Mortgage Rate Data Deluge 🏠📉🔒 (DEC 29)

Here is a deluge of mortgage rate data to start your week!

Included in this week’s deluge are the following sections:

MARKET RECAP ⏪

------------------

No Christmas surprise for bonds last week, as December looks poised to finish on a strong note.

After overcoming mid-month volatility, driven by rate cut uncertainty, mortgage rate PRICES are now within 10-bps of the low on October 21

Read more in the Rate Price Index section below.

METALS MANIA 🤪

------------------

Precious metals have been on a tear all quarter, but really started to shine in December.

Silver has been leading the charge, ripping passed $80 an ounce for the first time ever, and up 177% year-over-year.

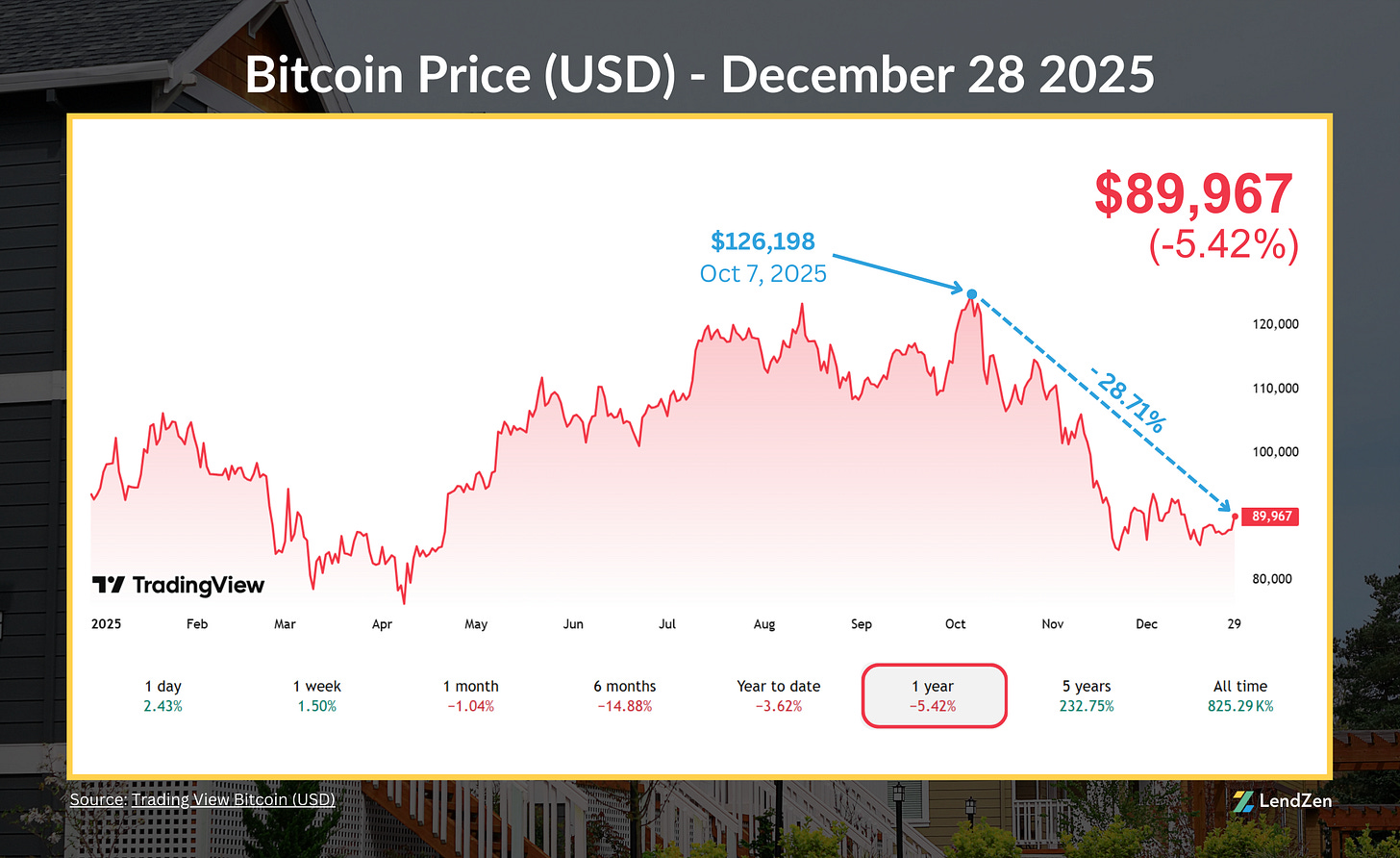

The battle for the throne of hard money hierarchy has been reclaimed by Gold and Silver, as Bitcoin struggles to find liftoff after falling 30% from the all-time high of $126k in October.

RATE PRICE INDEX 📉

----------------------

Mortgage rates DO NOT rise or fall.

The full range of rates is always available, and instead the price of each rate changes based on the trading of individual mortgage bonds.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

This provides borrowers with a more specific measurement of how the cost to obtain a mortgage is changing, regardless of the lender, rate, or credit score.

