Ho-Ho Holy Shi… metals rip to new all-time highs 🎅🪙📈

Midweek Market Update

Included in this update are the following:

Shop real-time mortgage rates anonymously and get instant qualification results at LendZen.com

MIDWEEK RECAP ⏪

-------------------

‘Twas the night before Christmas and all through the house, not a mortgage bond was stirring, not even a bounce.

The stocks were all pumped by the Fed without care, in hopes that Jerome Powell would still remain Chair.

The boomers were nestled all snug in their beds, while 3% mortgages danced in their heads.

Saylor with his mischief could not support market cap, as crypto settled down for a long winter’s nap.

Then from my notifications arose such a clatter, I sprang to my screen to read up on the chatter.

Seeing the silver price I flew like a flash, tore open the vault to start counting my stash.

With watering eyes I let out a great cheer, “a new record high” is finally here! 🥹

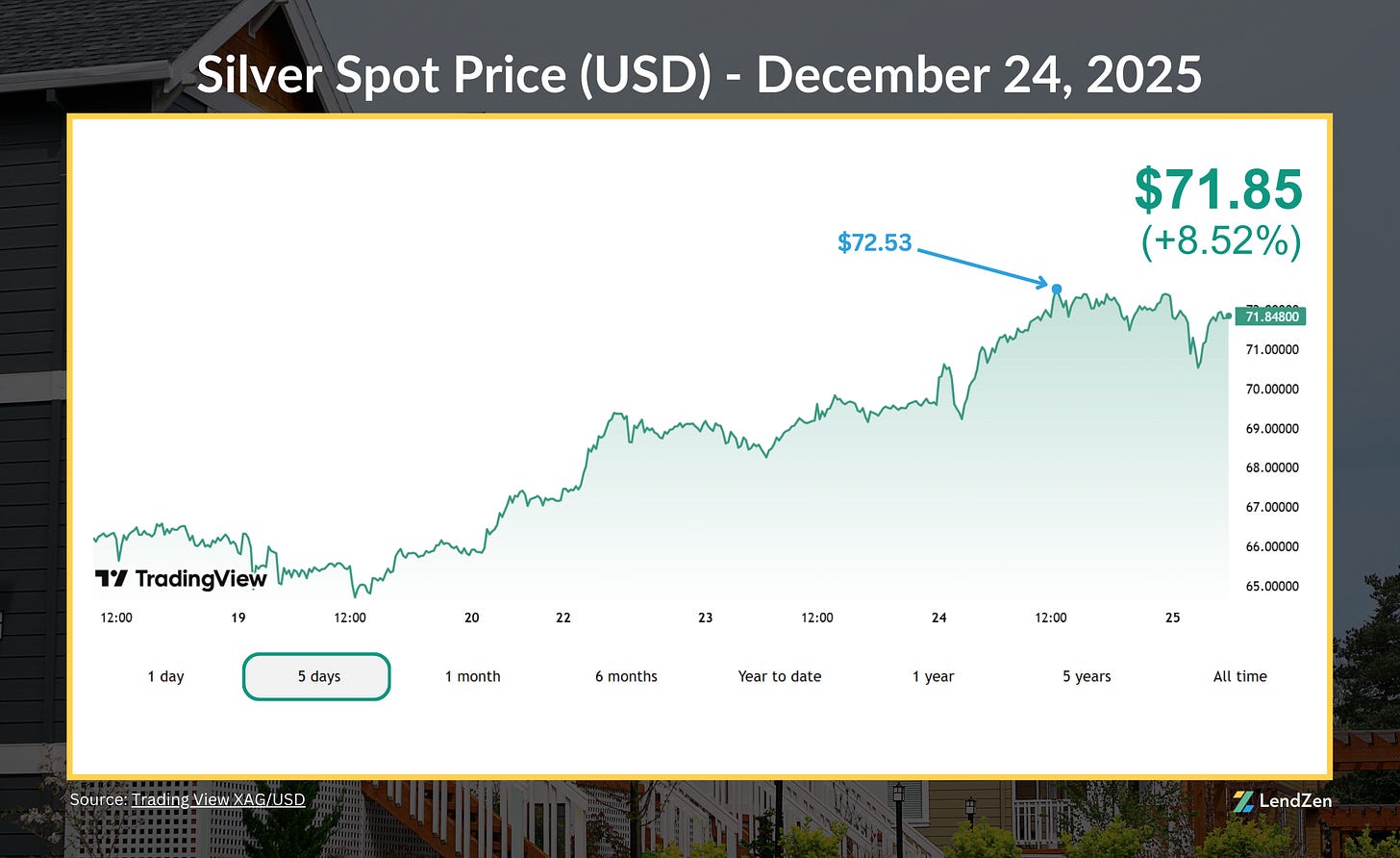

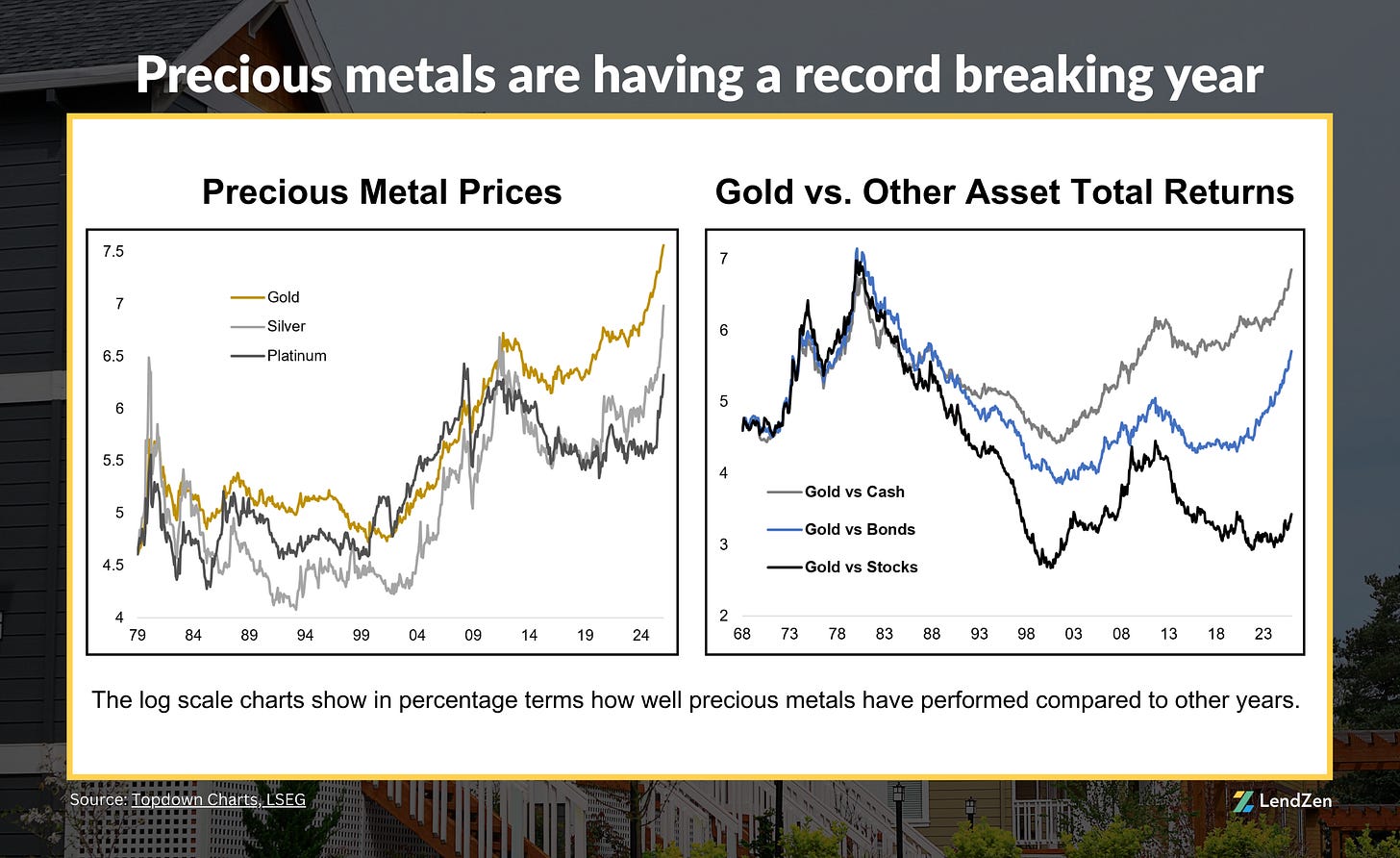

While mortgage rates (bond markets) and stocks have been quiet-as-a-mouse heading into the long holiday weekend, precious metals have been cooking up new all-time pies highs.

