BLACKJACK … and when to LOCK your mortgage rate 🃏🔒

Why borrowers are playing the wrong game with their mortgage.

“When should I lock my mortgage rate?” is one of the most popular mortgage related questions, and a frequent comment throughout Reddit.

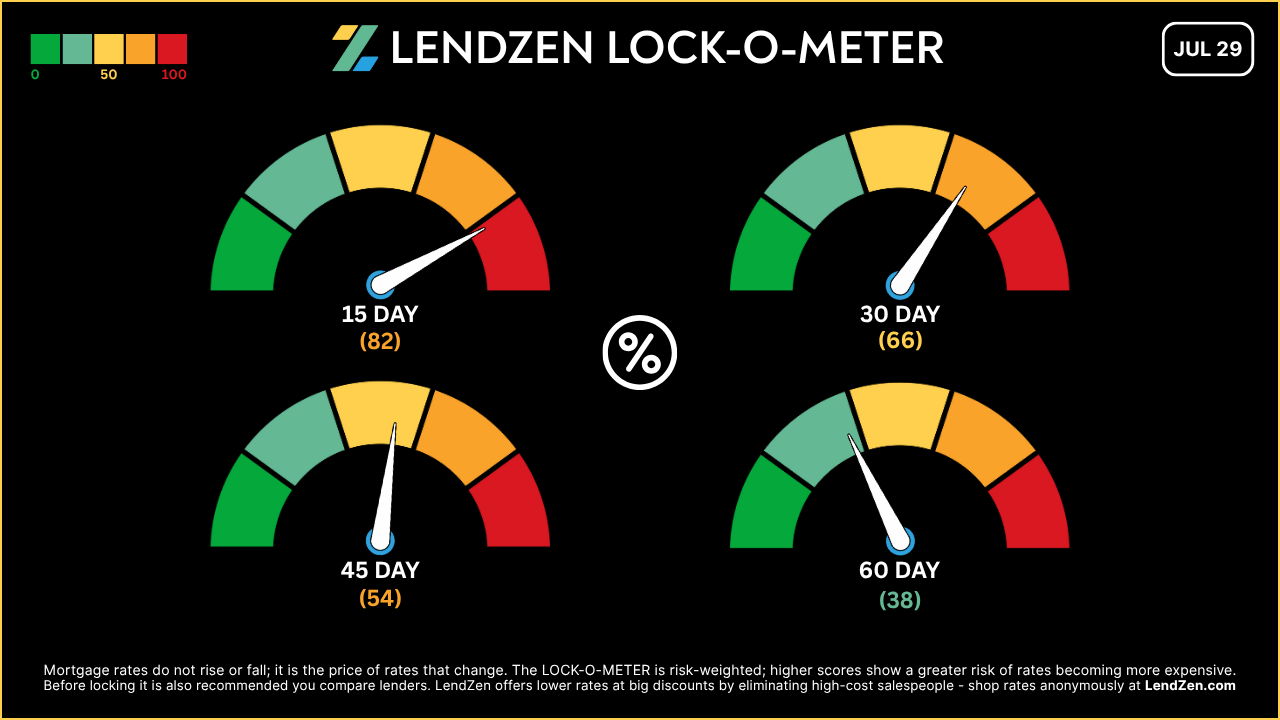

It is also why we developed the LendZen LOCK-O-METER.

Mortgage rates do not rise or fall; it is the price of rates that change in relation to mortgage bonds.

The LOCK-O-METER provides borrowers with a risk-weighted score based on how various macroeconomic events, including market data, central bank announcements, and geopolitics, each historically impacts the price of bonds.

Higher scores show a greater risk of rates becoming more expensive. The score is not necessarily a lock recommendation, but a measurement of risk should a loan remain unlocked.

“Hit Me”

If you were all-in on a single hand of Blackjack (21), and you already had a King and a 9, the odds would not favor asking the dealer for another card.

James Bond might hit the deuce in the movies, but would likely lose it all if he was locking a loan.

Deciding when to lock comes with subjective factors unique to each situation. The LOCK-O-METER standardizes everything else.

This empowers all borrowers to make independent, data driven choices, without relying on the questionable opinions of “professionals”.

The meter is posted at r/HomeMortgageRates when risk scores change and will be integrated live into the new LendZen toolkit when it is released later this year.

“Playing the Wrong Game”

Mortgage rate prices tend to only move a few basis-points a day, and even during a strong positive trend might only improve 20 basis points within tight closing windows.

This equates to total costs savings of $200 for every $100K, or only $1,000 on a $500k loan.

Consider the LendZen Index, which tracks the daily change in mortgage rate prices across a spectrum of mortgage-backed securities.

The price of mortgage rates, which is what borrowers are gambling with by trying to time locks, has ended up flat over the last 30 days.