-----------

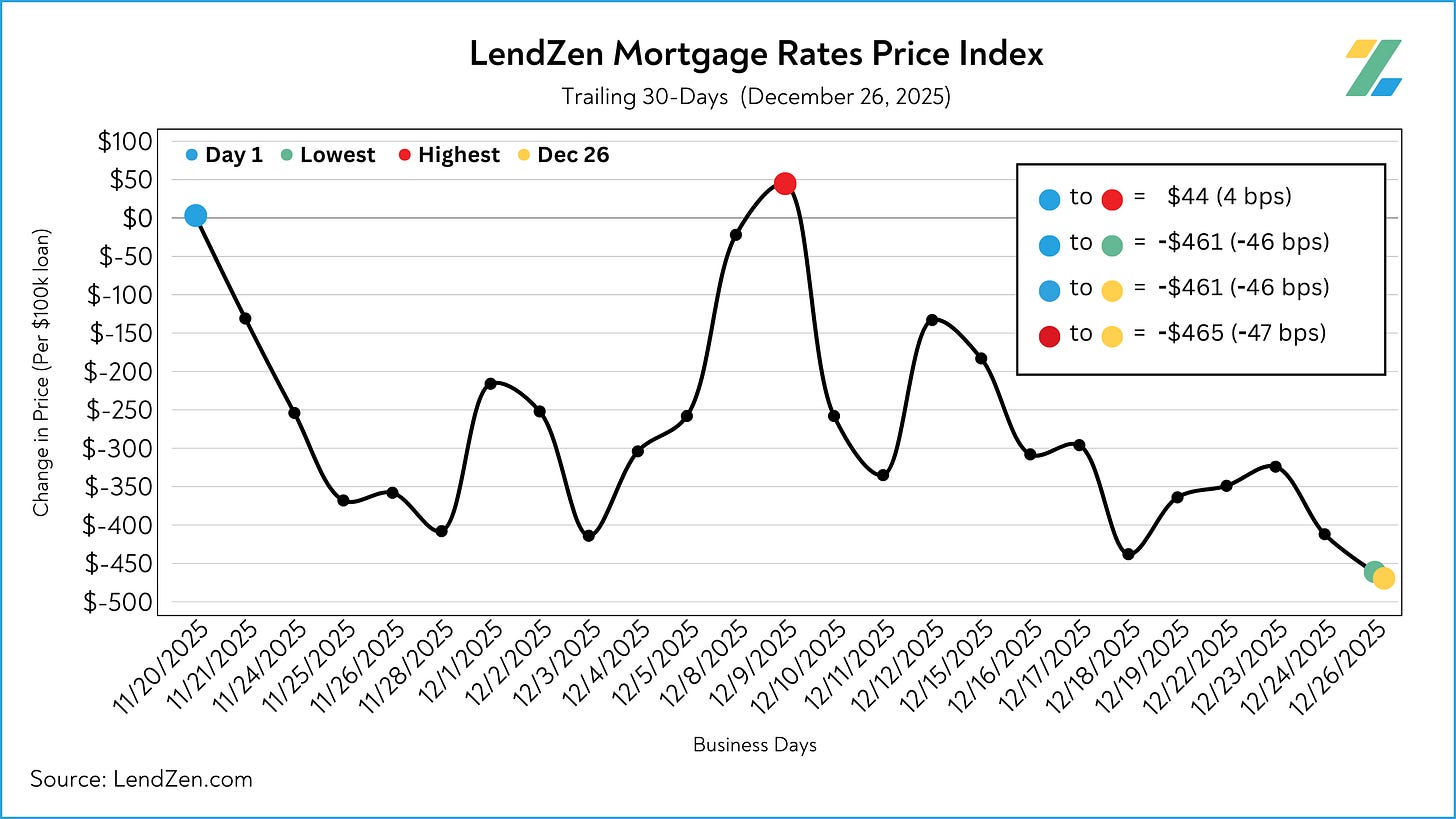

12/26/2025

-----------

24-Hour: -5 bps (-$49 per $100K)

5-Day: -10 bps (-$97)

10-Day: -33 bps (-$328)

30-Day: -46 bps (-$461)

60-Day: -60 bps (-$600)

90-Day: -166 bps (-$1657)

120-Day: -217 bps (-$2173)