Silver has been leading the charge since last week, ripping passed $72 an ounce.

See more in the Precious Metals section below.

IMPACT CALENDAR 📅

-----------------------

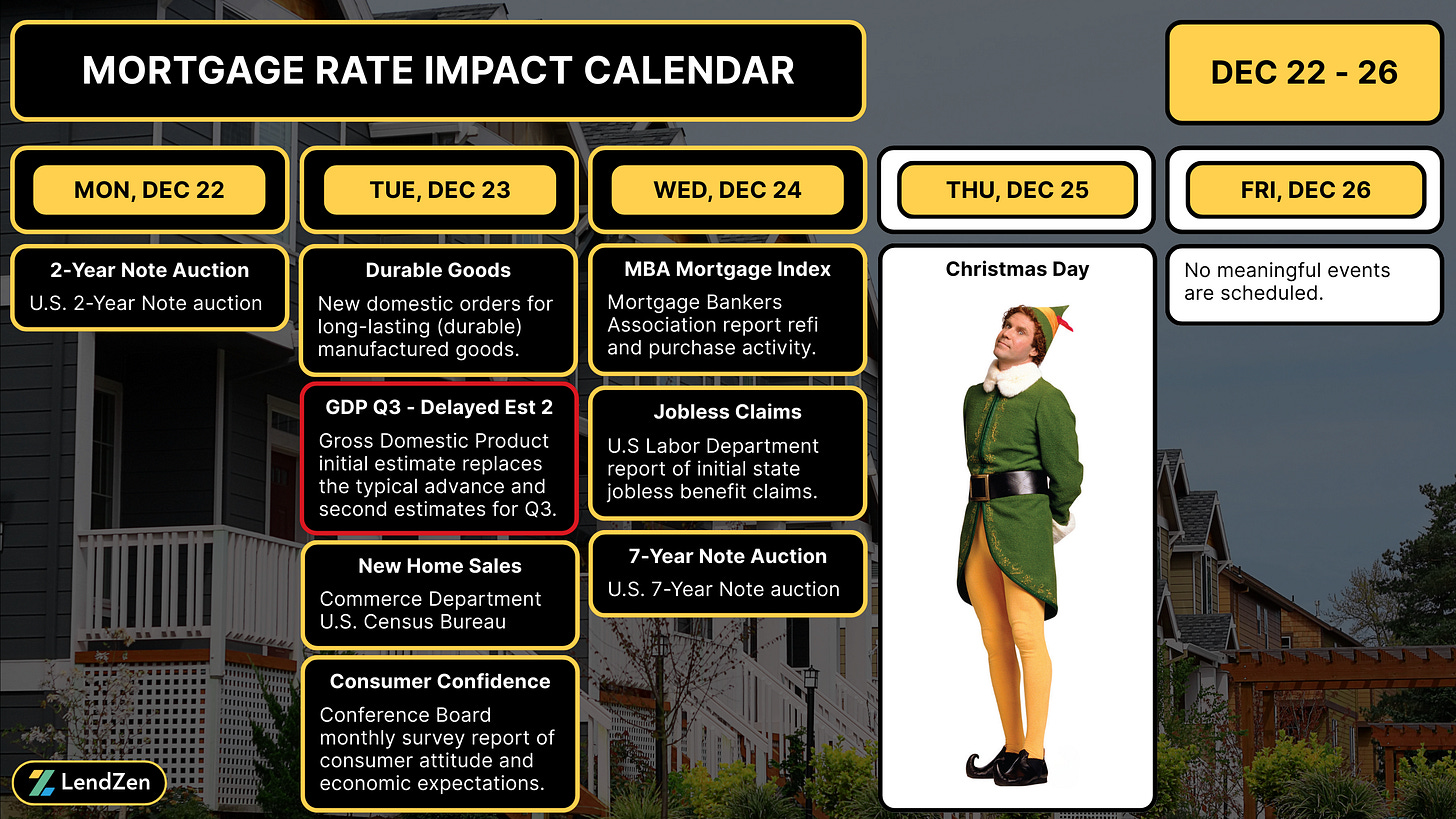

With the “Big 3” data (NFP, CPI, FOMC) out of the way, the rest of the year was expected to be quiet for bonds.

This has been the case so far, even though precious metals seem like they are trying to tell us something.

