🤔 Mixed inflation data keeps mortgage rates on the run 🏃➡️

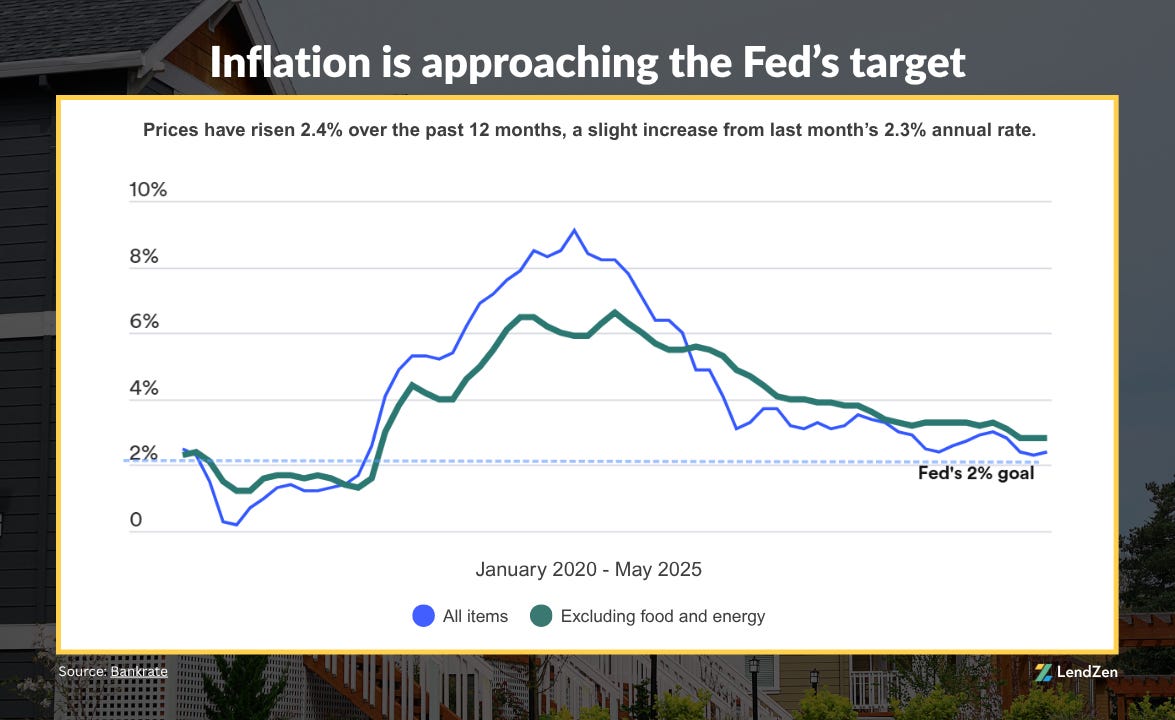

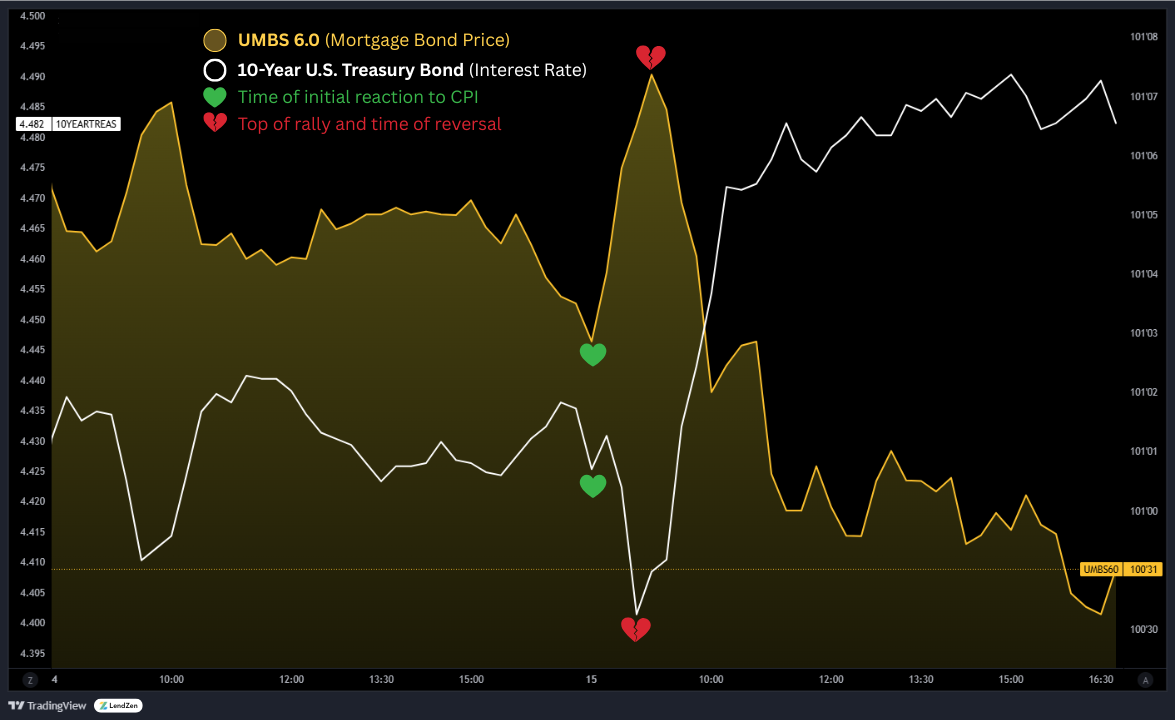

Markets initially cheered yesterday’s CPI report after core CPI inflation came in at 0.2% vs. 0.3% forecast.

Bonds rallied briefly, especially with shelter inflation falling to its lowest level since 2021.

But the rally didn’t last…