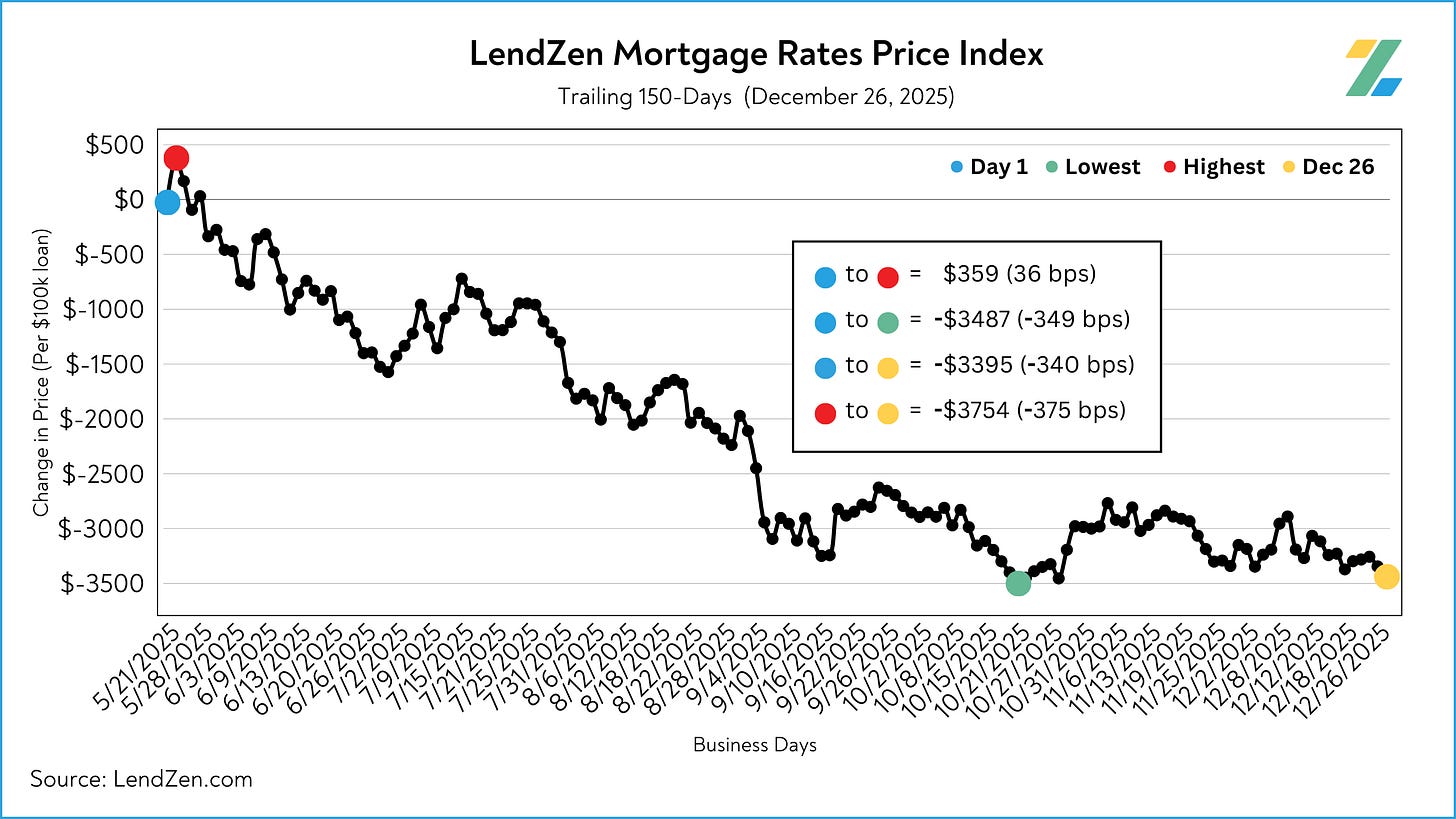

150-Day: -340 bps (-$3395)

After overcoming mid-month volatility, driven by rate cut uncertainty, mortgage rate PRICES are now within 10-bps of the low on October 21.