What we do know is markets are closed tomorrow (Christmas) and there is nothing of importance scheduled on Friday

If Scrooge doesn’t have any surprises up his sleeve for the first half of next week, 2025 will finish as the best year for mortgage rates since 2020.

Read more in the Rate Price Index section below.

RATE PRICE INDEX 📉

----------------------

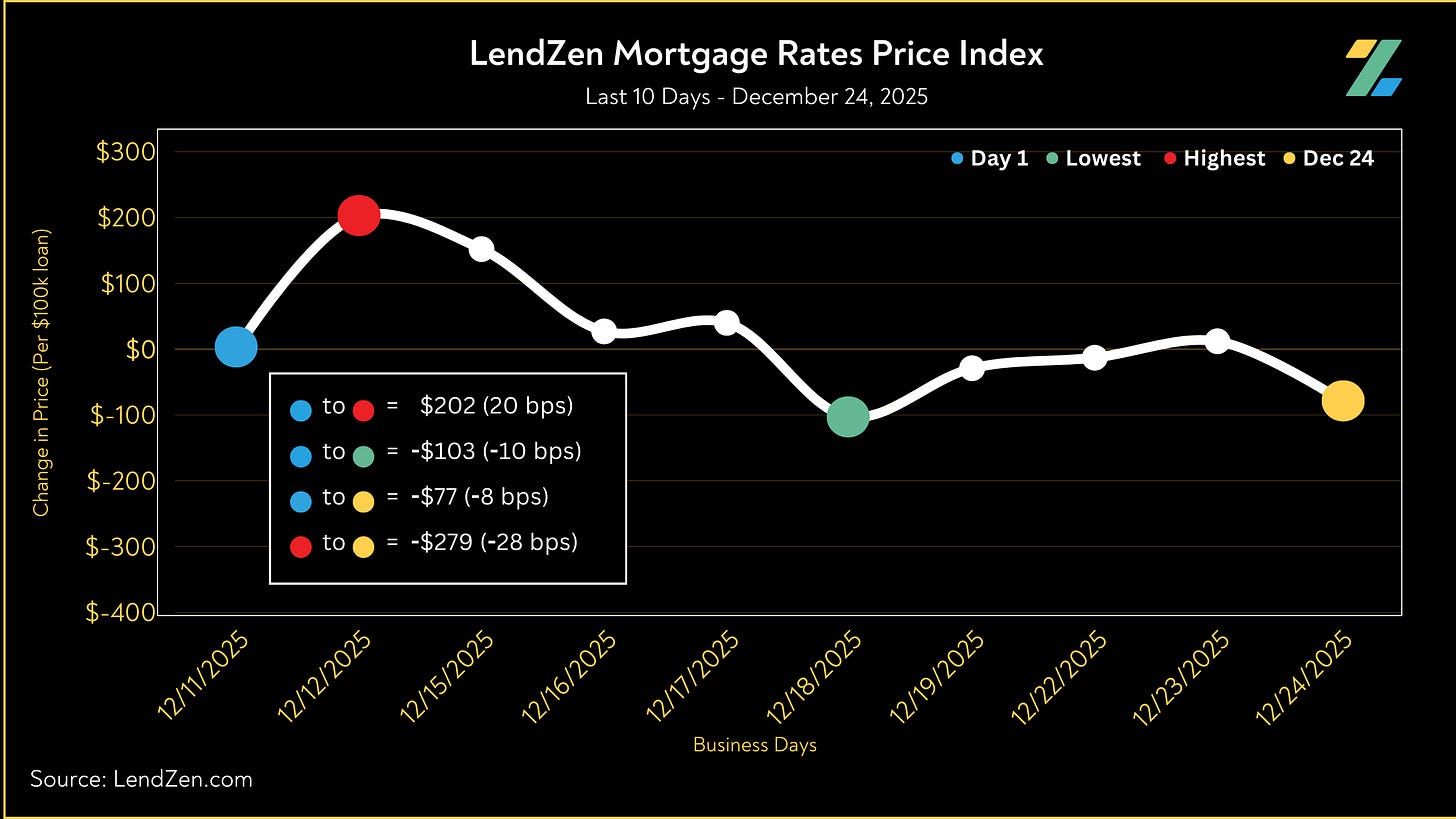

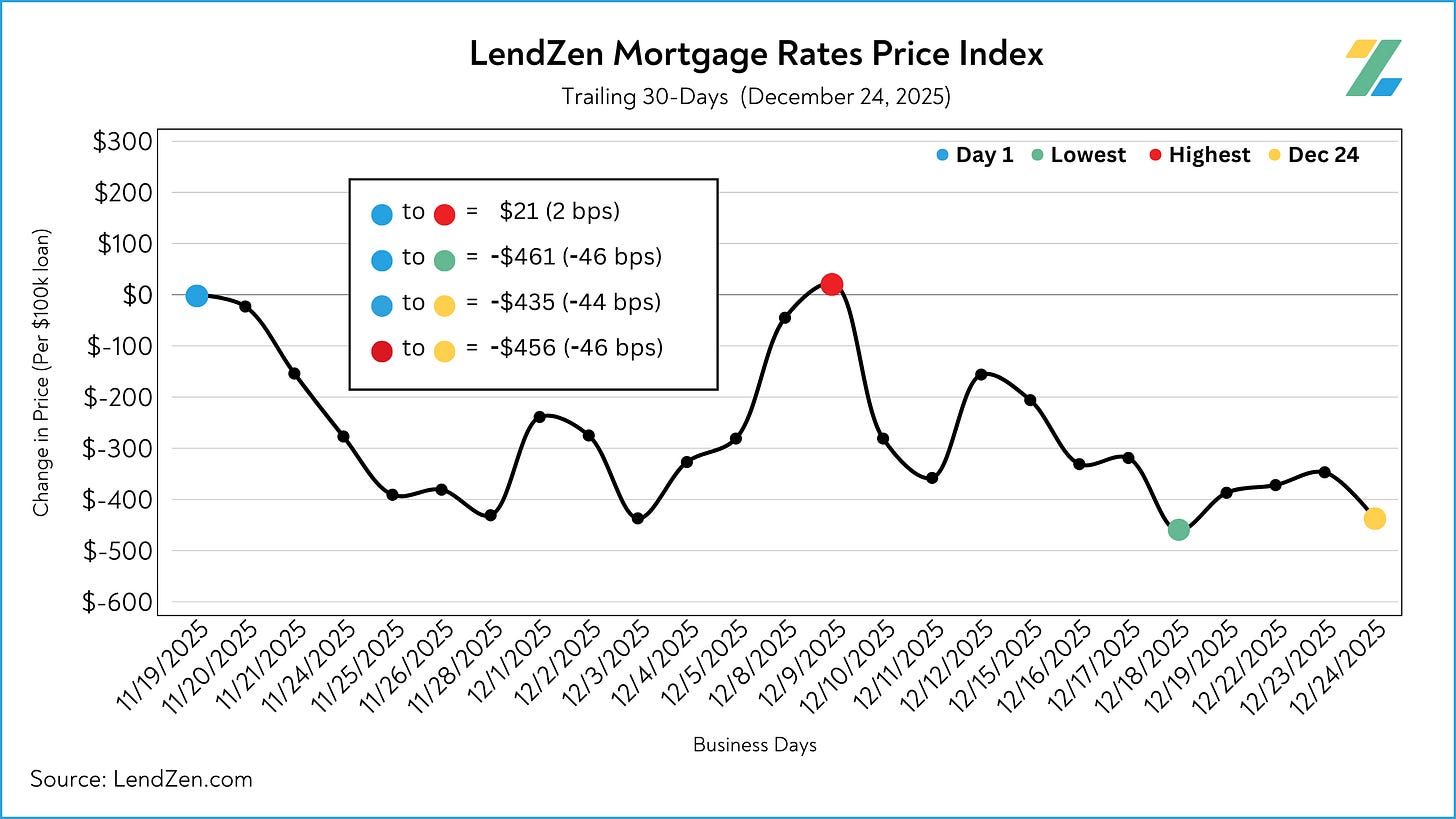

Mortgage rates DO NOT rise or fall.

