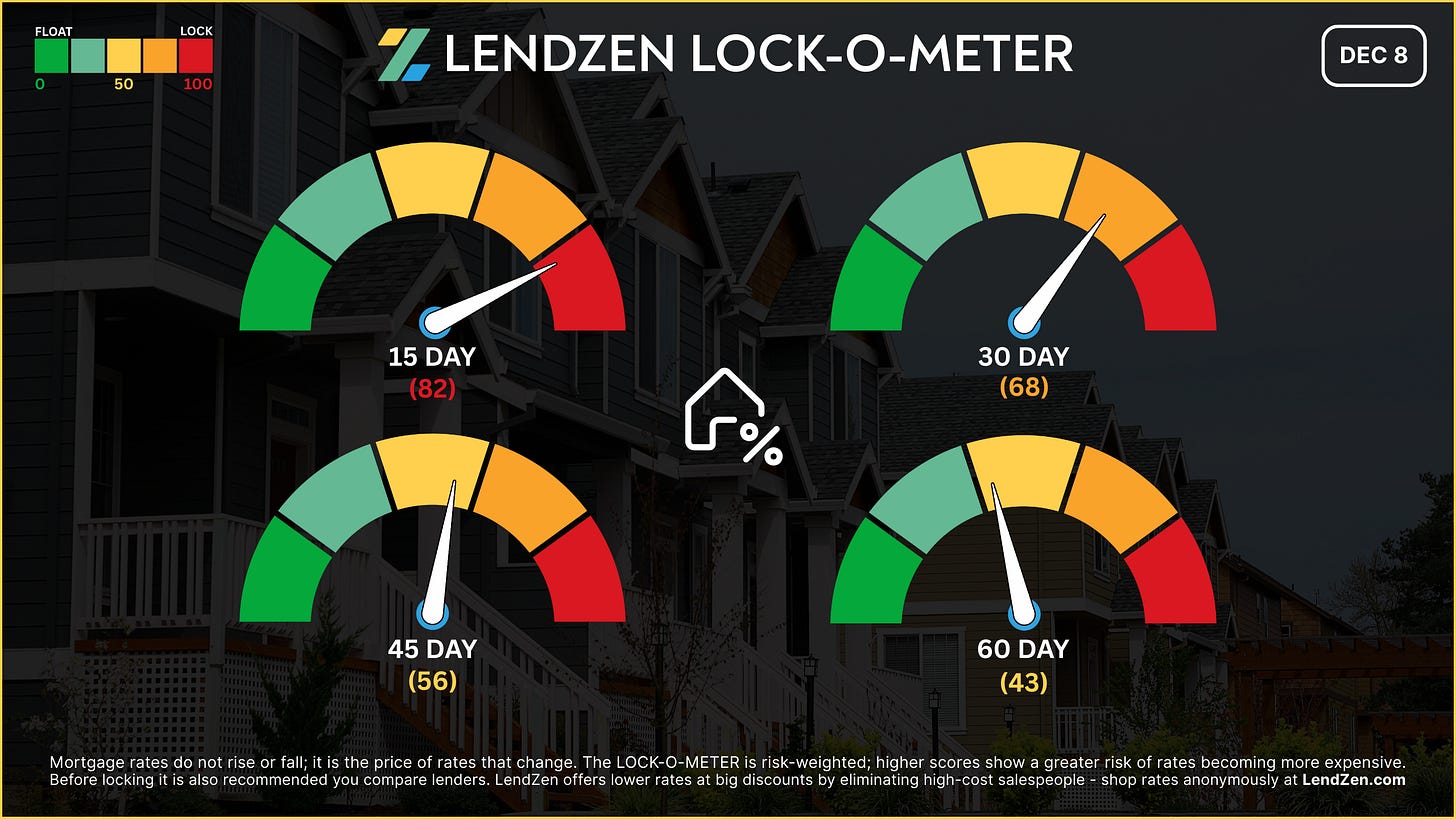

The LendZen LOCK-O-METER provides borrowers with a risk-weighted score based on how various macroeconomic events, including market data, central bank announcements, and geopolitics, each historically impacts the price of bonds.

higher risk scores = lean towards locking

------------------

Closing Window

------------------

[ 15 Days ] -- 82 🔴

The Fed meeting and Powell’s press conference create elevated risk for sharp rate reactions. Plus, bond markets are still jittery from the last rate cut’s aftermath.

[ 30 Days ] -- 68 🟠

Uncertainty lingers around Q4 inflation trends and labor slack as a result of mixed data. Mid-December NFP is the next wild card after this week’s FOMC.

[ 45 Days ] -- 56 🟡

Modest sideways trend has been in place the last two months, but with volatility along the way. Same could be on the horizon if Fed rate decision reaction is offset by November NFP.

[ 60 Days ] -- 43 🟡

Longer-term pricing still remains favorable. Hopefully, Fed policy and their forward guidance, along with employment data, can keep the positive bond trend intact through the beginning of 2026.

If you are already in a strong position locking generally makes the most sense, especially for shorter windows, since the focus should be on making a savvy rate choice based on your longer-term rate outlook.

I expand on this “long game” approach in this Substack post.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.