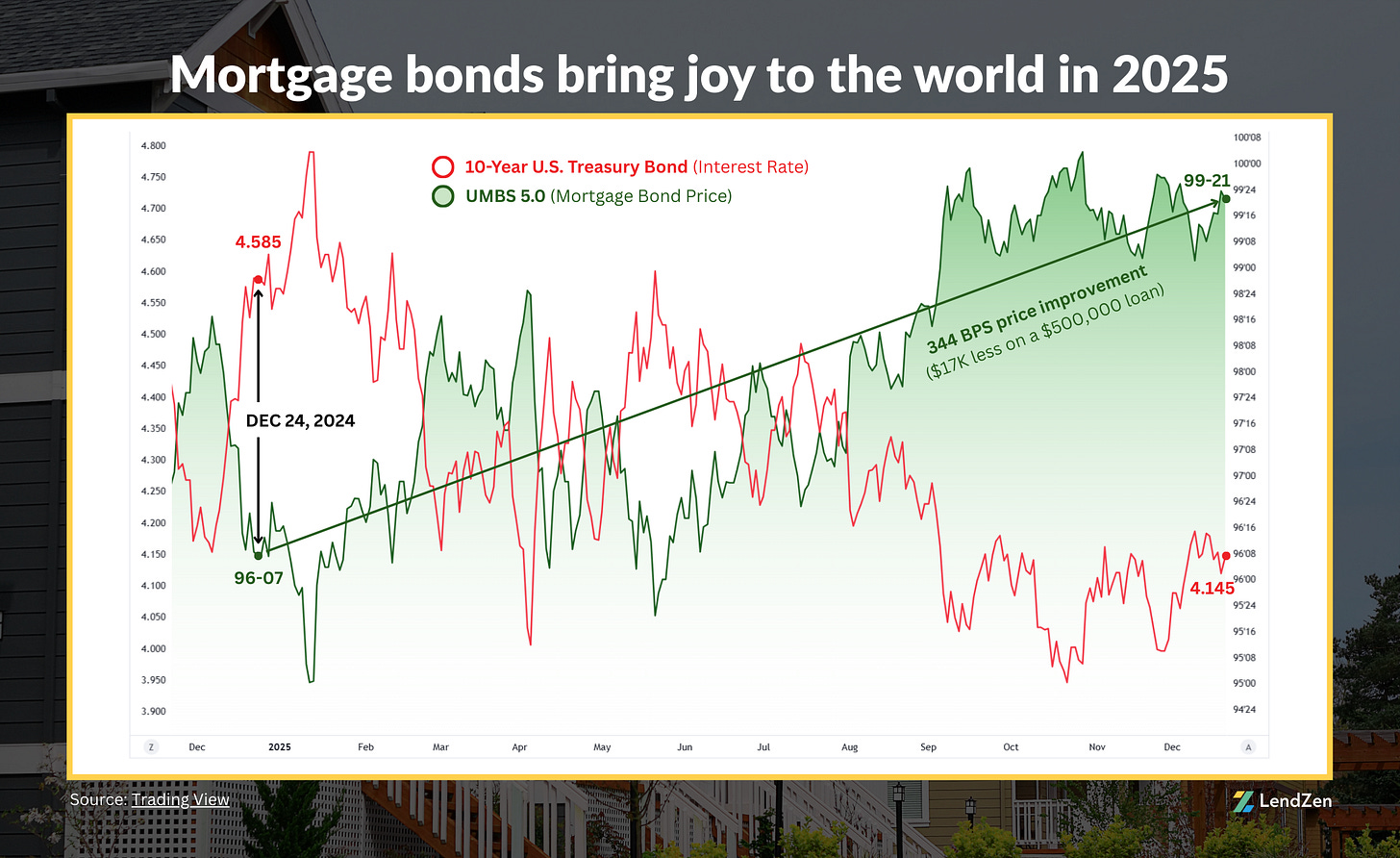

In terms of positive change, 2025 is the best year for mortgage rates since 2020.

In the last 12 months, mortgage bond prices have risen over 340 basis points.

That means the cost of getting a $500k mortgage is $17,000 cheaper today than the same time last year.

THE TRACKER 🔭

----------------

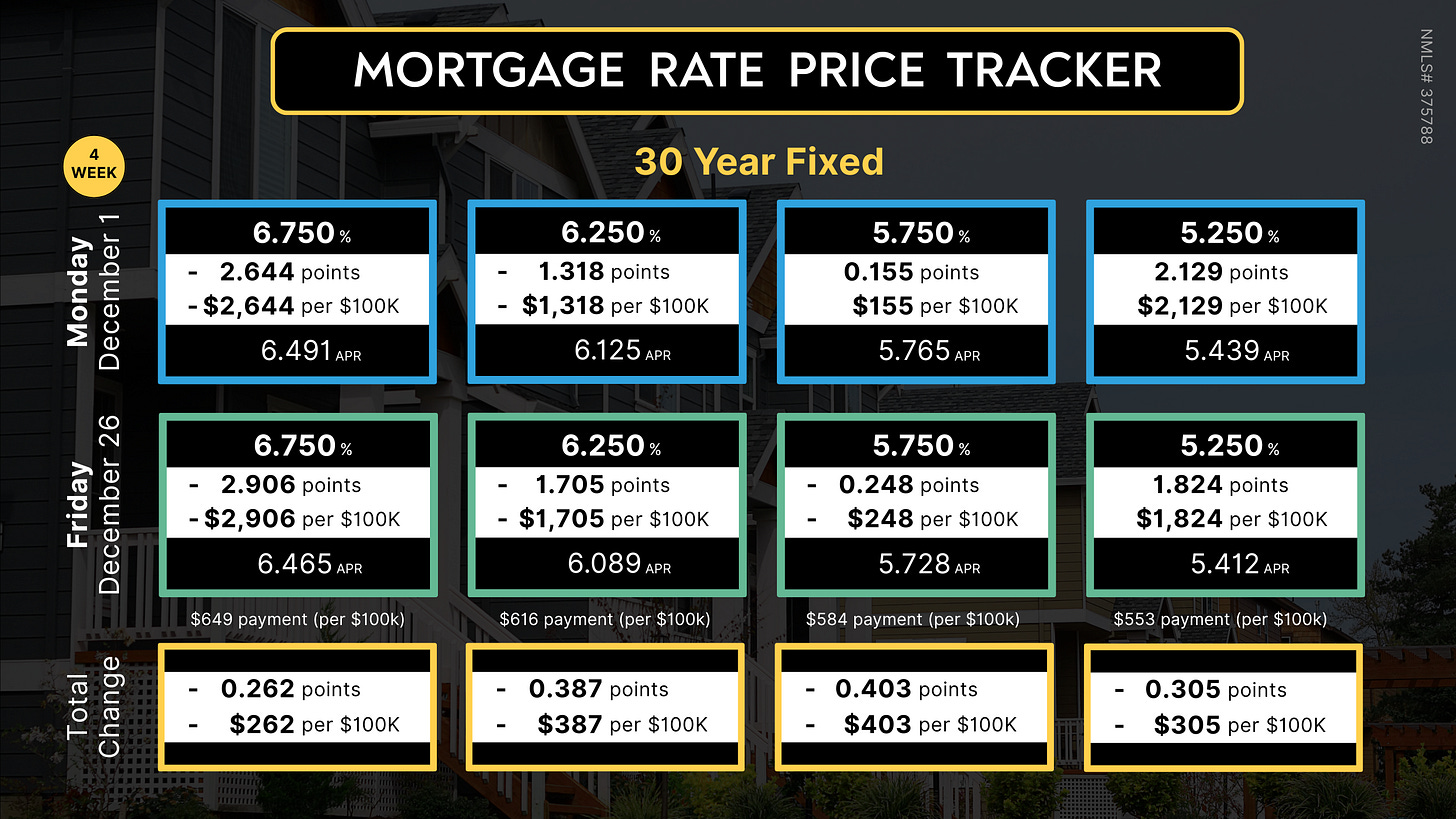

The LendZen Index monitors the change in price across a broad set of rates and mortgage bond coupons, whereas the Mortgage Rate Price Tracker is more “rate and loan program” specific.

Both are an example of how mortgage rates do not rise or fall, but instead it is their price that changes.

Since the LendZen Index has a variety of time series, the MRPT focuses on the current month’s activity.

You can explore the full results from December Week 4 on this Substack post.

