Gov Shutdowns, Mortgage Rates, and Gold 🪙🚨

There is a new hedge in town

U.S. Government shutdowns happen when Congress fails to agree on a new spending bill.

This doesn’t mean the U.S. is unable to pay its debts, but shutdowns do disrupt federal data releases and add a layer of uncertainty to markets.

Shutdown History

Since the modern shutdown era began the federal government had brief scuffles in the 1980’s, two high-profile standoffs in 1995 - 96, the 16-day lapse in 2013, and a record 35-day shutdown during Trump’s first term spanning Dec 22, 2018 - Jan 25, 2019.

Bond Reactions

Shutdowns tend to push investors into safer assets and treasuries often get the “risk-off” bid, helping to push 10-year yields lower.

But there is a catch...

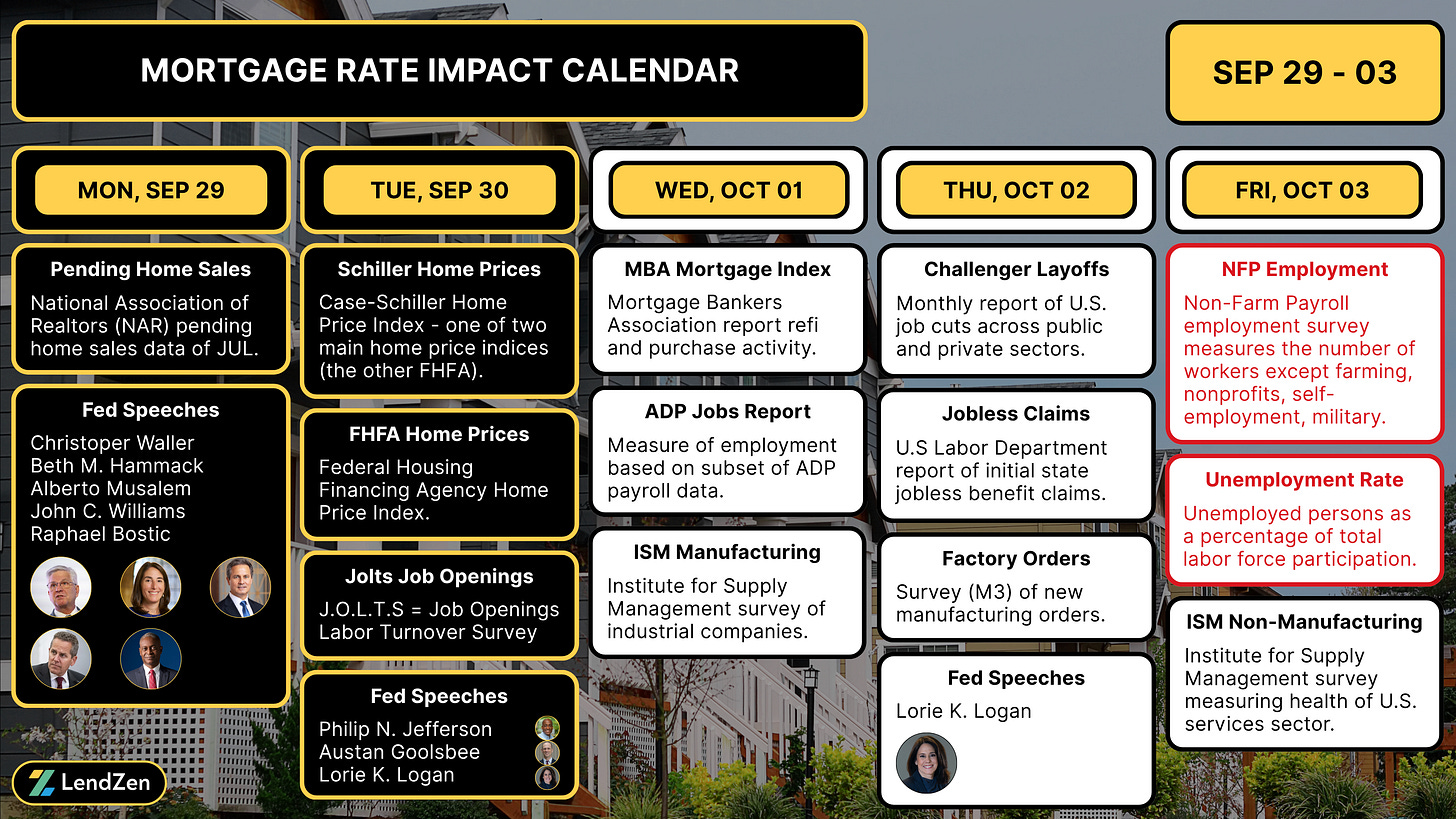

During a shutdown, government agencies stop releasing key reports like non-farm payrolls (NFP).