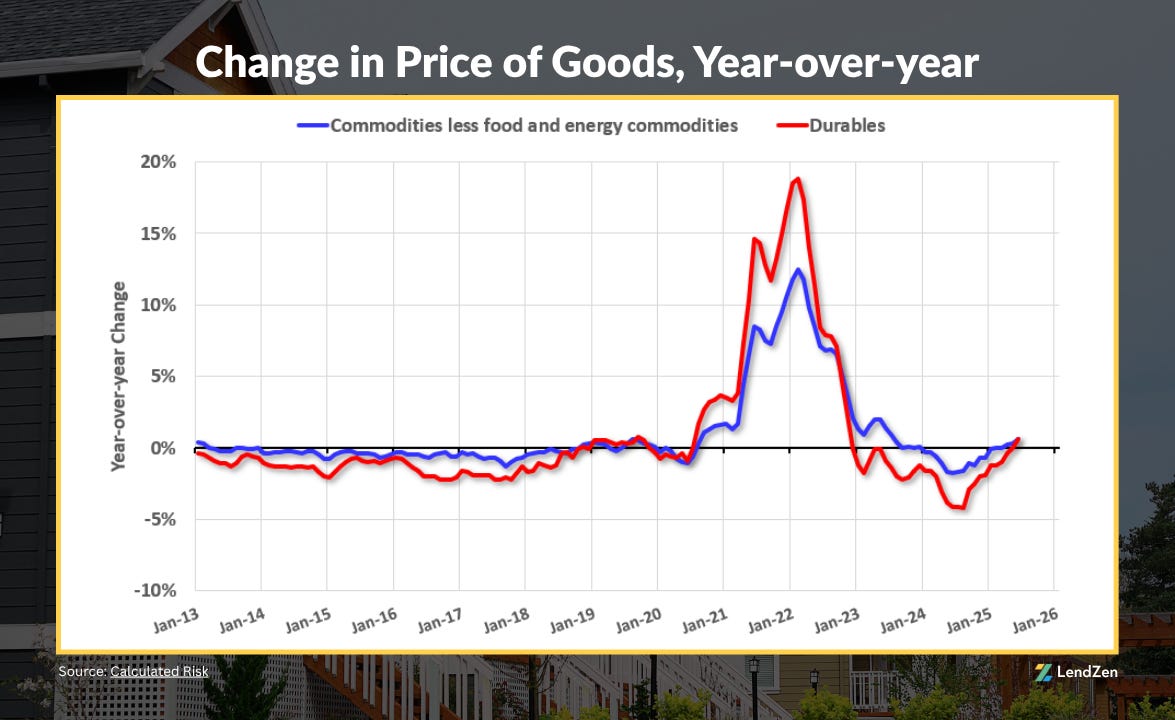

Traders quickly turned their attention to tariff-sensitive CPI categories, mostly commodities and durable goods, which showed an uptick.

This reignited fears that trade-related price pressures could be back, which would further embolden the Fed to stand their ground in the face of pressure from the Trump administration to cut rates.