MORTGAGE SPREADS 🧈

-------------------------

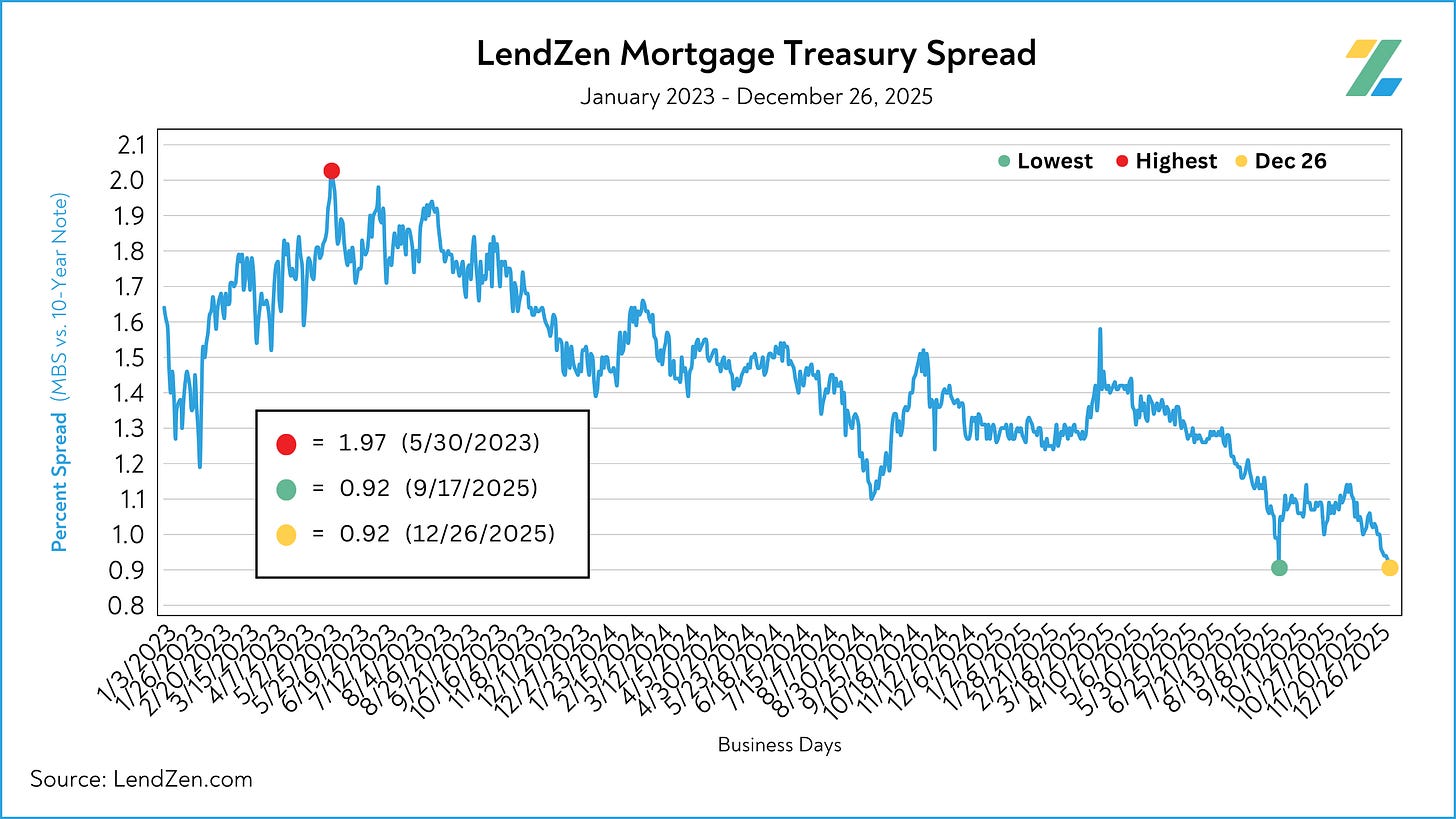

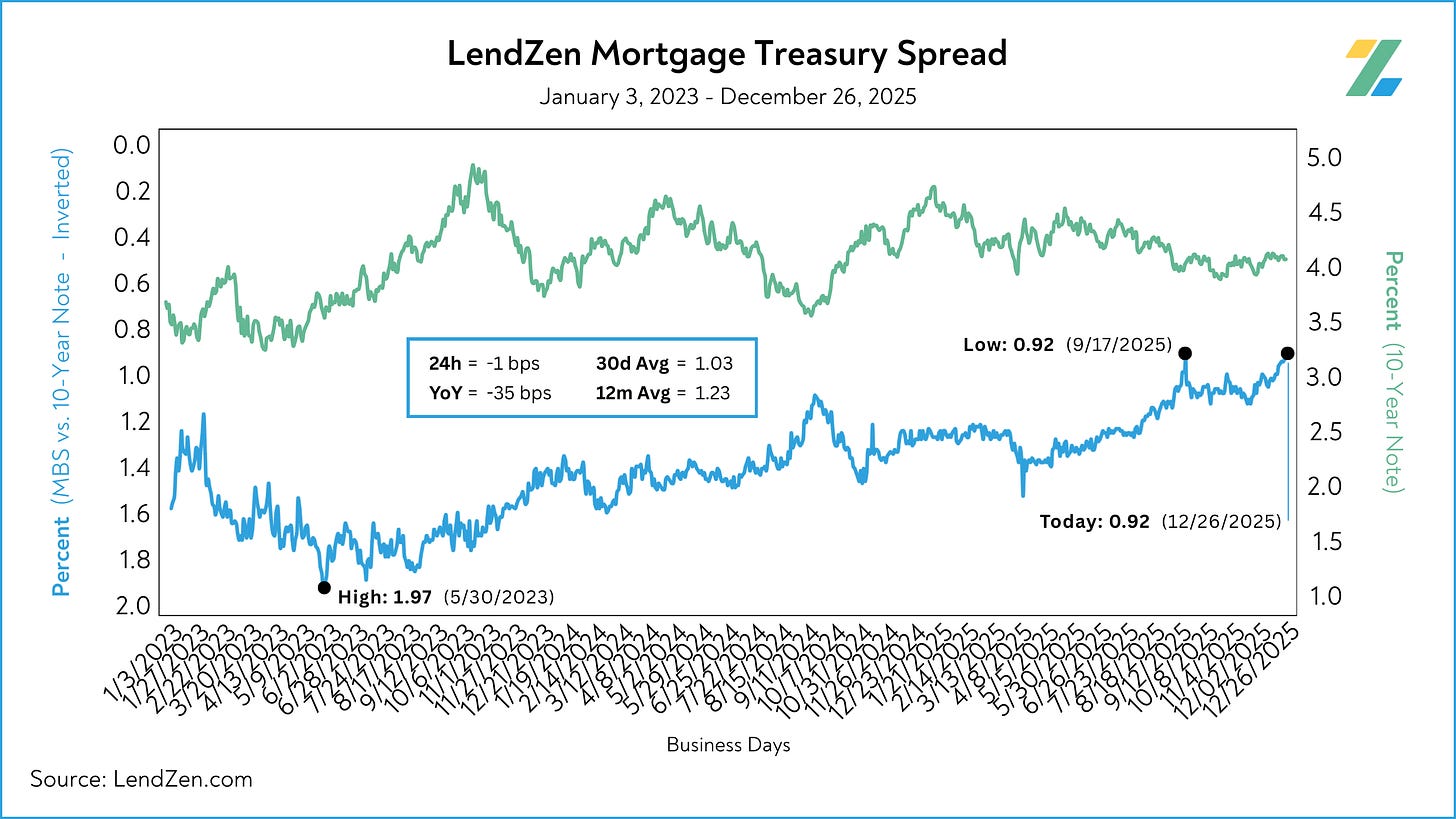

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

Learn more about the importance of accurately calculating spreads on this Substack post.

The spread between mortgage bonds and the U.S. 10-Year tightened 3-bps during the week, matching a multi-year low.

Dec 19: 0.95

Dec 26: 0.92

5d: -3 bps

30d Avg: 1.03

12m Avg: 1.23

YoY: -35 bps

Compared to the same time last year, spreads were tighter by nearly 40-bps at various times throughout the month.

This dramatic outperformance from mortgage bonds is why mortgage rate PRICES are better now than in 2024, despite the 10-Year yield sitting 47-bps higher (3.66 vs 4.13).