Without the data, traders and the Fed have less guidance. That uncertainty stirs up volatility in the bond market.

Mortgage Rates

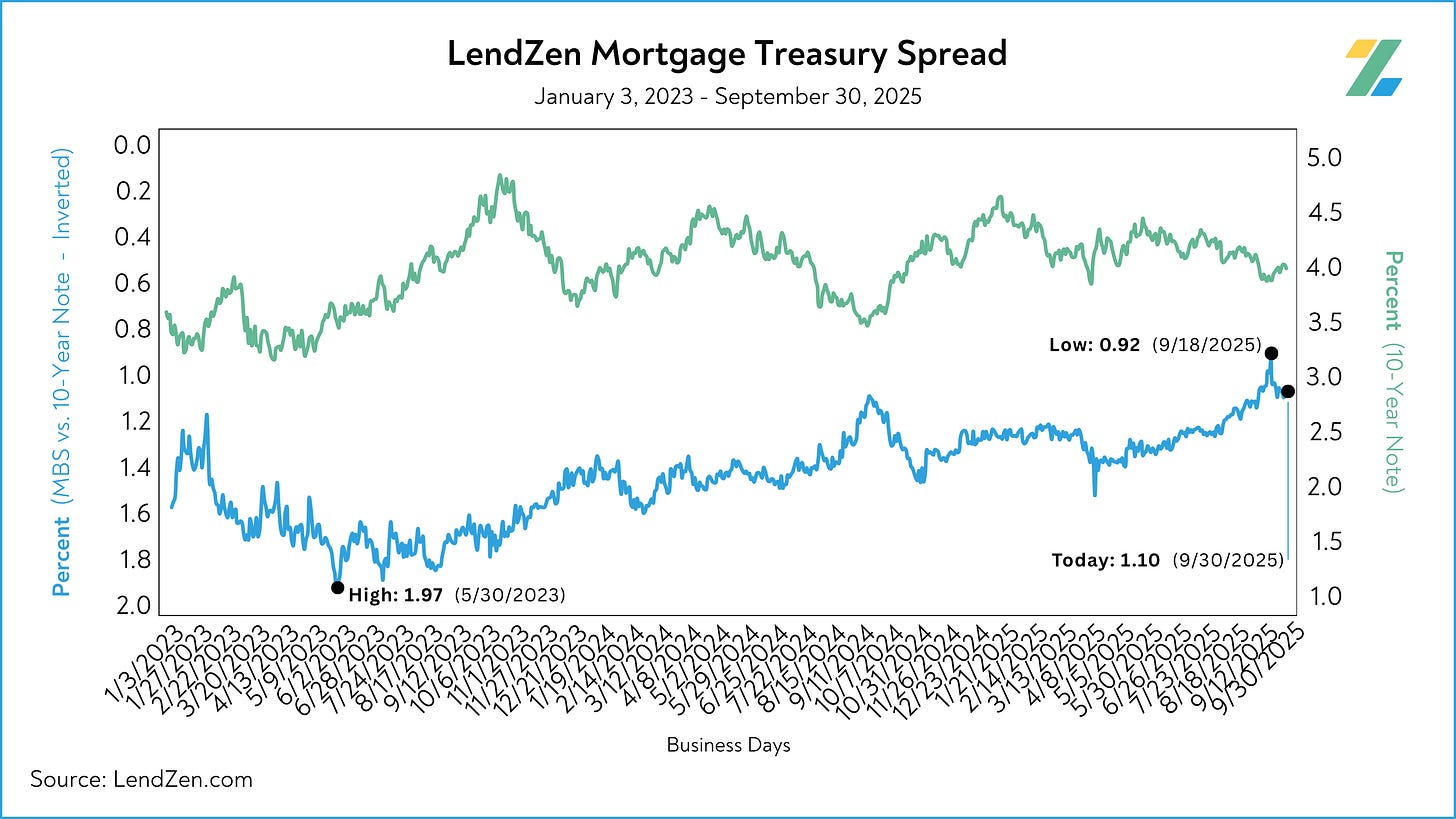

Agency mortgage-backed securities, the bonds that dictate mortgage pricing, don’t always follow U.S. Treasuries in lockstep.

In volatile moments, MBS spreads can widen due to liquidity concerns and prepayment risk.

That would be unfortunate considering spreads are at their tightest levels in years.

Learn more about mortgage spreads in this Substack post.