Although there have been 50 basis point swings overall, trying to catch the bottom within a typical closing window is PLAYING THE WRONG GAME.

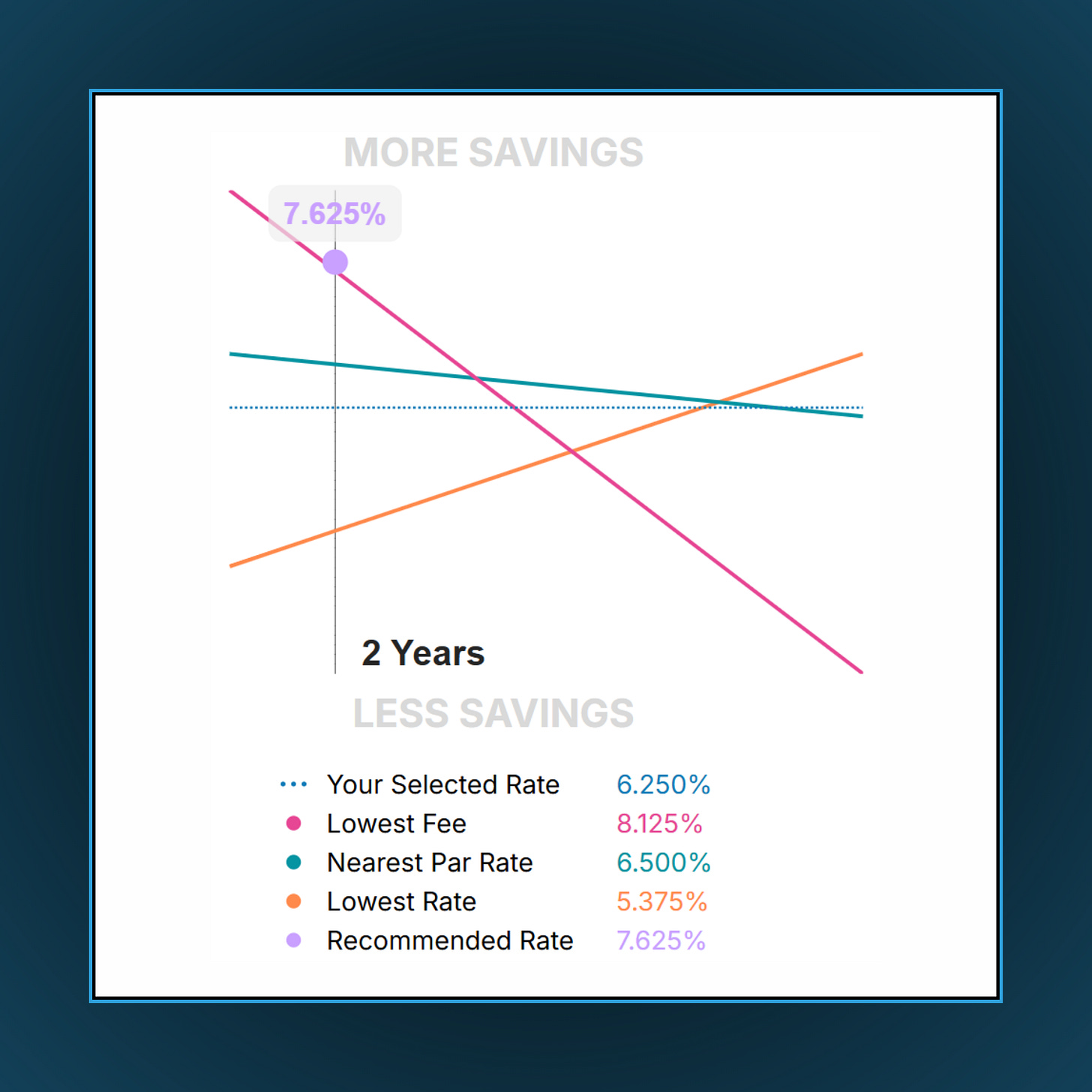

The longer-term outlook for mortgage rates over a 1 – 2 year timeline is much more important and is where subjectivity becomes applicable.

Your long view on where mortgage rate prices are headed has meaningful influence on what rate you should choose, regardless of the day you lock it.