The full range of rates is always available, and instead the price of each rate changes based on the trading of individual mortgage bonds.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

-----------

24-Hour: -9 bps (-$88 per $100K)

5-Day: +3 bps ($26)

10-Day: -8 bps (-$77)

30-Day: -44 bps (-$435)

60-Day: -65 bps (-$651)

Learn more about the LendZen Index and explore the full data series at LendZen.substack.com

MBS PRICING 🏦

----------------

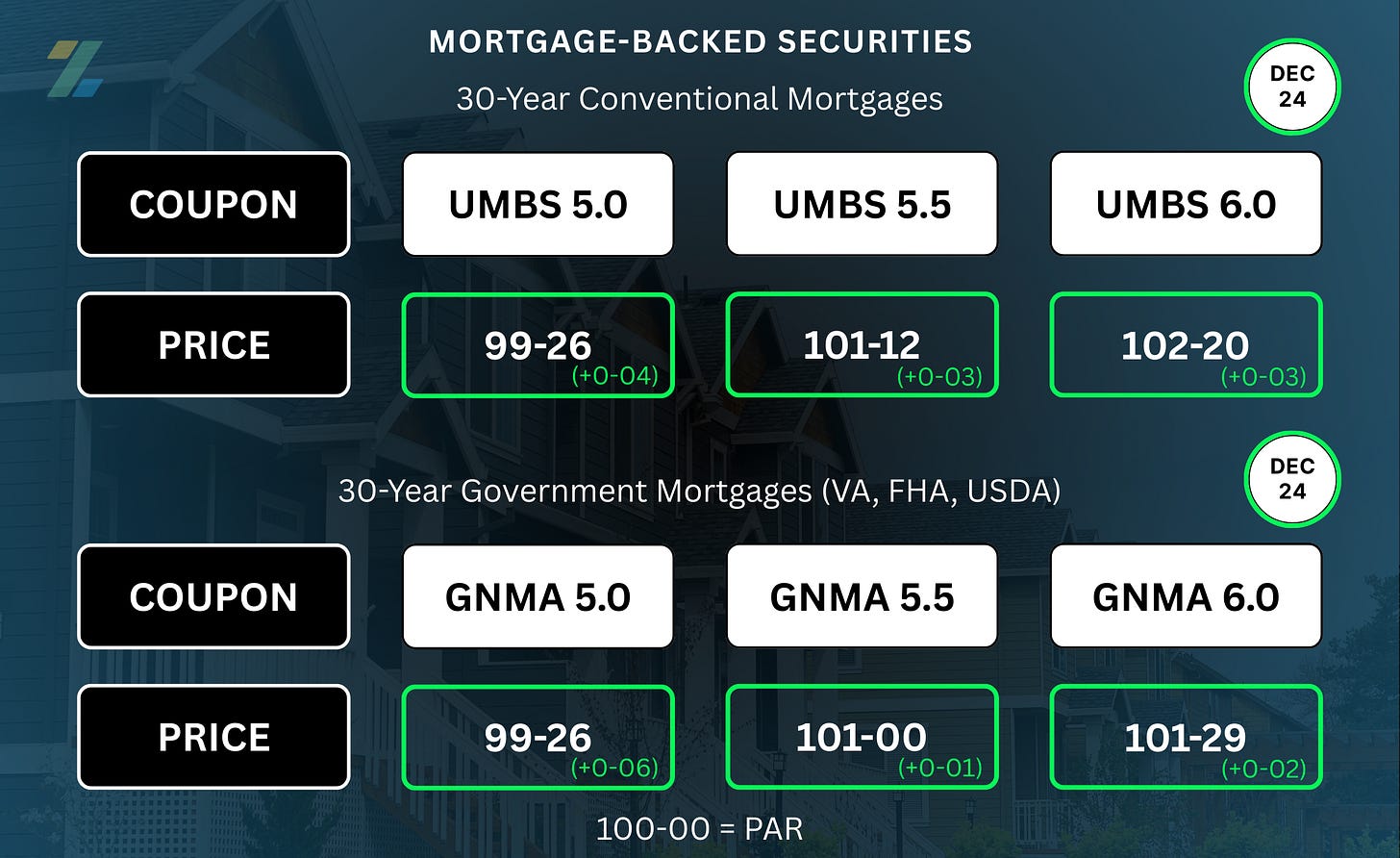

MBS coupons are sold at half-percent increments, while their price moves in 32nds (ticks).

ex. (0-04) = 4/32 = 12.5 bps

100-00 acts as the starting line, also referred to as PAR.

The higher the coupon price, the less expensive the rates will be that are sold into that security.

Therefore, an increase in the price of mortgage bonds is good for mortgage rates.

Learn more about the dynamics of MBS pricing and how it impacts your mortgage options in any of the bi-weekly “Rate Snapshot” Substack posts.