Takeaway for borrowers:

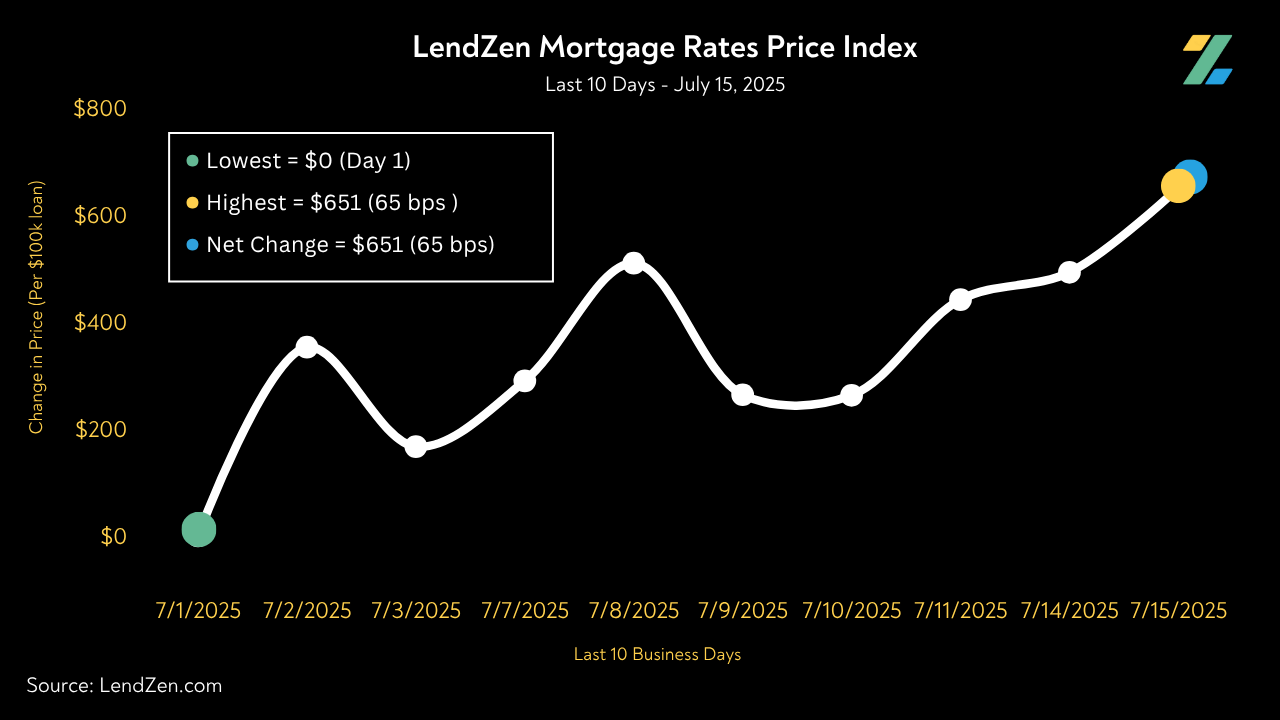

Until new data offers a better signal, the bond market is likely to continue facing selling pressure.

Which has been the case for the more than two weeks.

The LendZen Index shows the price of mortgage rates has increased by 65-basis points during that time.

That’s an increase in mortgage costs of $3,250 for a $500,000 mortgage.

Traditional mortgage indices falsely suggest rates are changing by posting a daily “average” they conjure up from unverifiable data.

The LendZen Index tracks the price of rates across a spectrum of MBS.

This provides a clearer picture of how the cost to obtain a mortgage has changed, regardless of the lender, rate, or borrower credit score.

For nearly 3 months, mortgage rates have been on a roller coaster ride.

There was reason to cheer at the start of the month when the price of mortgage rates had declined 178 basis points from the May 22nd high.

Unfortunately, we lost 40% of that improvement since, leaving us 71 basis points higher today than on May 1.

It also paints a troubling visual that bonds are losing the fight, and mortgage rate prices could continue to climb from here.

Homebuyers and refinancers should follow rate lock guidance from the LendZen LOCK-O-METER.

Today’s rate lock risk scores and econ calendar update can be found on this Substack Note:

Want to check customized, real-time mortgage rates instantly? 🧮

LendZen (NMLS# 375788) gives you real-time access to mortgage rates that update as bond prices change.

The detailed loan summaries have an interactive rate slider that shows all current mortgage rates and full transparency of costs upfront.

All information can be viewed anonymously and without any sign-up requirements or human interaction. This makes exploring the full range of rate options hassle-free.

See for yourself and customize your own loan scenario at LendZen.com