“Choose Your Rate Wisely”

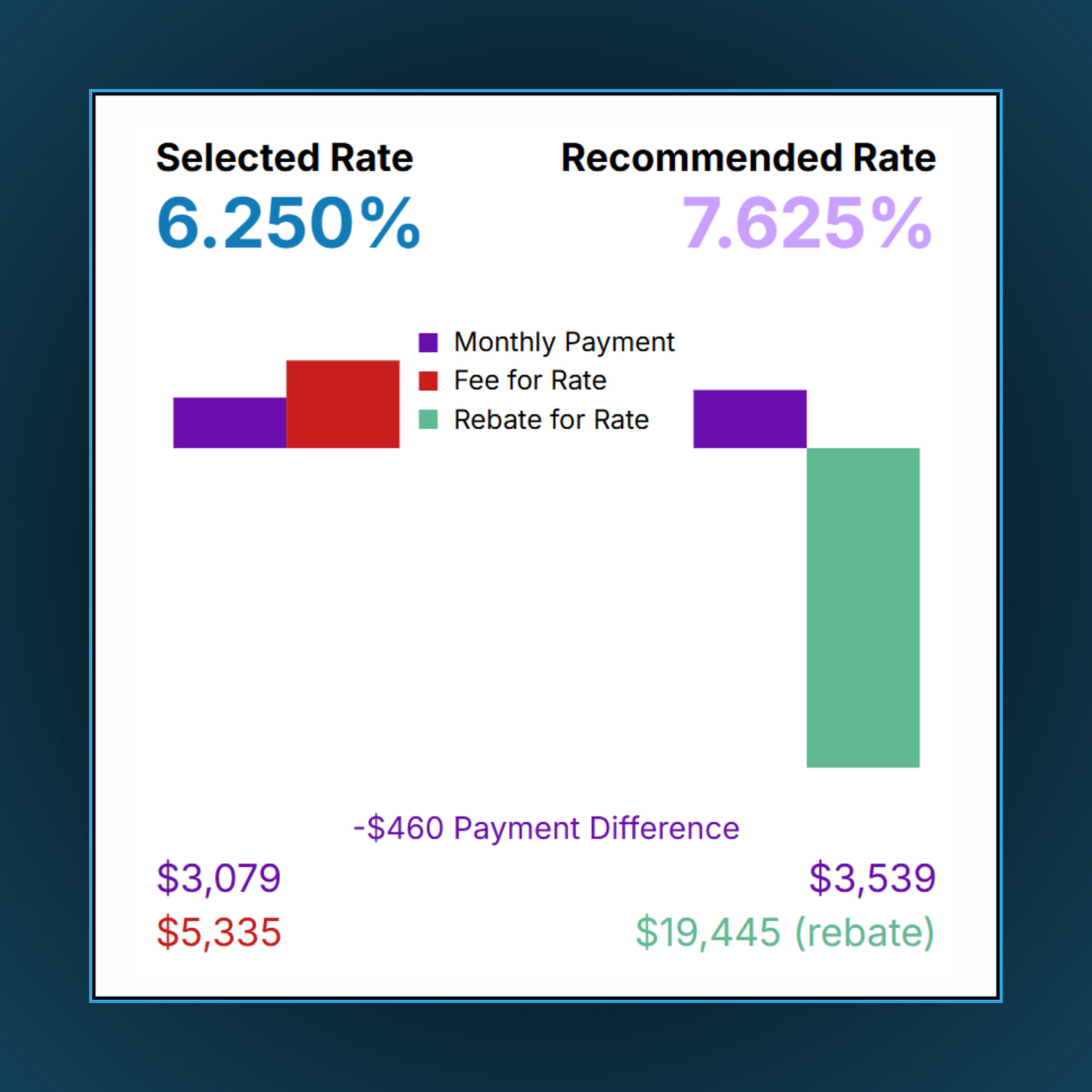

Lower rates are more expensive and require a borrower to be in the loan longer before it can outperform higher, less expensive rates.

This is why LendZen automatically determines the “recommended rate” for you, based on a TIMELINE you decide.

The timeline is less about how long you plan to be in the home, and more about how long you think it will take for the cost of ALL mortgage rates to decline.

Whereas the cost of rates within a typical closing window might only move 20 basis points, which the LOCK-O-METER has already considered within its risk-weighted scores, the potential for rate prices to have a more meaningful drop with a year or two is much greater.

That length of time is far too long to apply an empirical data driven rate recommendation, so the TIMELINE is for you to decide.

However, the rate with the most benefit is irrefutable, as it considers the payment and costs associated with the loan to determine the best choice within your timeline.

In summary, focus on choosing a rate that has the most benefit within a selected TIMELINE and spend less time trying to win a game of Blackjack, where the odds are telling you to take your chips and go home.

Want to check customized, real-time mortgage rates instantly? 🧮

LendZen (NMLS# 375788) gives you real-time access to mortgage rates that update as bond prices change.

The detailed loan summaries have an interactive rate slider that shows all current mortgage rates and full transparency of costs upfront.

All information can be viewed anonymously and without any sign-up requirements or human interaction. This makes exploring the full range of rate options hassle-free.

See for yourself and customize your own loan scenario at LendZen.com