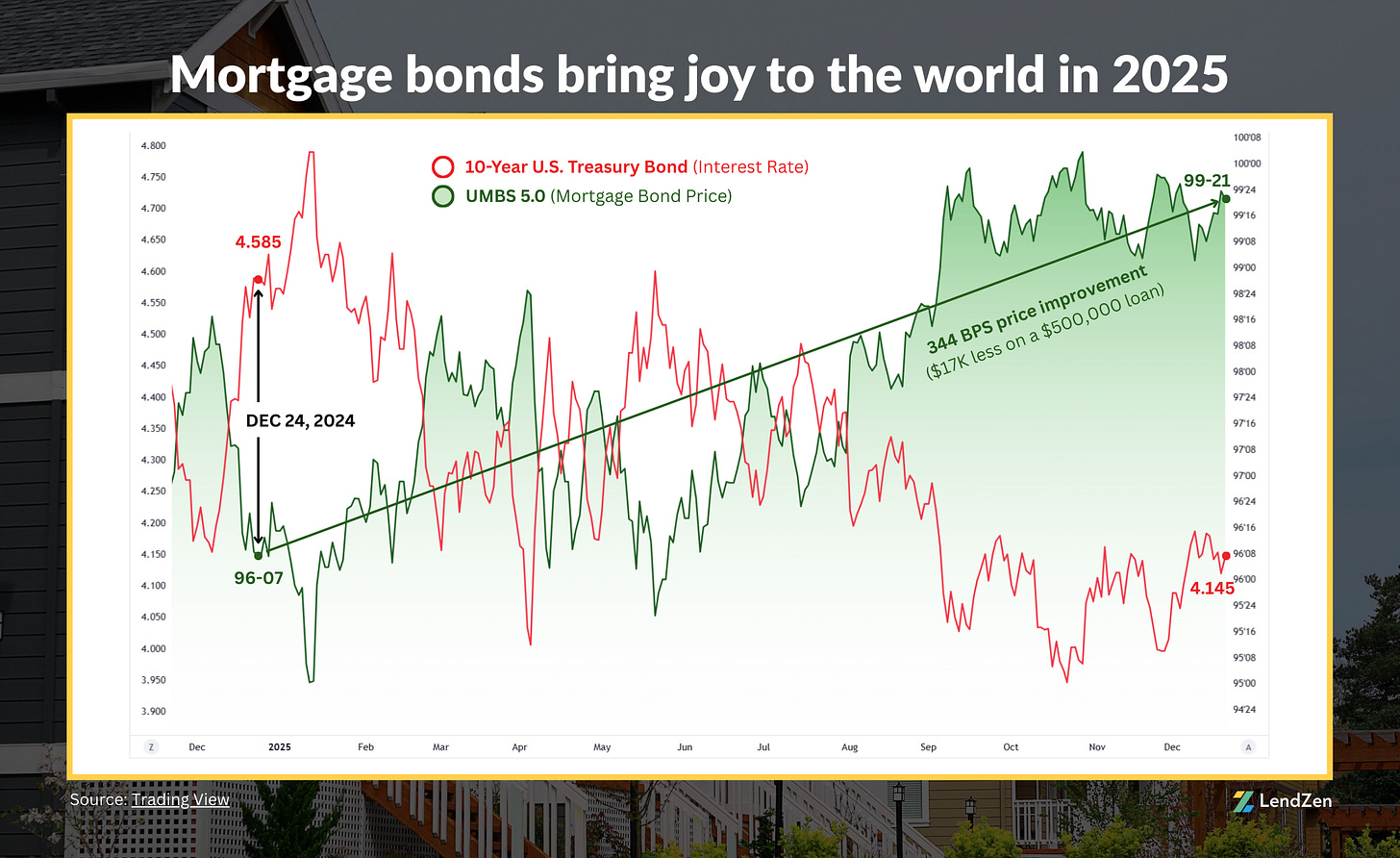

In the last 12 months, mortgage bond prices have risen over 340 basis points.

That means the cost of getting a $500k mortgage is $17,000 cheaper today than during Christmas 2024.