HOUSING DATA 🏠

------------------

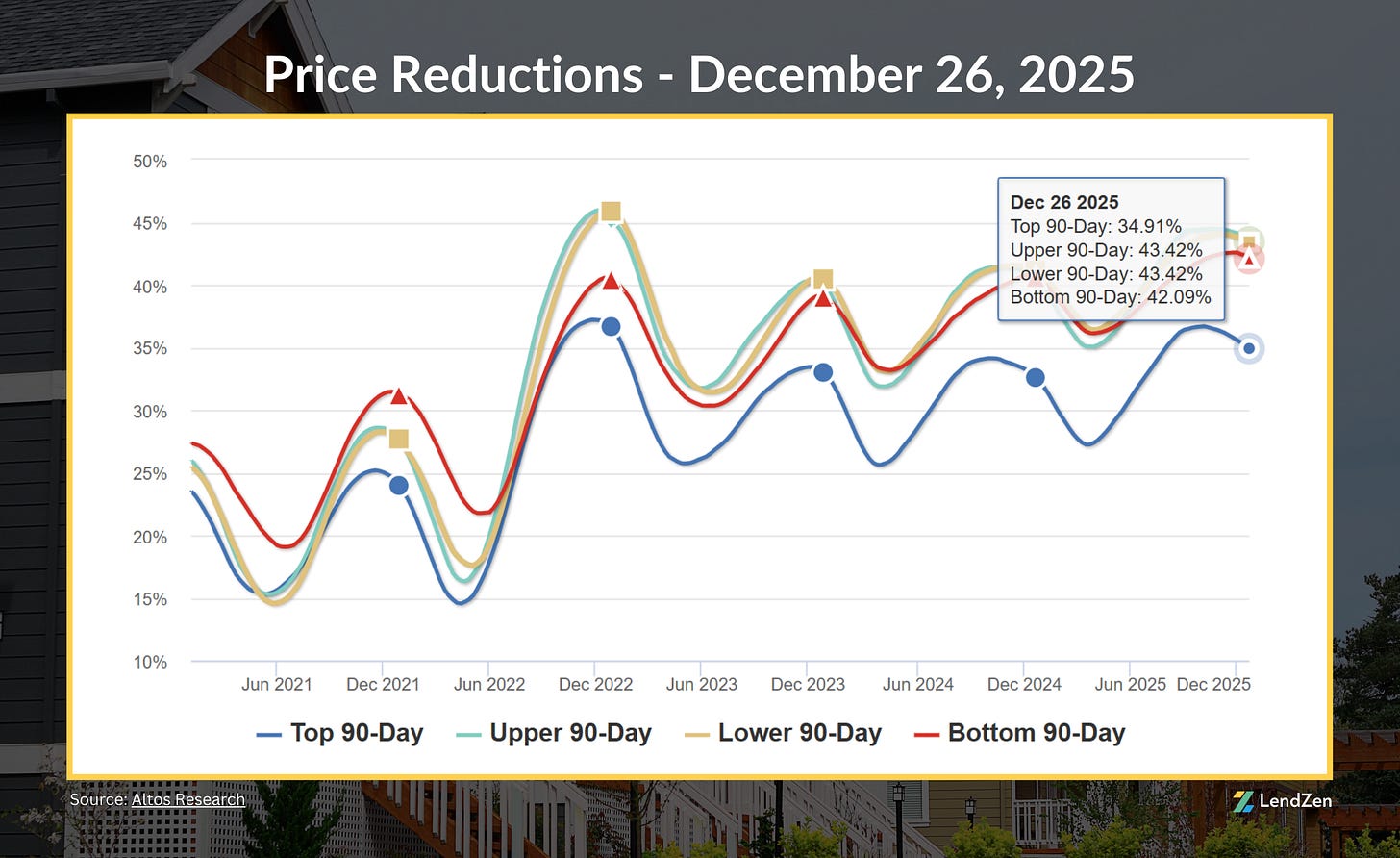

Here are the latest housing market stats, with trends from the last 90 days.

The U.S. median list price is $418,000, down a half-percent (0.46%) from last week, and down 6% in Q4.

Price reductions remain steady with a 90-day national average of 43% for all segments other than the highest priced tier, which has been slightly stronger with just 38%.

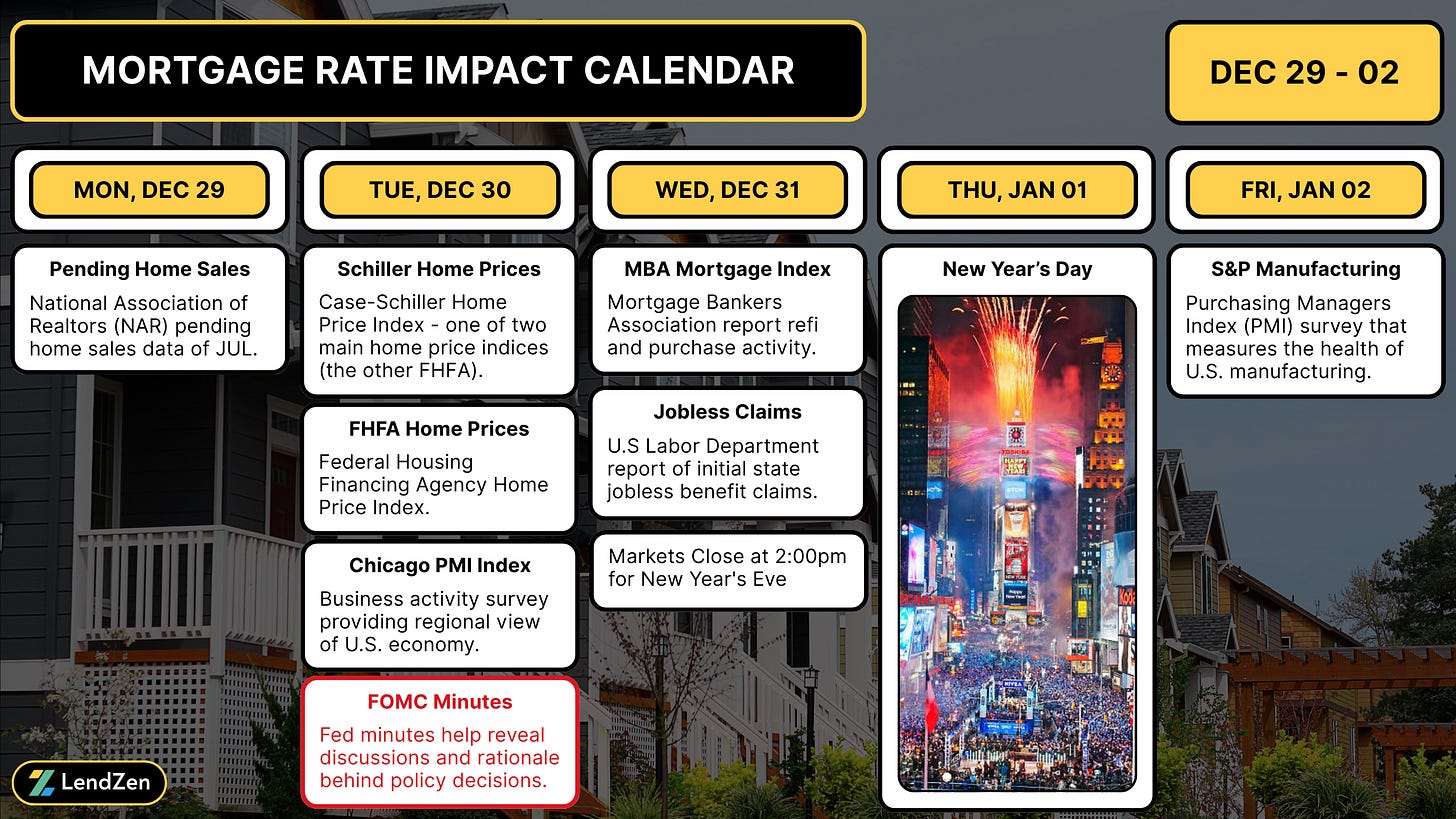

WEEK AHEAD 📅

----------------

The December Non-Farm Payroll report (November data) was originally due last week but was rescheduled to this Tuesday.