The Gold Hedge

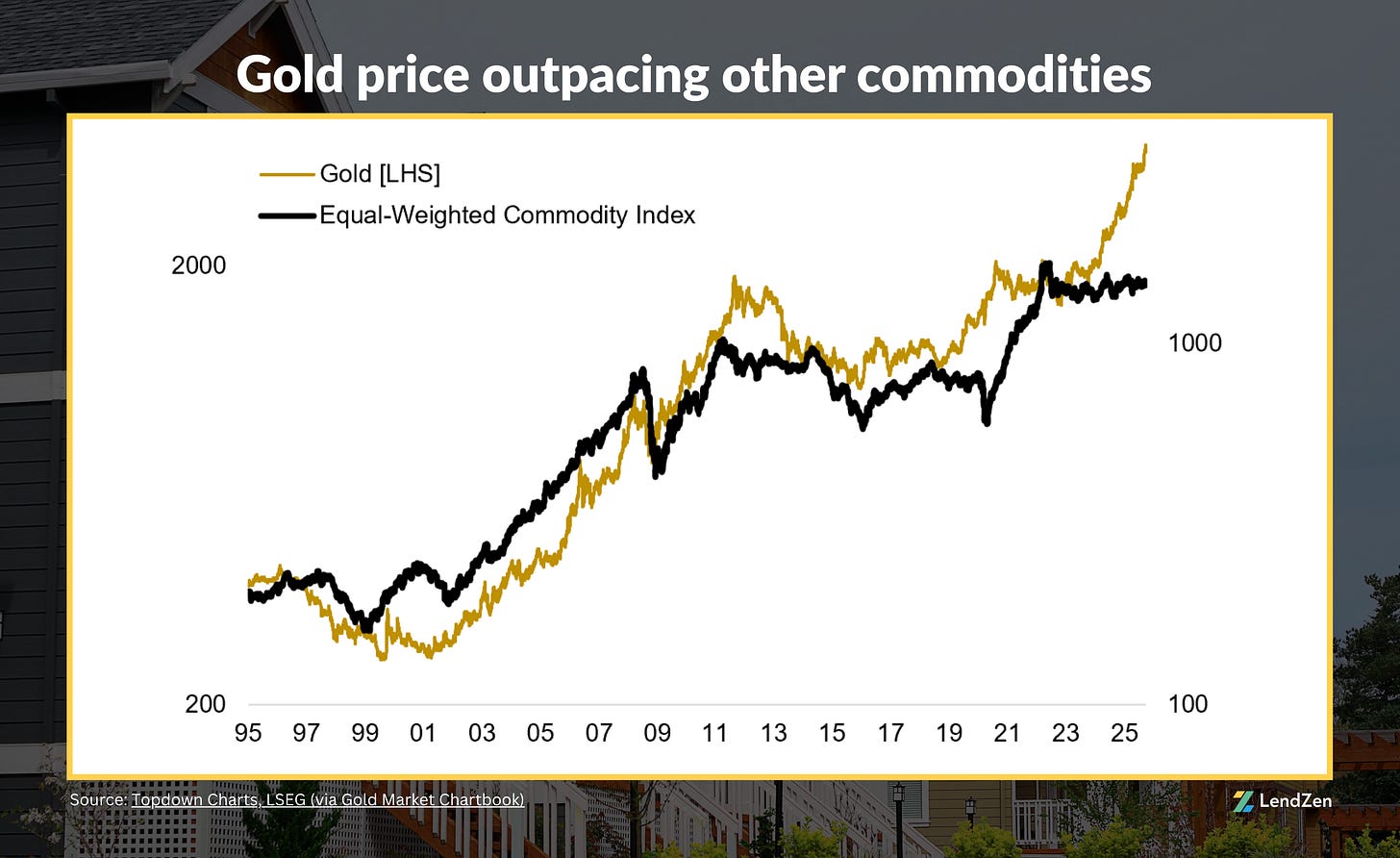

Gold has rocketed to fresh record highs this month, making it the current go-to hedge in the face of political uncertainty and government profligacy.

This shift in “risk off” allocation could mute the typical shutdown-related bond rally.

In other words, less safe-haven money flowing into treasuries = smaller yield drop.

If MBS spreads widen while Treasury demand is subdued, the price of mortgage rates could actually worsen despite the “shutdown risk” narrative.

With that being said, the gold rally does feel a bit overextended.

Predictions

The latest JOLTS data feels like déjà vu of last month, when similar results were a prelude to the ugly NFP employment data that followed the same week.

Today’s ADP can add to that bond friendly environment, that is, if we actually get it.

Government shutdowns are unpredictable but historically don’t last long.

However, given the circumstances I outlined above, particularly the recent price action in gold, the effects of a prolonged shutdown could wreak havoc on bonds for the interim.

The damage could also cancel out any potential benefits from another weak NFP jobs report … presuming the jobs data is weak.

Lock or Float

All things considered, the LendZen Lock-O-Meter risk scores are only slightly elevated compared to the start of the week.

If you are already in a strong position, locking makes the most sense since the focus should be on making a savvy rate choice (regardless of the lender) based on your longer-term rate outlook.

I expand on this “long game” approach in this Substack post.