MORTGAGE SPREADS 🧈

-------------------------

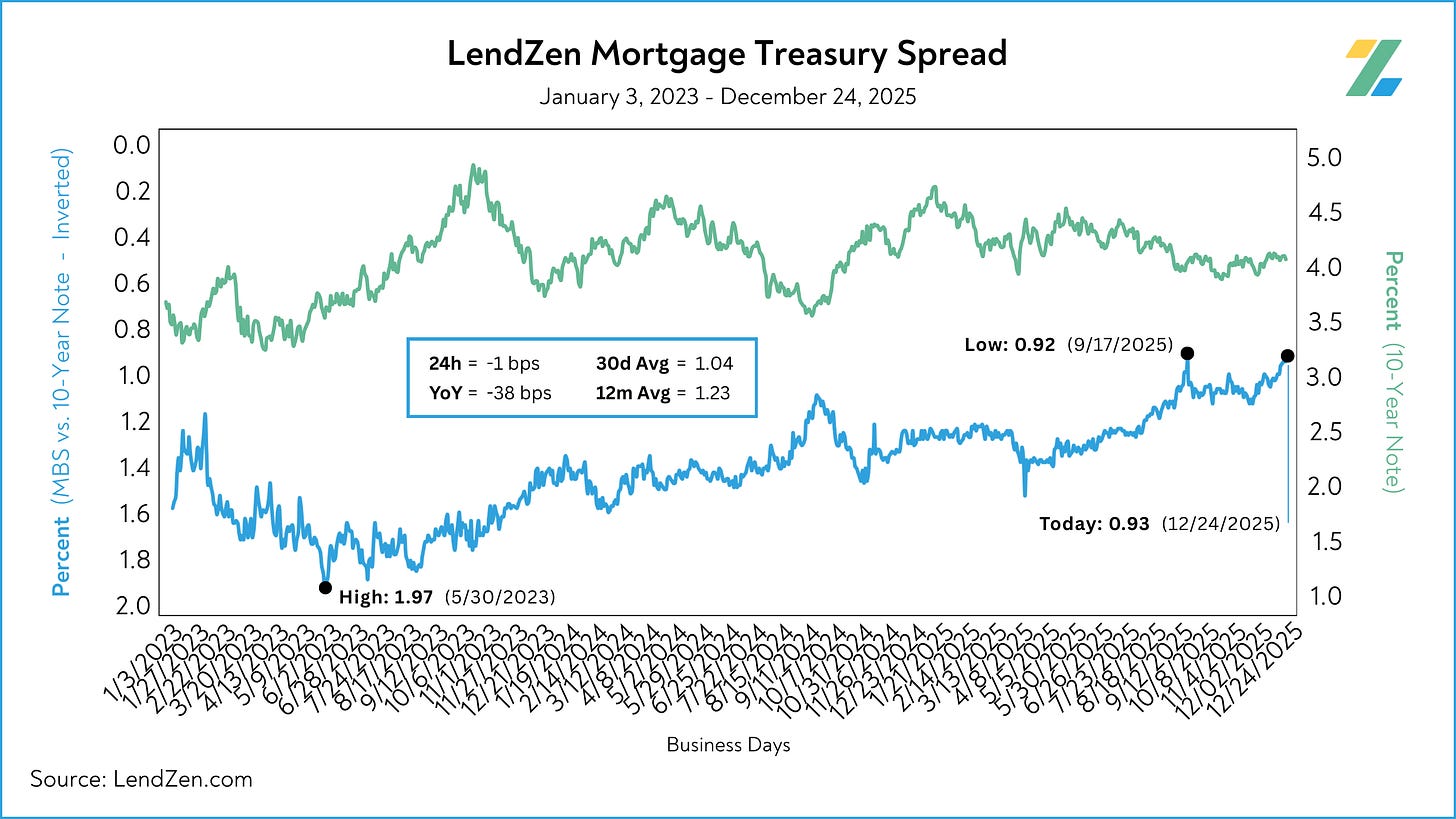

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

-----------

Dec 03: 1.00

Dec 10: 1.03

24h: -3 bps

5d: +3 bps

12m Avg: 1.24

YoY: -24 bps

Learn more about the importance of mortgage spreads on this Substack post.

STOCK MARKETS (5-Day) 📊

-----------------------------

DJIA: 48,731 (+1.58%)

S&P 500: 6,932 (+2.05%)

NASDAQ: 25,656 (+2.02%)

CRYPTO (1-Week) 🧮

---------------------

Bitcoin: $87,488 (-0.41%)

Ethereum: $2,944 (-0.59%)

Solana: $122.82 (-4.90%)

PRECIOUS METALS (5-Day) 🪙

-------------------------------

Gold: $4,479 (+3.31%)

Silver: $71.85 (+8.52%)

Platinum: $2,254 (+17.39%)

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.