NFP is followed by the Consumer Price Index (CPI) on Thursday, creating a double whammy of employment and inflation data in the same week.

Read more in yesterday’s Week Ahead.

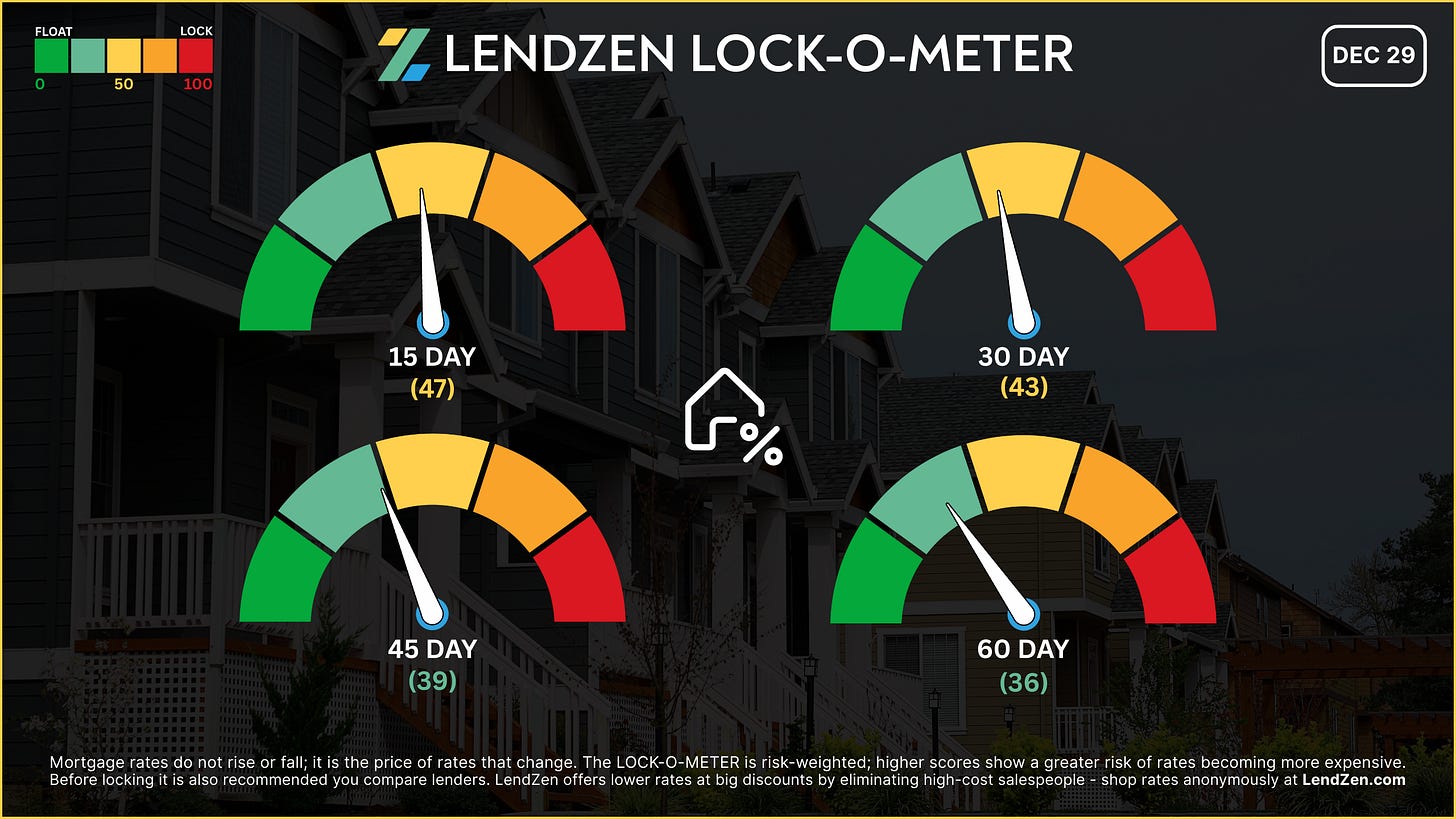

RATE LOCK GUIDE 🔒

---------------------

The LendZen LOCK-O-METER provides borrowers with a risk-weighted score based on how various macroeconomic events, including market data, central bank announcements, and geopolitics, each historically impacts the price of bonds.

higher risk scores = lean towards locking

------------------

Closing Window

------------------

[ 15 Days ] -- 47 🟡

Strong December performance and light holiday schedule ease short-term risks, but Fed Minutes could add volatility.

[ 30 Days ] -- 43 🟡

Momentum remains bond‑friendly, but stronger conviction will need to wait until January data returns. Any weakness is more likely to be technical than fundamental, keeping downside modest.

[ 45 Days ] -- 39 🟢

Early January will bring fresh data and macro inputs. Since mortgage rates retraced much of the autumn sell‑off, markets will need confirmation from new data to extend gains further.

[ 60 Days ] -- 36 🟢

Broader trend remains supportive of longer-term floating as inflation pressure cooled following the Dec CPI release, while labor data remains mixed.

If you are already in a strong position locking generally makes the most sense, especially for shorter windows, since the focus should be on making a savvy rate choice based on your longer-term rate outlook.

I expand on this “long game” approach in this Substack post.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.